6 استراتيجيات تسويقية مصرفية لتخطي منافسيك في عام 2025

في المشهد المالي سريع التغير اليوم، تواجه البنوك والاتحادات الائتمانية العديد من التحديات التي تؤثر بشكل كبير على استراتيجياتها التسويقية. من إغلاق الفروع إلى تحقيق التوازن بين التطورات الرقمية والتفاعل البشري، يجب على هذه المؤسسات أن تتكيف لتزدهر. تستفيد شركة InvestGlass، الرائدة في مجال أتمتة التسويق وتحسينه، من نماذج تعلُّم اللغة بالذكاء الاصطناعي (LLMs) لمواجهة هذه التحديات بشكل مباشر. تستكشف هذه المقالة استراتيجيات التسويق الرئيسية لعام 2024 وكيف يمكن لاستراتيجية تسويق مصرفية قوية، إلى جانب أدوات InvestGlass المبتكرة، أن تُغيّر الطريقة التي تتفاعل بها المؤسسات المالية مع عملائها.

تحديد التحديات التسويقية

عند صياغة خطة تسويق، فإن فهم هذه التحديات أمر بالغ الأهمية. فيما يلي نظرة فاحصة على بعض العقبات المهمة:

- ضعف أداء الفروع الجديدة: تكافح العديد من الفروع الجديدة لاكتساب الزخم في مجتمعاتها. وهذا الأداء الضعيف يمكن أن يقوض جهود التسويق الرامية إلى جذب العملاء والاحتفاظ بهم.

- غياب ثقافة المبيعات: غالبًا ما تفتقر المؤسسات المالية إلى ثقافة المبيعات الاستباقية، مما يجعل من الصعب الترويج لخدماتها بفعالية.

- ثغرات التثقيف والمناصرة: يمكن أن يؤدي العجز في تثقيف العملاء ومناصرة العملاء إلى إعاقة المؤسسات عن بناء علاقات قوية وثقة متينة.

- خدمة العملاء التفاعلية: بدلاً من أن تكون استباقية، تستجيب العديد من البنوك للمشكلات عند ظهورها فقط، مما قد يضر برضا العملاء وولائهم.

- الموازنة بين التفاعل الرقمي والتفاعل البشري: أثناء تبني التطورات الرقمية، تجد المؤسسات صعوبة في تعزيز العنصر البشري في التفاعل مع العملاء. هذا التوازن ضروري لنجاح استراتيجية التسويق.

الإبحار في التضاريس

تُعد معالجة هذه العقبات أمرًا أساسيًا لتحسين استراتيجيات التسويق. من خلال فهم هذه المشكلات والتخفيف من حدتها، يمكن للمؤسسات المالية تحسين حضور علامتها التجارية وخدمة احتياجات عملائها بشكل أفضل. إن تطوير حلول شاملة مصممة خصيصًا لمواجهة هذه التحديات يمكن أن يساعد البنوك والاتحادات الائتمانية على الازدهار في سوق تنافسية.

ما هي فوائد إقامة شراكات مجتمعية للبنوك والاتحادات الائتمانية؟

فوائد إقامة شراكات مجتمعية للبنوك والاتحادات الائتمانية

إن إقامة شراكات مجتمعية هي استراتيجية قوية للبنوك والاتحادات الائتمانية، حيث تعود بالفائدة على كل من المؤسسة والسكان المحليين.

تعزيز ولاء العملاء

يساعد الانخراط مع المنظمات المجتمعية من خلال الشراكات البنوك والاتحادات الائتمانية على تعميق علاقتها مع العملاء الحاليين. من خلال المشاركة بنشاط في الأحداث أو القضايا المحلية، مثل دعم فريق رياضي في الحي أو المساهمة في بنك الطعام المحلي، يمكن للمؤسسات المالية إظهار التزامها تجاه المجتمع. وهذا بدوره يعزز ولاء العملاء حيث يرى العملاء أن البنك أو الاتحاد الائتماني جزء لا يتجزأ من حياتهم اليومية.

توسيع قاعدة العملاء

الشراكات المجتمعية هي أيضًا وسيلة فعالة لجذب عملاء جدد. فمن خلال المواءمة مع المبادرات المدعومة على نطاق واسع - مثل المساعدة في بناء المنازل مع مؤسسة "هابيتات فور هيومانيتي" - تكتسب البنوك والاتحادات الائتمانية حضوراً بين العملاء المحتملين الذين يقدرون المسؤولية الاجتماعية. وغالباً ما يؤدي هذا الظهور إلى ظهور حسابات جديدة وتوسيع قاعدة العملاء.

إحداث تأثير ملموس

يمكن للمؤسسات المالية أن تُحدِث فرقاً ملموساً من خلال دعم المشاريع المؤثرة. وسواء كان ذلك من خلال استضافة ورش عمل مجانية لمحو الأمية المالية في مكتبة محلية أو تنظيم جمع التبرعات لملاجئ الحيوانات المحلية، فإن هذه الجهود تعزز سمعة المؤسسة ككيان مسؤول اجتماعياً. فالتأثير الإيجابي على المجتمع لا يعطي شعوراً بالرضا فحسب، بل ينعكس أيضاً بشكل إيجابي على المؤسسة.

