InvestGlass KYC Software for Customer Onboarding: An In-depth Review

Looking for a KYC solution to optimize your customer onboarding process? InvestGlass KYC software offers AI-driven automation and personalized digital integration for a streamlined and compliant onboarding experience. The global KYC software market was valued at $2.93 billion in 2021 and is projected to reach $15.81 billion by 2030, growing at a CAGR of 20.8% from 2022 to 2030 (Grand View Research). Let’s examine whether InvestGlass stands up to scrutiny against peers in the KYC onboarding software market.

Key Takeaways of modern onboarding process

- InvestGlass KYC software is designed as a comprehensive solution for financial services’ customer onboarding, incorporating AI for risk differentiation, personalized digital forms, and broad compliance support including an API-first approach for integrating various tools.

- The software aims to accelerate and adapt customer onboarding for financial institutions through its strategic partnership with Sumsub, improving efficiency and compliance with features like identity verification integrations and customer experience enhancements.

- InvestGlass provides robust safety measures, including document OCR, biometric verifications, and liveness detections, with flexibility to host on a bank’s own servers or secure Swiss servers, and the ability to automate business processes and minimize fraud risks.

Introducing InvestGlass KYC Software client onboarding process

InvestGlass KYC software claims to be a game-changer in the realm of client onboarding software. It presents itself as a one-stop solution for financial services, providing a digital infrastructure that automates the customer identification process and seamlessly integrates customer data collection with other systems. But what sets it apart?

The unique selling points of InvestGlass lie in its use of artificial intelligence and personalized digital forms. The software allegedly harnesses AI to efficiently differentiate between low-risk and high-risk clients, a capability not commonly found in other onboarding software. The integration of personalized digital forms and signatures within a client portal is another touted feature which, if true, could significantly enhance the KYC and client onboarding process.

The cherry on top? The software’s features include:

- Flexible and modular design that allows financial institutions to create tailored onboarding processes

- Alignment with the specifics of various industries and the changing risk profiles of customers

- Extensive API-first capabilities for connecting unlimited tools and additional compliance checks, ensuring adherence to necessary compliance procedures and support from a dedicated compliance team.

Combined with these features, InvestGlass may indeed be a formidable contender in the field of financial onboarding software. But can it deliver on its promises? Let’s find out.

The Promises of InvestGlass

As part of its ambitious vision, InvestGlass has joined forces with Sumsub, a provider of identity verification and anti-fraud technologies. The collaboration aims to bolster KYC compliance for a range of financial services, from banks and brokers to crypto platforms, promising enhancements in both process efficiency and adherence to compliance.

This strategic partnership aims to offer a comprehensive solution that not only streamlines operations but also elevates the customer experience for stakeholders in the financial sector. Both InvestGlass CEO Alexandre Gaillard and Sumsub co-founder and CEO Andrew Sever have expressed confidence that this collaboration will result in a more straightforward and rapid process for clients, making regulatory compliance expeditious and uncomplicated.

Furthermore, InvestGlass pledges to offer:

- Accelerated and adaptable customer onboarding across diverse industries

- Various identity verification software integrations

- Noticeable improvements in opening new client segments

- Enhancing onboarding speed

- Localizing user journeys

- A preference for using ONFIDO, Sumsub, Lexis Nexis, Credas, for handling larger volumes of customer verifications

These are strong claims, but can they hold up under scrutiny? Let’s move ahead and see.

