10 Best Bank Marketing Ideas to Boost Your Growth

Looking for effective bank marketing strategies that work? This article presents ten actionable strategies to help your bank increase visibility and deepen customer relationships. Whether it’s through community events or digital campaigns, find out how to apply these tactics for maximum growth.

Key Takeaways

-

Engaging with local communities through events and partnerships builds trust and enhances brand loyalty for banks.

-

Optimizing local SEO and utilizing online reviews can significantly boost a community bank’s digital presence and customer attraction.

-

Implementing tailored marketing strategies, such as targeted Google Ads and personalized customer services, improves customer retention and satisfaction.

Engage with Local Community Events

Implementing effective community bank marketing ideas aids in forging strong bonds and cultivating trust for banks. By offering sponsorships, making donations, and backing charitable causes, banks can establish a direct link with their local customers, which bolsters confidence and nurtures enduring fidelity.

Involvement in events held within the community positions your bank as a reliable ally. By harmonizing with the interests and principles of locals, it draws patrons to the bank while simultaneously elevating its standing within the community.

Partner with Local Businesses

Elevating visibility around philanthropic activities and joint ventures via newsletters or an online presence boosts trustworthiness. Such strategies not only benefit nearby companies, but also establish your bank as an integral pillar of the community.

Host Financial Literacy Workshops

Financial education workshops can elevate the stature of your bank, establishing it as a valuable asset to the community. By catering to various demographics such as students and individuals purchasing their first home, these sessions not only foster lead generation but also augment your strategy for marketing financial services.

By dispensing wisdom related to savings accounts, budget management, and borrowing options, your bank cements its role as a reliable consultant in finance matters. The addition of digital tools and online educational platforms can increase involvement with community members even further.

Optimize Local SEO and Online Visibility

Local SEO optimization enhances community banks’ digital visibility. Focusing on local strategies attracts customers and improves online presence. Using local keywords in advertising campaigns helps reach your audience effectively.

Using local keywords in content and metadata boosts search engine rankings and attracts customers. Combining local SEO with targeted Google Ads enhances visibility and engagement.

Utilize Local Keywords

Incorporating local keywords into the digital materials of a bank enhances its visibility in pertinent search results. Boosting your search engine standings is achievable by pinpointing and weaving in local terminology associated with your banking services.

To guarantee that your bank can be readily located, it’s vital to connect with the community and scrutinize what competitors are doing to unearth frequently used search terms. Employing this tactic not only bolsters the online footprint of your bank, but also increases visitor numbers to your website.

Leverage Online Reviews and Directories

Positive online reviews boost a community bank’s reputation and attract customers. Responding to all reviews shows commitment to customer satisfaction and builds trust.

Listing your bank in local directories and encouraging reviews improves online visibility, enhances reputation, and attracts more customers.

Implement Targeted Google Ads Campaigns as Part of Marketing Strategy

Targeted Google. Ads campaigns place community banks in front of potential customers. PPC advertising with Google Ads boosts prominence in search results, and calculating customer lifetime value ensures cost-effective ad spending.

Long-tail keywords target users closer to decision-making, improving conversion rates. Highlighting your bank’s unique qualities on Google Ads landing pages attracts customer interest.

Use Retargeting Ads

Retargeting advertisements serve to re-engage individuals who have already visited your site by recalling the services they contemplated. By segmenting these ads according to user interactions, personalized messages can be conveyed.

By dispatching content that aligns with the pages users have browsed, retargeting campaigns hold potential in transforming those exhibiting interest into customers while maintaining their involvement with what you offer.

Develop Valuable Content

Crafting impactful content is a crucial component of effective financial marketing strategies. Collaborating with local businesses enables community banks to cater to particular requirements, while the dissemination of stories about their impact solidifies their brand reputation and fosters stronger ties.

Incorporating storytelling into marketing materials significantly increases engagement by adding a relatable element. Tailoring content to address distinct financial concerns not only raises customer interest but also strengthens customer fidelity.

Produce Educational Videos

Sharing engaging content that demystifies complex financial subjects on platforms such as YouTube is essential for growth, by catering to the audience’s informational needs.

Conducting video workshops focusing on financial literacy can elevate your bank’s reputation as a valuable community asset. These educational videos are instrumental in attracting potential customers and boosting customer acquisition.

Share Success Stories

Presenting successful marketing campaigns underscores the art of storytelling and accentuates the beneficial outcomes your services have had. These accounts lend a human touch to your brand, forging an emotional bond with prospective customers.

Showcasing instances where your bank has made a positive difference in the lives of customers or community projects strengthens confidence and approachability, leading to deeper connections and allegiance from clients.

Enhance Customer Service Experience

Providing outstanding customer service is essential in nurturing enduring bonds with existing customers and boosting their loyalty. Featuring testimonials from clients bolsters confidence and demonstrates the value of your offerings.

