Can you start a private equity company?

Starting a private equity firm requires meticulous planning, strategic focus, and considerable expertise. In 2024, private equity activity soared, with 18 megadeals valued at over $5 billion each, reflecting significant investor confidence and market growth (CBH). Key steps include defining a clear investment strategy, assembling an experienced team, securing robust capital commitments, and ensuring thorough due diligence to maximize success and minimize risk (Carta).

What is a private equity and what are its key components to raise money

Private equity is a type of investment that is typically used to finance the expansion or acquisition of businesses. In most cases, private equity funds are managed by specialized firms that raise capital from a variety of investors, including pension funds, insurance companies, and high-net-worth individuals. The Fund managers then use this capital to invest in businesses that they believe have the potential for significant growth.

There are four key components to private equity: first, the initial investment; second, the holding period; third, the exit strategy; and fourth, the return on investment. The initial investment is typically made through the purchase of shares or other securities in a company. The holding period refers to the length of time that the investor intends to hold onto these securities. The exit strategy is the method by which the investor plans to sell their stake in the company, typically through an initial public offering (IPO) or a sale to another company. Finally, the return on investment (ROI) is the measure of how much profit the investor expects to make on their investment. Private equity funds typically aim for an ROI of 20-30%. As you can see, private equity is a complex but potentially lucrative way to invest in businesses. When done correctly, it can provide investors with significant returns while also supporting the growth of dynamic businesses.

Start a private equity company can be super lucrative

There are many reasons why starting a private equity company can be incredibly beneficial. For one, as the owner of a private equity firm, you’ll have a lot of control over how your business is run. You’ll be able to make decisions about which companies to invest in and how to structure deals, without having to answer to outside investors. Additionally, private equity firms tend to be much more nimble than larger public companies, which means you’ll be able to act quickly on opportunities that arise. And finally, private equity firms often enjoy much higher rates of return than other types of businesses, making it a very lucrative endeavour. If you’re looking for a great way to earn a significant return on your investment, starting a private equity company is definitely worth considering.

What is the difference between private equity and venture capitalism?

Private equity and venture capitalism are both forms of investment. Private equity is typically invested in established companies that are looking to expand or restructure. Venture capitalism is generally invested in start-up companies with high growth potential. One key difference between private equity and venture capitalism is the stage of development of the companies they invest in. Private equity firms tend to invest in more established companies, while venture capitalists usually invest in early-stage companies. Another difference is the level of control that investors have. In private equity, investors often have a great deal of control over the company they have invested in. They may have a seat on the board or be involved in major decisions. Venture capitalists, on the other hand, typically have less control over the companies they invest in. While they may provide advice and guidance, they generally leave day-to-day operations to management. Private equity and venture capitalism are both important sources of funding for businesses. Each has its own advantages and disadvantages, and each is suitable for different types of companies.

How do private equity firms make money?

Private equity firms make money by buying and selling companies. They do this by first purchasing a controlling interest in a company,and then providing it with the capital it needs to grow. The firm then sells the company for a profit, either to another private equity firm or to the public through an initial public offering (IPO). In order to make a profit, private equity firms need to carefully choose the companies they invest in and provide them with the right amount of capital. They also need to have a good exit strategy, so they can sell the company at a higher price than they paid for it. By carefully selecting their investments and exits, private equity firms can generate significant profits for theirinvestors capitall gains are allocated between the participants in an investment.

Typically, private equity managers receive an annual management fee of 2% of committed capital from investors. So, for every USD10 million the fundraises from investors, the manager will collect USD200,000 in management fees annually. However, fund managers with less experience may receive a smaller management fee to attract new capital. Carried interest is commonly set at 20% above an expected return level. Should the hurdle rate be 4-8% for the fund, you and your investors would split returns at a rate of 20 to 80.

Who regulates private equity funds?

In the United States, there are two main types of private equity funds: registered investment companies (RICs) and business development companies (BDCs). RICs are regulated by the Securities and Exchange Commission (SEC), while BDCs are regulated by the Financial Industry Regulatory Authority (FINRA). Both types of funds are required to disclose certain information to investors, including the use of leverage and the compensation of fund managers. In addition, both types of funds are subject to periodic audits by independent auditors. However, there are some important differences between RICs and BDCs. For instance, RICs are not allowed to make certain types of investments, such as real estate or venture capital, while BDCs are allowed to invest in a wider range of assets. As a result, each type of fund is suitable for different types of investors.