تسهيل النجاح على المدى الطويل

لا تعزز هذه الشراكات الإدراك العام الفوري فحسب، بل ترسي الأساس للنجاح المؤسسي على المدى الطويل. فمن خلال الاندماج في نسيج المجتمع المحلي، لا تزدهر البنوك والاتحادات الائتمانية من الناحية المالية فحسب، بل تساهم أيضاً في تحقيق الرفاهية العامة للمجتمعات التي تخدمها.

إن الشراكات المجتمعية في جوهرها لا تقدر بثمن بالنسبة للبنوك والاتحادات الائتمانية التي تتطلع إلى رفع مستوى تأثيرها وأعمالها من خلال تعزيز الولاء وجذب عملاء جدد وإحداث تأثير إيجابي في المجتمع.

ما هي بعض استراتيجيات التسويق الرئيسية للبنوك والاتحادات الائتمانية في عام 2025؟

استراتيجيات التسويق الرئيسية للبنوك والاتحادات الائتمانية في عام 2025

مع دخولنا عام 2025، يستمر المشهد التسويقي للبنوك والاتحادات الائتمانية في التطور. إليك بعض الاستراتيجيات الأساسية التي يجب مراعاتها هذا العام:

تحويل صرّافين البنوك إلى مدافعين عن العملاء

مع تزايد اعتماد تقنيات الخدمة الذاتية مثل أجهزة الصراف الآلي وأجهزة الصراف التفاعلية (ITMs) والخدمات المصرفية عبر الهاتف المحمول، يجب أن يتغير دور الصراف التقليدي. فبدلاً من التركيز فقط على المعاملات، يمكن إعادة تدريب الصرافين للعمل كمدافعين ماليين. وينبغي أن يركزوا على فهم احتياجات العملاء وتقديم المشورة المصممة خصيصًا بشأن المنتجات والخدمات المالية. الاستثمار في برامج التدريب أمر بالغ الأهمية لهذا التحول، مع التركيز على التواصل الاستباقي والمعرفة الشاملة بالمنتجات. يمكن لهذا التحول أن يعزز العلاقات مع العملاء ويميز مؤسستك في سوق تنافسية.

تعزيز الجهود التسويقية داخل الفرع

يظل تقديم تجربة استثنائية في الفرع أداة تسويقية قوية. على الرغم من أهمية التفاعل مع الموظفين، إلا أن الوقت الذي يقضيه العملاء في فرعك دون رقابة لا يقل أهمية عن ذلك. ولتحسين تجربتهم، ضع في اعتبارك دمج اللافتات الرقمية التي تسلط الضوء على الخدمات الرئيسية، وتقدم دروساً تعليمية، وتوفر تحديثات محلية مثل الطقس أو الأخبار. بالإضافة إلى ذلك، يمكن أن تعمل الأكشاك والأجهزة اللوحية الرقمية التفاعلية كأدوات تثقيفية تقدم للعملاء رؤى سهلة الاستخدام حول منتجات مثل الرهون العقارية والقروض وحسابات التوفير. تضع هذه التكتيكات مؤسستك في مكانة مؤسستك على أنها حديثة وتركز على العملاء، مما يعزز من التصور العام لعلامتك التجارية.

توسيع نطاق قدرات التسويق الرقمي وتوليد خدمة مخصصة

في عالمنا الرقمي اليوم، لا غنى عن التواجد القوي عبر الإنترنت. تُعد حملات التسويق الرقمي أمرًا بالغ الأهمية لتعزيز مقاييس الأعمال وزيادة مشاركة العملاء. مع استخدام العديد من عملاء البنوك لتطبيقات الهاتف المحمول، هناك فرصة كبيرة للتواصل من خلال القنوات الرقمية. يجب أن تشمل استراتيجيتك ما يلي:

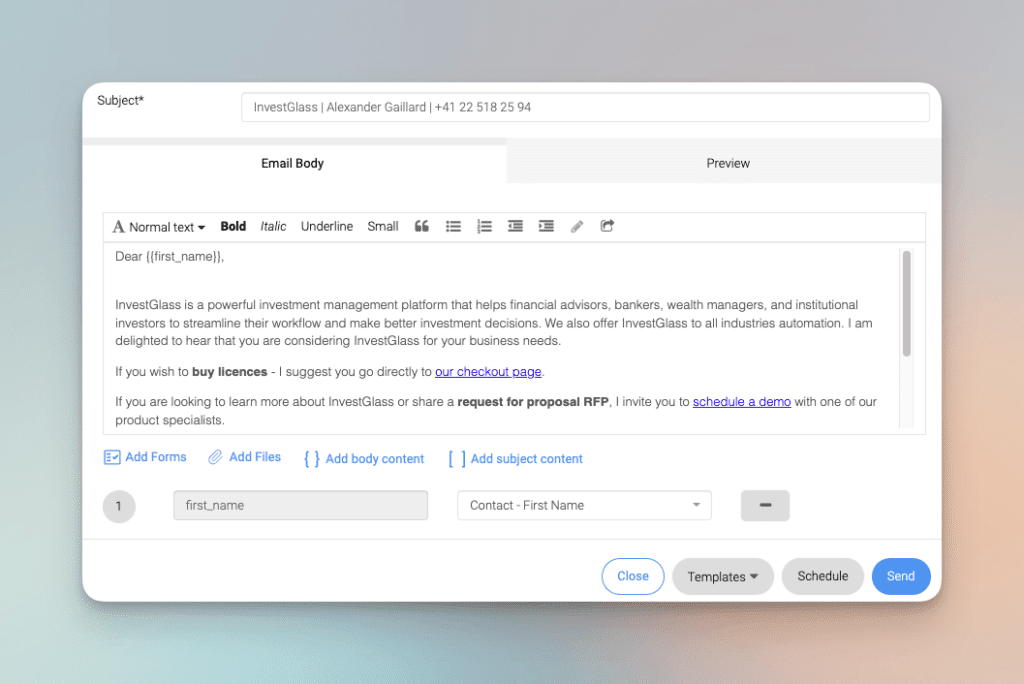

- التسويق عبر البريد الإلكتروني: تفاعل بانتظام مع العملاء من خلال رسائل البريد الإلكتروني، وشارك معهم التحديثات والعروض الترويجية ومحتوى المدونة الثاقبة.