Employing a CRM system contributes to maintaining customer relationships by facilitating services tailored to individual preferences. Applications equipped with customized financial instruments can greatly elevate contentment among customers, leading to increased retention rates.

Offer Personalized Services

Tailored banking solutions meet unique customer needs, fostering satisfaction. Leveraging customer data allows banks to customize communications and offers.

Providing personalized services fosters loyalty and long-term relationships, ensuring customers feel valued and understood.

Improve Onboarding Processes

Streamlined onboarding processes play a crucial role in shaping first impressions, which are vital for fostering enduring relationships with new customers.

By amplifying meaningful interactions, pinpointing potential points of customer loss, and focusing marketing efforts on key performance indicators (KPIs), businesses can minimize churn during the initial customer transition period.

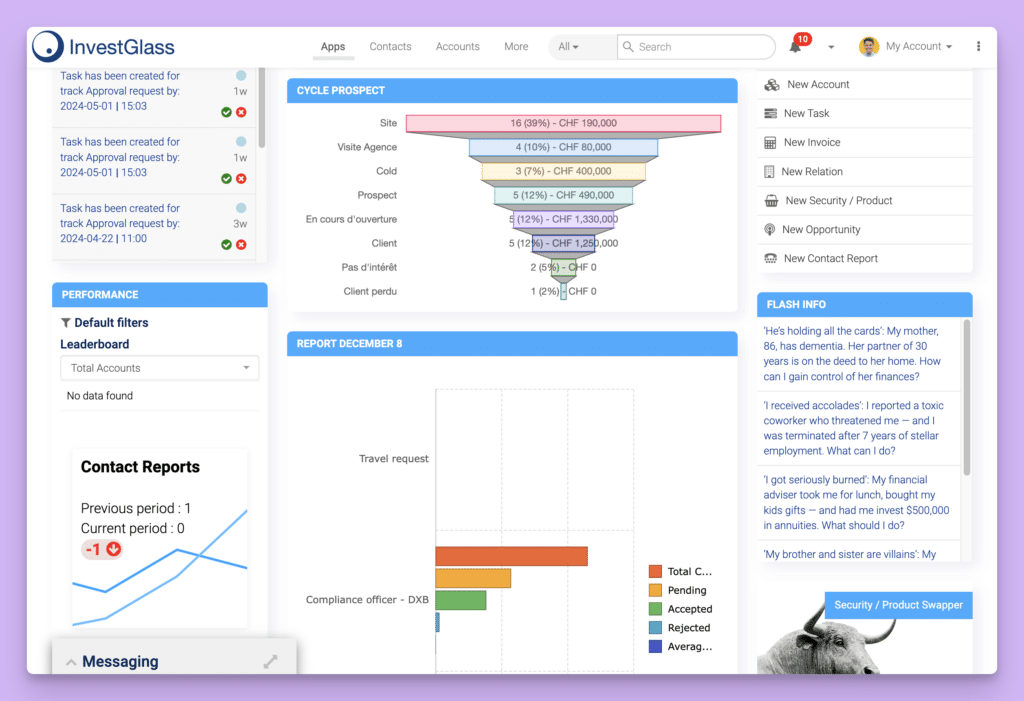

Invest in CRM Systems

Utilizing CRM systems enhances the ability to track leads, boosts efficiency, and consolidates marketing efforts. It offers an all-encompassing perspective on customer engagements, ensuring product alignment with financial objectives.

By offering instant access to customer data profiles, CRM systems enable swifter operational processes. The adoption of a CRM system elevates staff productivity through the amalgamation of information and minimization of clerical duties.

Promote Digital Banking Solutions

The shift in consumer preferences towards mobile and online services is being addressed by digital banking solutions, with an increasing emphasis on the convenience these platforms provide. Approximately one-third of community banks are focusing on the adoption of cutting-edge technological services such as immediate payment features to upgrade their mobile applications.

To advance their process for opening accounts online, many community banks collaborate with fintech firms. It is vital for a financial institution, whether it’s a bank or credit union, including credit unions specifically, to utilize dependable data sources when verifying identities to ensure efficient digital onboarding practices.

Develop a Feature-Rich Mobile App

For an effective and captivating mobile banking experience, it is imperative that the app offers features that are easy to use and facilitate convenience. Key functionalities should comprise:

-

Safe transaction capabilities

-

Easy balance inquiries

-

Accessible account transaction records

-

Tools for managing finances

-

Practical insights based on user activity

-

Valuable third-party integrations

A mere 36% of American banking customers perceive distinct value in the primary mobile application provided by their bank, suggesting a vast potential for enhancement. By upgrading these key aspects, banks can significantly increase customer satisfaction and involvement.

Ensure Seamless Online Account Opening

Consumer and business expectations are rising for online deposit account openings. Banks must combat fraud while launching digital account opening solutions.

Streamlining online account openings involves minimizing the steps required, ensuring a seamless and efficient experience for new account holders.