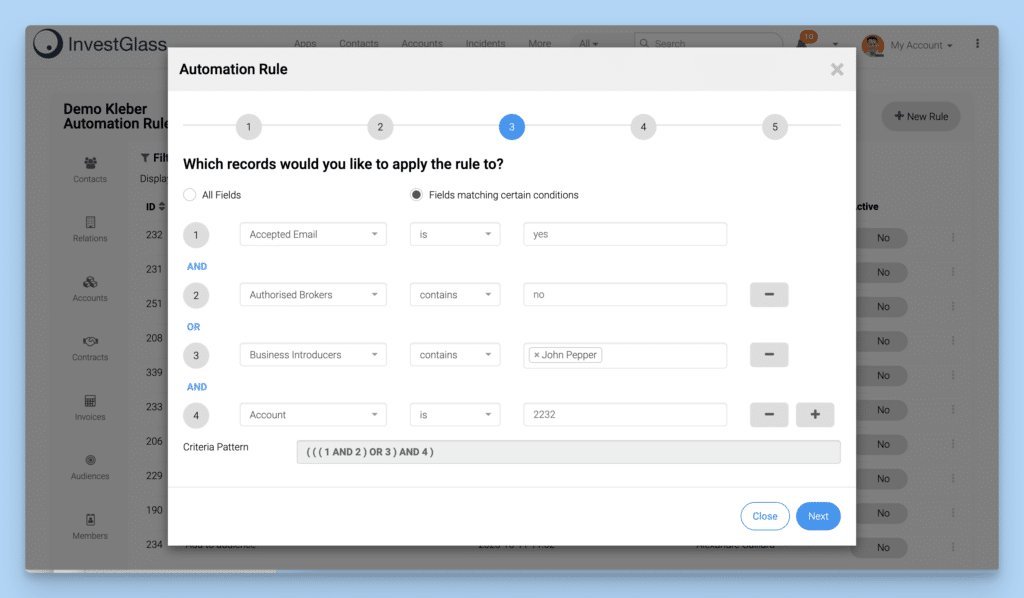

InvestGlass Approval Process and Automation

The approval process and automation features of InvestGlass KYC software are a testament to its flexibility and efficiency. The system allows for a fully customizable approval workflow, enabling financial institutions to set their own thresholds for client acceptance. This means that the software can automatically filter out prospects who do not meet the minimum criteria, significantly reducing the workload of compliance teams. By leveraging these automated processes, InvestGlass ensures that only qualified clients are considered, streamlining the onboarding journey and maintaining high standards of compliance. The ability to tailor these processes to specific business needs not only enhances operational efficiency but also provides a safeguard against potential risks associated with client onboarding.

InvestGlass digital signature is embed in the client onbarding

One of the standout features of InvestGlass KYC software is its integrated digital signature technology, designed to validate client contracts with ease and legal compliance. This system is embedded within the InvestGlass platform, streamlining the process for companies and individuals alike. It supports multiple jurisdictions, ensuring that contracts are legally binding no matter where the clients are based. The digital signature capability not only expedites the contract signing process but also enhances the overall security and authenticity of the documents, providing peace of mind for all parties involved in the transaction.

Getting Started with InvestGlass

Getting started with InvestGlass seems to be a straightforward process. The company claims that its KYC software can be seamlessly integrated into a financial institution’s existing system or used to develop create an entire frontend for client management. It can even be hosted on the bank’s own servers for enhanced data security, and is compatible with various website platforms.

The setup advises a light client onboarding process with just 3 to 5 questions to start, using pre-built forms that optimize customer experience during initial customers data collection. The software also utilizes AI to:

- Extract data automatically from documents

- Integrate with Regtech partnersfor automated verification

- Connect to services like ONFIDO for swift and easy identity checks without extensive programming.

What’s more, financial institutions can tailor and manage the approval process offered by InvestGlass’s software to accept or reject customers based on their verification results. It supports diverse identity verification methods through integrations with Onfido and LexisNexis, providing flexibility in the onboarding process.

But how safe is this setup? Let’s explore.

Safety Measures and Tests in Setup

When it comes to safety, InvestGlass seems to have all bases covered. Its KYC software includes document OCR checks, biometric verifications, and liveness detection, integrating with partners such as Onfido and Lexis Nexis for video identification and ID analysis to enhance safety during customer and client onboarding process. Moreover, the software can be hosted on banks’ own servers or remain on Swiss servers for Swiss-based clients, thus protecting customer data within secure IT infrastructures. Automation is central in InvestGlass KYC software, where it is used to trigger business processes, analyze risk signals, and expedite identity verification. This helps minimize the risk of fraud and money laundering.

InvestGlass emphasizes the importance of customizing verification methods to meet different regulatory requirements, enhancing the software’s adaptability for various customer demographics and countries. These safety measures and tests certainly seem impressive, but how does the software look and feel? Time to check out its aesthetics and build.

Aesthetics and Build of InvestGlass KYC Software

A user-friendly interface can significantly enhance the user experience of any software, and InvestGlass seems to have hit the mark in this regard. The software features a sleek interface with drag-and-drop functionality for easy navigation and data management. This simplicity of design can be a boon for users who are not very tech-savvy, contributing to operational efficiency.

In addition to its aesthetic appeal, the build of the software is designed to be robust and reliable. But it’s not just about how it looks and feels; it’s about how well it functions. So, let’s dive deeper and understand the functionality of this onboarding software.

Navigating the Functionality

The user interface of InvestGlass offers a minimalistic initial onboarding with 3 to 5 questions and a multi-language option to accommodate diverse clients. This thoughtful inclusion enhances the verification experience and gives a hassle-free start for new clients.

Interactive tutorials and in-app guidance are provided to assist new users with their acquaintance to the system and its functionalities. Furthermore, InvestGlass presents customizable approval processes and pre-built KYC templates, as well as no-code customization, catering to the specific business needs of the institutions using the software.

A workflow builder aids in designing varied onboarding paths for customers with different risk profiles, and the inclusion of form options such as not answering or using radio buttons ensures clarity in client responses. The software automates essential customer identification collecting, reducing manual workload, supported by ONFIDO’s efficient biometric and identity verification, which requires no programming to use.

The responsive design enables access from various devices, ensuring a seamless onboarding experience for all users, particularly mobile ones. Now, let’s see how this software performs in real-world scenarios.