Swiss law does not provide for a specific private equity legal framework but addresses a variety of structural frameworks in a number of different laws. The Federal Act on Collective Investment Schemes and accompanying ordinances, among which the most important is the Ordinance on Collective Investment Schemes (CISO), including rules applicable to closed-end fund structures and in general offer key provisions for the set-up sought after by private equity players.

Why you need a CRM to manage your deals and your prospects?

A CRM is a powerful tool for managing your deals and keeping track of your prospects. By keeping all of your customer information in one place, you can easily see who your best customers are and what deals are the most promising. Additionally, a CRM can help you to automate your sales process, making it more efficient and freeing up your time to focus on other tasks. While there is no replacement for personal relationships with your customers, a CRM can be a valuable addition to your business, helping you to close more deals and grow your business.

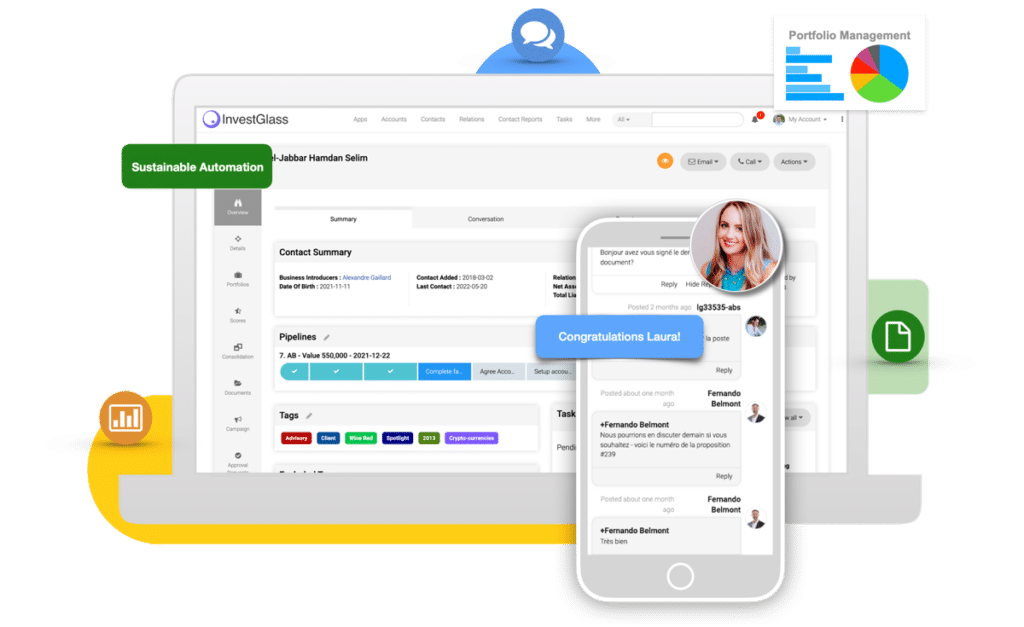

What InvestGlass built to support private equity firm automation?

No need to attend Harvard Business school. Investglass is a Swiss-based serum that is made to collect your prospects, general partner of interest, portfolio management, family office details, and limited partners’ details, in secured Swiss CRM. The tool has been built for the private equity space as well as hedge funds, and venture capital firms. So if you are changing your offer Investglass will adapt.

If you raise the money you will use the InvestGlass Campaign tool to track institutional investors’ interests. Managing investments can be performed via the investor portal. In the investor portal you can share all information related to your deals :

- company outright

- cash flow

- valuation guidelines

- business plan

- accredited investors’ documents

- already committed capital

- management team team

- fund structure

- track record

- highlight management fees

- portfolio managers’ monthly newsletter

- business strategy

The platform is fully customized for different segments of investors :

- investment bankers

- institutional investors

- general partners

- retail investors – with specific habilitations

- fund managers

- fund investors

InvestGlass CRM and investors portal is key to your automation. Automation is used for :

-Eliminating tedious and time-consuming tasks

-Reducing the risk of human error

-Improving accuracy and consistency

-Speeding up processes

-Raising money faster

-Freeing up your time to focus on other tasks.

Private equity companies are becoming more and more popular as people realize the benefits of owning one. If you’re thinking of starting your own private equity company, there are a few things you need to know before getting started. InvestGlass CRM and client portal can help power your private equity firm and make it run smoothly. With our help, you can overcome the challenges of starting a private equity company and thrive in this competitive industry. Contact us today to learn more about how we can help your business grow!