Utilize Social Media Advertising

Social media advertising targets individuals based on demographic and lifestyle factors, allowing banks to effectively reach specific demographics and promote financial products to those most likely to be interested.

Combining targeted social media advertising with engaging content marketing strategy boosts customer interest and increases conversion rates.

Target Specific Audiences

Advertising on social media provides an avenue for financial institutions to engage with potential customers by tapping into their interests, demographic profiles, and online behaviors. Platforms such as Facebook and Instagram offer sophisticated targeting tools that assist banks in identifying and attracting individuals who are more inclined to use their services.

By consistently sharing captivating content on social platforms, these institutions can grab the attention of prospective clients and foster enduring connections with them. This strategy ensures that marketing efforts are customized according to the specific needs and tastes of their target audience.

Share Engaging Content

Utilizing storytelling methods on social media can help make financial products accessible and attractive to those who might be interested in them. It also promotes trust and loyalty by providing educational and enlightening material.

Creating interactive materials such as surveys and polls not only fosters trust but also supports customers in making well-informed choices, which leads to increased engagement with the brand as well as a positive perception of it.

Highlight Community Bank Involvement

Active participation in community events and charitable endeavors showcases a dedication to the local area, boosting your bank’s profile and nurturing stronger bonds. By sponsoring activities and backing philanthropic causes, you signal to residents that your institution is invested in their well-being, which can lead to increased goodwill among the populace.

By emphasizing support for local businesses via social media promotion, you reinforce ties with existing customers while also appealing to potential clients who value community engagement. Featuring narratives about neighborhood enterprises not only strengthens communal connections, but also improves the perception of your bank, drawing in patrons who prioritize social responsibility and fostering lasting loyalty.

Publish Newsletters

By regularly issuing newsletters that showcase their support for the community, a bank underscores its dedication to local advancement. These publications maintain customer awareness regarding both the bank’s contributions and imminent activities.

Utilizing newsletters adeptly can bolster the reputation of a brand and fortify relationships with customers by showing an enduring devotion to communal endeavors. This strategy boosts the chances that individuals will opt for a local banking option while deepening their fidelity to it.

Feature Community Stories

Sharing community stories strengthens brand image and fosters customer loyalty. Engaging in local events, sponsoring festivals, and participating in fairs enhances visibility and connection with local customers.

Partnering with local businesses supports the community and creates mutually beneficial bank marketing campaigns. Sharing success stories of your bank’s positive impact builds trust and relatability.

Publishing newsletters keeps customers engaged with your bank’s initiatives.

Conduct Customer Surveys

Understanding the needs and preferences of customers is crucial, which can be achieved through customer surveys. Inquiring about why they selected your bank and what enhancements they seek offers valuable insights that can inform marketing campaigns. To capture a wide demographic spectrum, it’s important to conduct these surveys online as well as over the phone.

To boost participation in these surveys, providing incentives like gift cards could be beneficial. A comprehensive analysis of the survey data followed by crafting marketing strategies tailored to those responses has the potential to enhance customer satisfaction and foster loyalty.

Summary

In essence, banks aiming to expand and increase their prominence should adopt marketing strategies that are both creative and oriented towards the local community. Key approaches include participating in local events, improving local SEO practices, utilizing Google Ads effectively, generating high-quality content, and upgrading customer service quality. These methods serve to draw in new customers while keeping current ones engaged. Enhancing customer experience through CRM systems deployment and promotion of digital banking options can elevate overall satisfaction levels.

By integrating these various marketing concepts into its operations plan, a bank not only strengthens ties within the neighborhood, but also lays down the foundation for enduring growth by nurturing consumer loyalty. Banks should seize these ideas as opportunities to solidify their role as dependable pillars in the community fabric thereby ensuring sustained prosperity.

Frequently Asked Questions

How can engaging with local community events benefit my bank?

Participating in community events within the local area can bolster your bank’s standing by cultivating trust and solidifying bonds with customers. Such engagement promotes a communal spirit, potentially leading to heightened customer loyalty.

What are the benefits of partnering with local businesses?

Partnering with local businesses attracts new customers and strengthens community relationships while also supporting the local economy. This collaboration positions your bank as a vital part of the community.

How can financial literacy workshops help my bank?

By offering workshops on financial literacy, your bank can bolster its standing as a dependable advisor and improve its image, concurrently cultivating leads and delivering vital knowledge across various population segments.

Such dedication to educating the community may consequently result in heightened customer loyalty and expansion of business.

Why is local SEO important for community banks?

Community banks can significantly enhance their engagement with local customers and drive more traffic by focusing on Local SEO, which improves their search engine rankings and online visibility.

How can social media advertising benefit my bank?

Social media advertising can significantly benefit your bank by enabling precise targeting of demographics, which enhances engagement with potential customers and improves conversion rates for your financial products.

This focused approach ultimately drives growth and customer acquisition.