Real-World Application of InvestGlass

InvestGlass has been successfully implemented across various industries, including:

- Wealth management: Companies have integrated InvestGlass into their workflows, reportedly improving client engagement and satisfaction.

- Real estate: InvestGlass is used to manage investor relations and simplify new client investment processes.

- Asset management: Firms have leveraged InvestGlass to comply with regulatory requirements, enhance the KYC process, and ensure precise client data collection during the onboarding process.

- Insurance: Companies have benefited from InvestGlass’s features in streamlining processes and improving client data management.

Financial advisors, brokerage firms, and over 80 companies have utilized InvestGlass for automating client profiling, reducing manual onboarding tasks, and creating improved client profiles. This has reportedly led to quicker client acquisition, higher conversion rates, and increased revenue. Furthermore, the software combines KYC with AML measures and ongoing monitoring, addressing both KYC and AML requirements, and enhancing due diligence and fraud prevention.

InvestGlass’s software also supports AML, CTF, and sanctions screening compliance programs for diverse regulatory requirements. With comprehensive background checks, including PEP screening and adverse media checks, and automation to accelerate verification and reduce fraud and money laundering risks, InvestGlass appears to be a robust solution for customer onboarding. But what if users face challenges with the software? How does InvestGlass help overcome them?

Overcoming Challenges with InvestGlass

While the InvestGlass platform may be challenging to customize without assistance, the company provides dedicated support to tailor the system to specific business requirements. This is a significant advantage as customization is often a common challenge with new software implementation. InvestGlass also offers:

- Comprehensive training modules

- A knowledge base to facilitate self-service learning

- Dedicated customer support teams on standby to assist with any queries or issues

This ensures that users can identify and overcome challenges they face with the software.

Moreover, InvestGlass is committed to resolving technical issues swiftly with updates and patches, and users are encouraged to report any problems they encounter. Now, after having walked through all these aspects of InvestGlass KYC software, what’s the final verdict?

The InvestGlass Verdict

After a thorough examination, it can be concluded that InvestGlass KYC software provides a comprehensive onboarding solution with a pricing model that is competitive for the offering. The software’s customizable AI-driven customer onboarding platform and seamless integration capabilities, along with its customer due diligence features, make it stand out among its competitors.

While there are other robust solutions available in the market, InvestGlass offers unique features like regulatory compliance checks that are not as comprehensive in similar products. In terms of value for money, it seems to deliver on its promises.

However, as with any product or service, the final decision should be based on the specific needs and requirements of your business. It’s always recommended to take advantage of a free demo or trial period to ensure that the software is a good fit for your company.

Summary

In conclusion, InvestGlass KYC software appears to be a strong contender in the realm of client onboarding software. Its AI-driven automation, customizable features, comprehensive regulatory compliance checks, and seamless integration capabilities make it a robust solution for customer onboarding.

The software has been successfully implemented across various industries, enhancing client engagement, compliance, revenue, and operational efficiency. Though users may face some challenges with customization and integration, InvestGlass provides dedicated support and training resources to overcome these hurdles. Ultimately, the final verdict on InvestGlass points to its potential as a reliable tool for efficient and effective customer onboarding in the financial services sector.

Frequently Asked Questions about Client Onboarding

What is the unique selling point of InvestGlass KYC software?

InvestGlass KYC software’s unique selling points include its use of artificial intelligence for client differentiation and compliance team the integration of personalized digital forms and signatures within a client portal, offering advanced and personalized features for client management.

How does InvestGlass ensure safety during customer onboarding?

InvestGlass ensures safety during customer onboarding by using KYC software with document OCR checks, biometric verifications, and integration with partner services like Onfido and Lexis Nexis for enhanced security.

How easy is it to get started with InvestGlass?

Getting started with InvestGlass is straightforward and can be seamlessly integrated into your existing system or used to develop a client management frontend. We suggest you to share with us your customer due diligence roadmap and existing on boarding process documents.

How much is the budget to build my forms with InvestGlass?

Creating and boarding with Investglass and stay compliance with a very low cost. Budget is possible. Customer experience is always key for our team to understand the process that you wish to implement. You can use the solution with our Fintech partner SDK. You can also use Investglass forms to stay compliance and verify, new clients identity. If Investglass team builds your own boarding, this will reduce your manual workload, the cost raises from €5000-€20,000 or more.

How has InvestGlass been applied in real-world scenarios?

InvestGlass has been successfully applied in real-world scenarios across industries such as wealth management, real estate, asset management, and insurance, leading to improved client engagement, compliance, and operational efficiency.

What support does InvestGlass provide to overcome potential challenges with the software?

InvestGlass provides dedicated support for customization, comprehensive training modules, and swift resolution of technical issues to help users overcome challenges. This ensures that users have the necessary tools and assistance to address any potential software obstacles.