- إنشاء المحتوى: قم بتطوير منشورات مدونة غنية بالمعلومات ومحسّنة لتحسين محركات البحث، والتي تعمل على تثقيف المستهلكين حول خدماتك واتجاهات الصناعة، مما يؤدي إلى زيادة عدد الزيارات العضوية وتعزيز سلطتك.

- التفاعل مع وسائل التواصل الاجتماعي: حافظ على وجود قوي على وسائل التواصل الاجتماعي مع مزيج من الإعلانات والمحتوى التثقيفي والمسابقات التفاعلية لتعزيز ظهور العلامة التجارية.

- الإعلانات المستهدفة: الاستفادة من المنصات مثل إعلانات جوجل للوصول إلى العملاء المحتملين المحليين وتسليط الضوء على العروض الجديدة.

تعزيز العلاقات المجتمعية

يعد بناء علاقات مجتمعية في قطاع الخدمات المالية طريقة فعالة أخرى لتعزيز الحضور المحلي لمؤسستك. لا يؤدي الانخراط في شراكات مجتمعية إلى تعزيز الولاء للعلامة التجارية فحسب، بل يؤدي أيضًا إلى الاستفادة من قواعد عملاء جديدة. فكر في أنشطة مثل رعاية الرياضات المحلية أو تنظيم حملات خيرية أو المشاركة في مشاريع بناء المجتمع أو استضافة ورش عمل حول محو الأمية المالية في المراكز المجتمعية أو المدارس.

نشر مواد ترويجية فعالة

يساعد التسويق الترويجي على توسيع نطاق وصولك إلى ما وراء الفرع. فكر في توفير الملابس ذات العلامات التجارية، أو الأدوات العملية لعملاء الرهن العقاري الجدد، أو الهدايا الشخصية مثل الأكواب وزجاجات المياه. لا تعمل هذه المواد على تعزيز الوعي بالعلامة التجارية فحسب، بل تخلق أيضاً شعوراً بالانتماء بين العملاء والموظفين على حد سواء.

تسخير تحليلات بيانات العملاء

تُعد استراتيجيات التسويق الفعالة أمرًا بالغ الأهمية لتحسين جهود التسويق، وتكييف العروض، وتعظيم العوائد. من خلال تحليل البيانات المتعلقة بسلوك العملاء وتفضيلاتهم، يمكن للبنوك صياغة استراتيجيات تسويقية مخصصة تلقى صدى لدى جمهورها. فالرسائل والعروض المخصصة تجعل العملاء يشعرون بالتقدير والفهم، مما يعزز العلاقات ويشجع الولاء.

في عامي 2024 و2025، يمكن أن يساعد تبني هذه الاستراتيجيات البنوك والاتحادات الائتمانية على التواصل بشكل أكثر فعالية مع جمهورها، وتعزيز رضا العملاء، والبقاء في صدارة السوق.

فهم جمهورك وفهمه

تحديد الاحتياجات والتفضيلات الفريدة

إن فهم جمهورك أمر بالغ الأهمية لتطوير استراتيجية تسويق فعالة لمؤسستك المالية. ولتحديد الاحتياجات والتفضيلات الفريدة، ابدأ بجمع البيانات عن التركيبة السكانية لجمهورك المستهدف وسلوكياته ونقاط الألم. ويمكن تحقيق ذلك من خلال الاستبيانات ومجموعات التركيز وأدوات التحليلات عبر الإنترنت.

بمجرد جمع هذه البيانات، قم بإنشاء شخصيات مشترين مفصلة تحدد خصائص واحتياجات وتفضيلات عملائك المثاليين. ستساعدك هذه الشخصيات على تكييف استراتيجياتك التسويقية لتتناسب مع جمهورك وتلبي احتياجاتهم الخاصة.

على سبيل المثال، إذا كان جمهورك المستهدف يتكون من جيل الألفية، ركز على القنوات الرقمية مثل التسويق عبر وسائل التواصل الاجتماعي والإعلان عبر الإنترنت. فجيل الألفية متمرس في التكنولوجيا ويفضل التفاعل مع العلامات التجارية من خلال المنصات الرقمية. من ناحية أخرى، إذا كان جمهورك المستهدف يشمل جيل طفرة المواليد، ففكر في استراتيجيات تسويقية أكثر تقليدية مثل الإعلانات المطبوعة والفعاليات الشخصية، حيث أنهم قد يقدرون التفاعلات المباشرة والمواد الملموسة.

من خلال فهم احتياجات جمهورك وتفضيلاته الفريدة، يمكنك تطوير استراتيجيات تسويقية تخاطبهم مباشرة، مما يزيد من احتمالية تحويلهم إلى عملاء مخلصين.

