How to Use AI in Banking: Transforming the Industry with InvestGlass CRM

In the ever-evolving banking industry, artificial intelligence (AI) has become a pivotal force, transforming operations and customer interactions. A 2024 survey by the Bank of England and the Financial Conduct Authority revealed that 75% of UK financial firms are already utilizing AI, with an additional 10% planning to adopt it within the next three years.

Financial institutions worldwide are leveraging AI technologies to enhance customer experience, streamline banking operations, and improve risk management. For instance, InvestGlass CRM offers a rule-based engine designed to enforce banking compliance, ensuring that financial institutions adhere to regulatory standards efficiently. Additionally, the integration of ChatGPT tools has been shown to boost productivity by automating routine tasks and providing personalized customer interactions.

These advancements not only improve operational efficiency but also position banks to better navigate the complexities of modern financial landscapes.

How AI is Revolutionizing the Banking Sector

AI in banking has come a long way, with leading financial institutions adopting AI models to improve various banking services. The benefits of utilizing AI in the banking and finance sector are manifold, including:

- Fraud detection, suspicious transactions and prevention

- Enhanced customer experience through personalized services

- Improved risk management using predictive analytics

- Regulatory compliance and operational efficiency

Let’s delve deeper into the role of InvestGlass CRM in revolutionizing banking operations and ensuring regulatory compliance.

InvestGlass CRM: Enforcing Banking Compliance with a Rule-Based Engine

InvestGlass CRM, a powerful platform for financial services firms, offers automation tools that enable banks to comply with regulatory requirements. The CRM uses a rule-based engine, designed to enforce banking compliance effectively. This engine allows banking institutions to:

- Define specific rules and triggers for risk management, use voice assistants

- Monitor customer data and transactions for signs of fraud or suspicious activity

- Automate anti-money laundering (AML) and other internal compliance team processes

By integrating InvestGlass CRM, financial institutions can streamline banking processes and ensure compliance while enhancing operational efficiency. The tools can be customised for a personal loan, cost savings, and credit scores, based on data analytics training. InvestGlass team will then get a sample of your legacy systems data and process it to check how the AI can be leveraged for robotic process automation. The banking artificial intelligence is different from one bank to another. Your data processing will offer valuable insights and not only fraud detection patterns.

ChatGPT: Boosting Productivity in Banking Operations

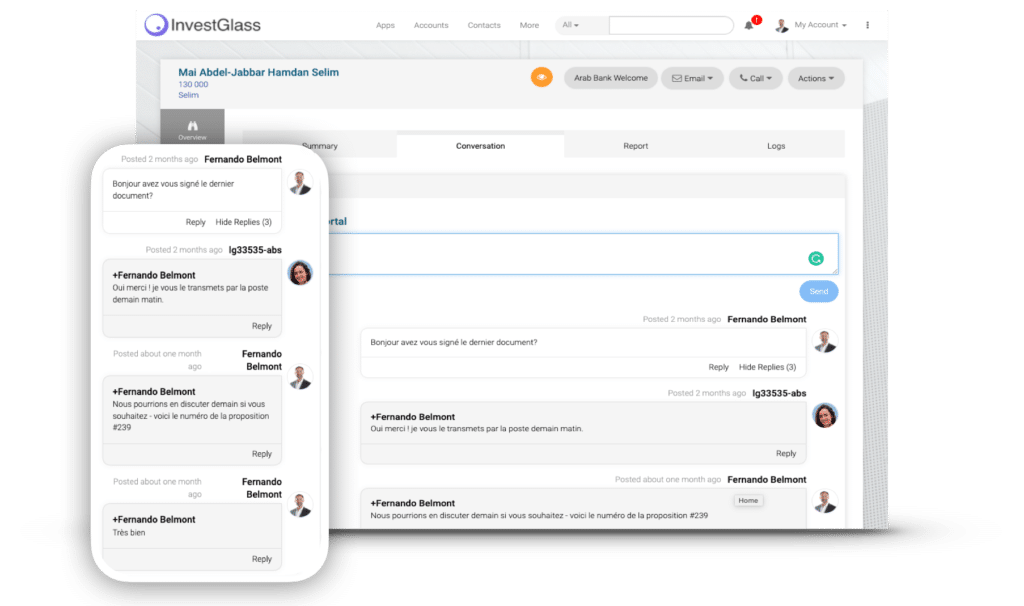

Another crucial aspect of AI in banking is the use of natural language processing (NLP) and machine learning techniques in communication. InvestGlass CRM utilizes ChatGPT tools to enhance productivity in the banking sector.

These tools have applications in various areas of banking, such as:

- Virtual assistants for customer support in mobile banking apps

- Automating routine tasks, such as account balances and transaction history queries

- Assisting human resources departments with talent acquisition and onboarding

Incorporating ChatGPT tools in banking operations not only streamlines processes but also elevates customer experience.

Enhancing Digital Onboarding with AI

Digital banking services are becoming increasingly popular, and consumers expect fast and efficient onboarding processes. InvestGlass CRM offers a digital onboarding solution that uses AI to create seamless and secure experiences for customers. By employing AI-powered systems, banks can:

- Speed up customer verification processes, customer behavior, limited credit history

- Provide tailored services based on customer data infrastructure

- Improve data security and prevent unauthorized access

With these advantages, AI solutions have become essential in enhancing customer experience and ensuring the success of digital banking services.

Conclusion

The adoption of AI in banking is no longer a matter of if, but when. AI models and technologies are changing the landscape of the banking industry, leading to better customer experiences, operational efficiency, and risk management. By leveraging InvestGlass CRM’s rule-based engine and ChatGPT tools, financial institutions can stay ahead of market trends, meet customer expectations, and maintain regulatory compliance.

InvestGlass can be hosted on your server which means that customer data will not leave your premise. We are also offering an on-premise artificial intelligence module which is powered with a machine learning component. The tool uses reinforcement learning to highlight relevant data. The tool has a pre-built ai model but we can improve it with access to operational data. The system fits new neobanks as well as traditional banks. Technology teams will appreciate the direct revenue impact of the AI on the bank’s processes.

Invest in AI today and revolutionize your banking operations with InvestGlass CRM’s sales tools, marketing tools, and collaborative portal.