ما هي الأساليب التسويقية الفعّالة في الفروع لتحسين تجربة العملاء؟

تكتيكات التسويق الفعالة للفروع لتعزيز تجربة العملاء

إن تعزيز تجربة العملاء داخل الفرع أمر حيوي لخلق تصور إيجابي لعلامتك التجارية. فكل زيارة يقوم بها العميل توفر لحظة لإثارة الإعجاب، ويمكن أن تؤدي الاستفادة من ذلك إلى تعزيز ولاء العلامة التجارية بشكل كبير. إليك كيفية تحسين تكتيكاتك التسويقية للفروع:

1. تحسين التفاعلات مع العملاء

في حين أن التفاعلات الشخصية أمر بالغ الأهمية، فإن ضمان قضاء العميل لوقت ممتع في الفرع بمفرده أمر مهم بنفس القدر.

2. استخدام اللافتات الرقمية

قم بتنفيذ لافتات رقمية جذابة، مثل الرسومات ومقاطع الفيديو اللافتة للنظر. يمكن لهذه التقنية تسليط الضوء على أفضل الخدمات التي تقدمها، وتقديم دروس توضيحية للمنتجات، وتقديم تحديثات محلية مثل الطقس والأخبار. من خلال القيام بذلك، يمكنك إبقاء العملاء على اطلاع وتسلية وإثراء تجربة انتظارهم.

3. تقديم كتيبات رقمية تفاعلية

جهز فرعك بأكشاك رقمية أو أجهزة لوحية أو شاشات عرض رقمية. يمكن أن تكون هذه الأجهزة التفاعلية بمثابة كتيبات رقمية، مما يتيح للعملاء الوصول إلى معلومات مفصلة حول الخدمات مثل الرهون العقارية والحسابات الجارية وقروض السيارات وحسابات التوفير. هذا التفاعل يبقيهم متفاعلين ومطلعين على العروض ذات الصلة باحتياجاتهم.

من خلال دمج هذه الاستراتيجيات، فإن عملك يضع نفسه كمؤسسة ذات تفكير مستقبلي، حيث يوفر محتوى قيماً وجذاباً للعملاء أثناء انتظارهم. هذا النهج لا يعزز صورة علامتك التجارية فحسب، بل يعزز أيضاً من تجربة العميل بشكل عام في الفرع.

كيف يمكن لإعادة تصور دور الصرافين المصرفيين كمدافعين عن العملاء أن يفيد البنوك والاتحادات الائتمانية؟

تعزيز التجارب المصرفية: الصرافون كمدافعين عن العملاء

يمثل تحويل الصرافين المصرفيين إلى مدافعين عن العملاء العديد من الفوائد لكل من البنوك والاتحادات الائتمانية. وفي عصر تنتشر فيه بدائل الخدمة الذاتية مثل أجهزة الصراف الآلي وأجهزة الصراف التفاعلية (ITMs) وتطبيقات الخدمات المصرفية عبر الهاتف المحمول، فإن الفرصة سانحة لإعادة تعريف دور الصراف.

بناء علاقات قوية مع العملاء

من خلال تحويل تركيزهم من مجرد واجبات المعاملات إلى مشاركة أعمق مع العملاء، يمكن للصرافين أن يصبحوا لاعبين رئيسيين في فهم الاحتياجات المالية الفريدة لعملائهم وتلبيتها. يتيح لهم هذا التحول تقديم المشورة والحلول الشخصية بشكل استباقي، مما يعزز علاقات العملاء وولائهم.

زيادة التفاعلات الشخصية إلى أقصى حد ممكن

مع التعامل مع المعاملات الروتينية بكفاءة من خلال التكنولوجيا، يتوفر لدى الصرافين المزيد من الوقت للتفاعل بشكل هادف مع العملاء. هذه التفاعلات المباشرة وجهاً لوجه تُمكِّن الصرافين من تثقيف العملاء حول المنتجات والخدمات المالية التي يمكن أن تعزز رفاهيتهم المالية.

التمكين من خلال البرامج التدريبية

لتسهيل هذا الانتقال، يمكن للبنوك والاتحادات الائتمانية تطوير برامج تدريبية شاملة. يجب أن تزود هذه البرامج الصرافين بمهارات التواصل المتقدمة والمعرفة بعروض المؤسسة. يمكن أن يؤدي التركيز على خدمة العملاء الاستباقية، حيث يقدم الصرافون اقتراحات غير موجهة، ولكنها قيمة، إلى رفع مستوى تجربة العملاء بشكل كبير.

فرص البيع المتبادل الذكي

وباعتبارهم مدافعين عن العملاء، فإن الصرافين في وضع أفضل لتحديد فرص البيع المتبادل ذات الصلة. إن فهم المجموعة الكاملة من المنتجات المتاحة ومتى يكون من المناسب تقديمها يمكن أن يؤدي إلى زيادة المبيعات وزيادة رضا العملاء وقاعدة عملاء أكثر إلماماً.

ومن خلال تبني هذا الدور المبتكر، لا تقوم البنوك والاتحادات الائتمانية بتعزيز عروض خدماتها فحسب، بل تعزز أيضًا ثقافة الدعوة المالية التي تركز على العملاء. لا يعزز هذا النهج رضا العملاء فحسب، بل يمكن أن يؤدي أيضًا إلى تحقيق النمو والنجاح على المدى الطويل للمؤسسات المالية.

ما الدور الذي تلعبه بيانات العملاء في تحسين استراتيجيات التسويق المصرفي؟

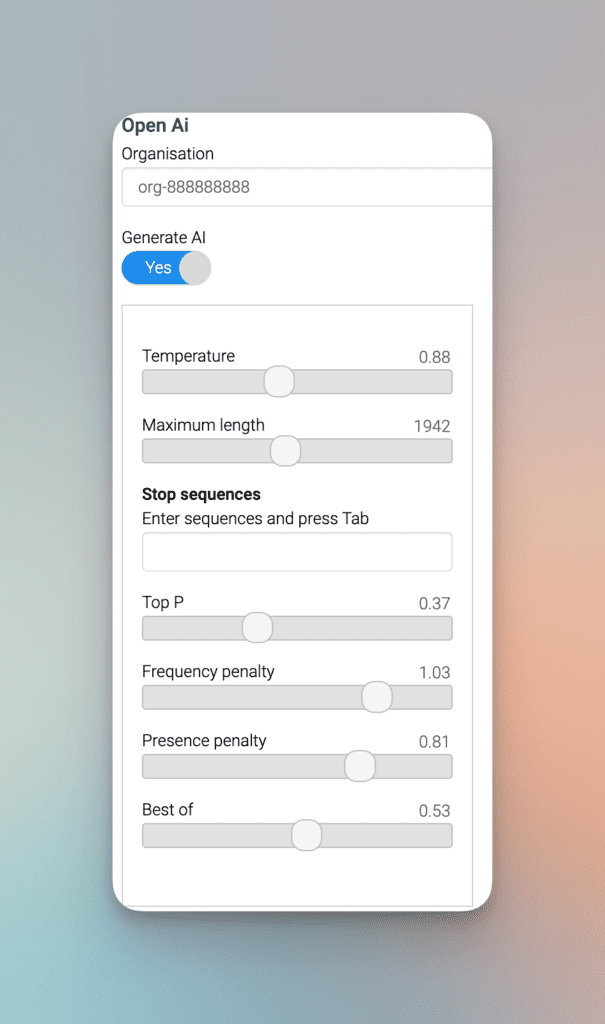

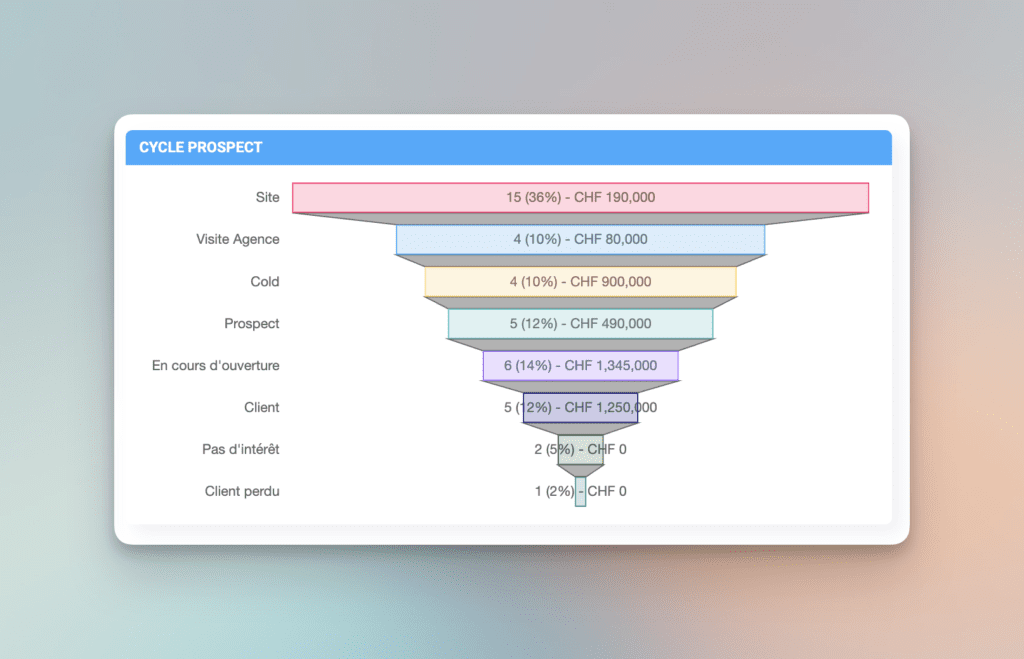

"أولاً، اطرح المزيد من الأسئلة على العملاء. إذا كنت لا تستطيع أو لا ترغب في طرح السؤال - جرّب نهج البيانات الضخمة. من خلال خوارزمية أتمتة بسيطة، يمكن لـ InvestGlass أن توصي بالمنتجات لقاعدة عملائك الحالية. يتم رصد جميع التفاعلات السابقة. ستمنحك المزيد من البيانات المزيد من تفضيلات العملاء. تُستخدم بيانات العملاء الحالية لاستقراء توقعات العملاء المحتملين للخدمات المالية. يمكن للبيانات الضخمة المجمّعة في تقارير InvestGlass التسويقية أن تعلّمك استراتيجيات التسويق الناجحة. لن تخمن لماذا يأتي حساب جديد إلى البنك الذي تتعامل معه. الأمر يتعلق بالتسويق المستهدف. ولاء العملاء هو الركيزة الأخيرة لهذه الاستراتيجية.

قوة البيانات والذكاء الاصطناعي في التسويق المصرفي

يُعد فهم بيانات العملاء أمرًا بالغ الأهمية للمسوقين الماليين والبنوك الذين يتطلعون إلى تحسين استراتيجياتهم التسويقية. فمن خلال جمع البيانات وتحليلها حول أنماط الإنفاق واستخدام بطاقات الائتمان وتفضيلات الاستثمار، يمكن للبنوك تكييف خدماتها لتلبية احتياجات عملائها بشكل أفضل. لا يقتصر هذا النهج على تبسيط العمليات فحسب، بل يزيد أيضًا من العوائد من خلال ضمان استخدام الموارد بكفاءة.

التخصيص ورضا العملاء

إن استخدام تحليلات البيانات يتجاوز مجرد تحسين الأرباح، فهو يعزز أيضًا من رضا العملاء. تسمح الرسائل المصممة خصيصًا وذات الصلة، المستندة إلى البيانات، بتقديم تجربة أكثر تخصيصًا للعملاء. من خلال فهم أنماط السلوك، يمكن للبنوك تقديم صفقات تندمج بسلاسة في حياة العملاء، مما يجعلهم يشعرون بالتقدير والتواصل.

تعزيز تجربة العملاء

استخدم البيانات لتحسين تجربة العملاء، والتركيز على الشكاوى، وأن تكون أكثر استباقية في خدمة العملاء. سترى بسرعة أي القنوات هي القنوات المفضلة للتواصل مع مؤسستك. أفضل شيء يمكنك القيام به هو التركيز على جعل التفاعلات الرقمية مع العملاء إنسانية قدر الإمكان.

إن دمج هذه الاستراتيجيات يضمن أن البنوك لا تكتفي بتلبية توقعات العملاء فحسب، بل تتجاوزها. هذا النهج القائم على البيانات يعزز ولاء العملاء، مما يوفر أساسًا قويًا للنجاح المستدام في القطاع المالي."

كيف يمكن لتحليلات البيانات تحسين رضا العملاء في المؤسسات المالية؟

استخدم البيانات لتحسين تجربة العملاء، والتركيز على الشكاوى، وأن تكون أكثر استباقية في خدمة العملاء. سترى بسرعة أي القنوات هي القنوات المفضلة للتواصل مع مؤسستك. أفضل شيء يمكنك القيام به هو التركيز على جعل التفاعلات الرقمية مع العملاء إنسانية قدر الإمكان.

ولتعزيز هذا النهج، يمكن للمؤسسات المالية الاستفادة من تحليلات البيانات لاكتساب رؤى أعمق حول سلوك العملاء وتفضيلاتهم. من خلال تحليل البيانات المتعلقة بأنماط الإنفاق واستخدام بطاقات الائتمان وخيارات الاستثمار، يمكن للبنوك تخصيص خدماتها لتلبية الاحتياجات الفردية. لا يؤدي هذا التخصيص إلى تحسين الموارد فحسب، بل يؤدي أيضًا إلى تبسيط العمليات، مما يؤدي إلى تحقيق أقصى قدر من العوائد.

علاوة على ذلك، تتيح تحليلات البيانات تقديم رسائل مخصصة وذات صلة وفي الوقت المناسب. ويمكن أن يعزز ذلك من رضا العملاء بشكل كبير من خلال ضمان توافق الاتصالات والعروض مع حياة العملاء اليومية. يسمح فهم سلوك العملاء من خلال البيانات بتقديم عروض وخدمات تكميلية، مما يعزز الشعور بالتواصل والقيمة.

يضمن لك دمج العمليات المستنيرة بالبيانات في استراتيجيتك أن يشعر العملاء بالتقدير، حيث يتلقون خدمات ليست متاحة فقط بل مفيدة حقًا. هذا النهج الاستباقي في استخدام البيانات يعزز علاقة أعمق بين المؤسسة وعملائها، مما يجعل التفاعلات الرقمية تبدو شخصية وجذابة.

ما هو دور تحليلات البيانات في فهم سلوك العملاء؟

تلعب تحليلات البيانات دورًا حاسمًا في فك رموز أنماط سلوك العملاء والأعضاء. يمكّن هذا الفهم المؤسسات المالية من صياغة العروض والخدمات التي لا تتناسب مع أنماط حياة العملاء فحسب، بل تتكامل أيضًا مع أنماط حياتهم.

ما هي فوائد التواصل المخصص للعملاء؟

التواصل المخصص، المستند إلى بيانات العملاء، يجعل العملاء يشعرون بالتقدير والتواصل. فهو يضمن توافق الخدمات والعروض التي يتلقونها بشكل مباشر مع تفضيلاتهم الفريدة وأنشطتهم اليومية.

كيف يمكن لتحليلات البيانات أن تؤدي بشكل مباشر إلى زيادة رضا العملاء؟

من خلال استخدام تحليلات البيانات، يمكن للبنوك إرسال رسائل مصممة خصيصًا لتلبية احتياجات العملاء الفردية، مما يجعلها أكثر ملاءمة وفي الوقت المناسب. يعمل هذا التخصيص على تحسين تجربة العملاء بشكل عام، مما يؤدي إلى زيادة مستويات رضا العملاء.

خط أنابيب مبيعات إنفست جلاس وإعداد التقارير

كيف تستخدم المؤسسات المالية بيانات العملاء لتحسين عملياتها؟

تستفيد المؤسسات المالية من بيانات العملاء من خلال تحليل أنماط الإنفاق واستخدام بطاقات الائتمان وخيارات الاستثمار. يتيح لهم هذا النهج القائم على البيانات تخصيص الموارد بكفاءة، وتبسيط عملياتهم، وتعزيز الربحية.

كيف يمكن استخدام المواد الترويجية لتعزيز الوعي بالعلامة التجارية وولاء العملاء؟

إن إنشاء كتيبات وإرشادات التسويق هو أساس الجهود التسويقية لأي مؤسسة مالية. يمكن أن تساعدك وكالة التسويق الرقمي في تحديد اللون الأساسي والصياغة ولكن عليك التأكد من أن زملائك يستخدمونها بفعالية. سيبحث العملاء الجدد في الملفات الشخصية للمصرفيين. لذلك يمكنك أيضًا اقتراح وإنشاء جهات اتصال لموظفيك المصرفيين لدفعهم على وسائل التواصل الاجتماعي. هذا ما نسميه التسويق المؤثر أو التسويق عبر المؤثرين الصغار. يمكن لكل زميل أن يكون جزءًا من استراتيجية تسويق فعالة.

للارتقاء باستراتيجيتك التسويقية بشكل أكبر، ضع في اعتبارك قوة المواد الترويجية. هذه المواد ليست مجرد هدايا؛ إنها أدوات استراتيجية لتعزيز الوعي بالعلامة التجارية وتعزيز ولاء العملاء. بالإضافة إلى ذلك، يمكن أن يؤدي دمج تحسين محركات البحث (SEO) في جهودك التسويقية الرقمية إلى تحسين ظهور موقعك الإلكتروني وسهولة استخدامه بشكل كبير لكل من محركات البحث مثل جوجل والمستخدمين. إليك كيفية استخدامها بفعالية:

الملابس

- يمكن للعناصر الشائعة مثل الملابس الخارجية وقمصان البولو أن تحوّل موظفيك وعملائك إلى لوحات إعلانية متنقلة، مما ينشر صورة علامتك التجارية على نطاق واسع.

المجموعات المخصصة

- صمم العناصر الترويجية حسب الخدمات التي تقدمها. على سبيل المثال، يمكن أن يؤدي تقديم مجموعة أدوات ذات علامة تجارية لعملاء القروض السكنية الجدد مع عناصر عملية مثل شريط قياس أو مجموعة مفك البراغي إلى خلق انطباع دائم وشعور بالاهتمام.

هدايا مخصصة حسب الطلب

- إن توفير الأكواب والقمصان وزجاجات المياه وغيرها من الهدايا ذات العلامات التجارية المخصصة لا يسعد العملاء فحسب، بل يجعلهم يشعرون أيضًا بأنهم جزء من عائلة علامتك التجارية، مما يعزز الولاء وتكرار الأعمال.

ملابس الموظفين

- إن اللباس المتناسق للموظفين يميزهم عن الزوار ويغرس الفخر بمؤسستك ويعزز صورة العلامة التجارية المهنية والجديرة بالثقة.

من خلال نسج هذه العناصر في استراتيجيتك التسويقية، فإنك تضمن وصول علامتك التجارية إلى ما وراء حدود المكتب، وتظهر للعملاء والعملاء المحتملين مدى أهميتها. إن تحقيق التوازن بين التسويق التقليدي والاستراتيجيات الترويجية المبتكرة يخلق نهجاً شاملاً يكون له صدى على مستويات متعددة.

تحسين موقعك الإلكتروني للسرعة وسهولة الاستخدام على الهاتف المحمول

في العصر الرقمي الحالي، يعد وجود موقع إلكتروني مُحسَّن للسرعة وسهولة الاستخدام على الأجهزة المحمولة أمرًا بالغ الأهمية للمؤسسات المالية. يمكن أن يؤدي الموقع الإلكتروني البطيء التحميل إلى ارتفاع معدلات الارتداد وسوء تجربة المستخدم، في حين أن الموقع الإلكتروني غير المحسّن للأجهزة المحمولة يمكن أن يؤدي إلى فقدان العملاء المحتملين.

لتحسين موقعك الإلكتروني من حيث السرعة، استخدم أدوات مثل Google PageSpeed Insights لتحديد مجالات التحسين. يمكن أن يشمل ذلك ضغط الصور، وتصغير التعليمات البرمجية، والاستفادة من التخزين المؤقت للمتصفح. يمكن أن تؤدي هذه التحسينات إلى تقليل أوقات التحميل بشكل كبير، مما يعزز تجربة المستخدم بشكل عام.

لسهولة الاستخدام على الأجهزة المحمولة، تأكد من أن موقعك الإلكتروني يستخدم تصميمًا متجاوبًا للتكيف مع مختلف أحجام الشاشات والأجهزة. تعد القوالب الملائمة للجوال وسهولة التصفح ضرورية لتوفير تجربة سلسة على الشاشات الأصغر حجماً. احرص على سهولة النقر على الأزرار، وقراءة النص دون تكبير، وسهولة ملء النماذج على الأجهزة المحمولة.

من خلال تحسين موقعك الإلكتروني من حيث السرعة وسهولة الاستخدام على الهاتف المحمول، يمكنك تحسين تجربة المستخدم، وزيادة التفاعل، وزيادة التحويلات، مما يؤدي في النهاية إلى تعزيز استراتيجية التسويق الرقمي الخاصة بك.

استخدم تحسين محركات البحث المحلية للوصول إلى العملاء المحتملين

يُعد تحسين محركات البحث المحلية استراتيجية تسويقية بالغة الأهمية للمؤسسات المالية التي تهدف إلى الوصول إلى العملاء المحتملين في منطقتهم المحلية. من خلال تحسين موقعك الإلكتروني وحضورك على الإنترنت لمصطلحات البحث المحلية، يمكنك زيادة ظهورك في صفحات نتائج محرك البحث (SERPs) وجذب المزيد من الزيارات إلى موقعك الإلكتروني.

لاستخدام تحسين محركات البحث المحلية بفعالية، قم بتضمين الكلمات المفتاحية المستندة إلى الموقع الجغرافي في محتوى موقعك الإلكتروني وعلاماته الوصفية وعلاماته البديلة. فهذا يساعد محركات البحث على فهم مدى ملاءمتك لعمليات البحث المحلية. بالإضافة إلى ذلك، أنشئ قائمة "نشاطي التجاري على Google" وحسِّنها بمعلومات دقيقة ومُحدَّثة، بما في ذلك عنوانك ورقم هاتفك وساعات عملك.

علاوةً على ذلك، استفد من الدلائل والاستشهادات عبر الإنترنت لتعزيز وجودك على الإنترنت وإنشاء روابط خلفية عالية الجودة لموقعك الإلكتروني. أدرج نشاطك التجاري في أدلة الأعمال المحلية والغرف التجارية والقوائم الخاصة بالصناعة لتعزيز جهود تحسين محركات البحث المحلية.

من خلال تنفيذ استراتيجيات تحسين محركات البحث المحلية، يمكنك زيادة ظهورك في نتائج البحث المحلية، وجذب المزيد من الزيارات إلى موقعك الإلكتروني، وجذب المزيد من العملاء المحتملين إلى مؤسستك المالية، مما يعزز في النهاية من وجودك في السوق المحلية.

InvestGlass - حليفك في حملة التسويق المدعومة بالذكاء الاصطناعي للبنوك

في عصر يُعيد فيه الذكاء الاصطناعي تشكيل كيفية تقديم الخدمات المالية اليوم، يجب أن تتطور استراتيجيات التسويق للبنوك لتظل قادرة على المنافسة. وسواء كنت بنكًا محليًا أو بنكًا رقميًا أو أحد البنوك الكبرى، فإن مفتاح النجاح يكمن في الاستفادة من أدوات الذكاء الاصطناعي مثل InvestGlass لتعزيز كل مرحلة من مراحل رحلة العميل.

تُمكِّن InvestGlass البنوك المحلية والبنوك التقليدية على حد سواء من إنشاء محتوى يلقى صدى لدى جمهورها المحلي. بدءًا من صياغة إعلانات فعّالة على وسائل التواصل الاجتماعي إلى إطلاق حملات بريدية مباشرة تعتمد على البيانات، فهي تبسّط تعقيدات التسويق الحديث. وتساعد المنصة البنوك على التفاعل مع العملاء المحتملين والاحتفاظ بالعملاء الحاليين من خلال تصميم خدمات مخصصة تبني الولاء وتحقق سعادة العملاء.

من خلال دمج الذكاء الاصطناعي في حملاتك التسويقية، يمكن للبنوك زيادة توليد العملاء المحتملين إلى أقصى حد، وتعزيز الشعور بالثقة في علامتها التجارية المالية، وتمييز نفسها عن البنوك المحلية الأخرى. تعمل أدوات مثل InvestGlass على تسهيل تحليل المراجعات عبر الإنترنت وتحسين الإعلانات المدفوعة وبناء استراتيجيات تسويق محتوى فعالة، بما في ذلك التسويق عبر الفيديو، والتي تجذب العملاء حقًا.

لم يعد بإمكان القطاع المصرفي الاعتماد فقط على الأساليب التقليدية للترويج للخدمات المصرفية والمنتجات المصرفية مثل الحسابات الجارية والحسابات المصرفية. إن الدمج بين الذكاء الاصطناعي ومنصات التواصل الاجتماعي والتحليلات المتقدمة يُمكِّن معظم البنوك من المنافسة في مشهد رقمي ديناميكي مع الحفاظ على الصلة مع جمهورها المحلي والشركات المحلية.

سواء كنت تهدف إلى محاكاة نجاح الشركات الرائدة عالميًا مثل بنك الكومنولث أو تسعى إلى تحقيق مكانة خاصة في السوق، فإن InvestGlass هو الشريك المثالي. وبفضل قدرته على تبسيط العمليات وإضفاء الطابع الشخصي على الخدمات المصرفية عبر الإنترنت والخدمات عبر الإنترنت، فإنه يزوّد البنوك بالأدوات اللازمة لبناء الوعي بالعلامة التجارية، والتكيف مع متطلبات العملاء، والازدهار في سوق تنافسية.

ابدأ رحلتك نحو تسويق أكثر ذكاءً وقائم على الذكاء الاصطناعي مع InvestGlass. دعنا نعيد تعريف كيفية إنشاء البنوك للمحتوى والتواصل مع العديد من العملاء وتشكيل مستقبل الخدمات المالية اليوم.