7 Benefits Of Digital Banking In 2025

In 2025, digital banking continues to revolutionize the financial industry, offering enhanced accessibility, cost efficiency, and personalized services. Notably, 87% of UK adults, approximately 47 million people, utilize online or remote banking services.

This widespread adoption underscores the shift towards digital platforms, driven by the convenience of 24/7 account access and real-time transaction processing. Financial institutions benefit from reduced operational costs, with the global digital banking market projected to reach $53.5 billion by 2030.

Moreover, the integration of artificial intelligence enables personalized financial services, enhancing customer satisfaction and loyalty. As digital banking becomes increasingly prevalent, it plays a pivotal role in promoting financial inclusion and meeting the evolving needs of consumers worldwide.

1 – Go digital it’s never too late

The global pandemic has tremendously impacted the speed of technology adoption. Indeed, lockdowns and remote work has made face-to-face encounters rarer. This trend forces executives and managers to, if not yet the case, accelerate digital adoption and offer digital products and services. In the wealth management industry, this implies a greater focus on digital advisory. One of the key shifts has been the growing awareness of the benefits of digital banking.

The global pandemic disrupted the means of communicating and satisfying clients. Besides, it also modified clients’ demands and approaches. The economic crisis and the ongoing uncertainty have led to increasing demand for financial advisory. InvestGlass provides the means for wealth managers to offer digital advising, be it via their workforce or artificial intelligence, and, thus, to develop a clear competitive advantage over laggards. With this pandemic – private banking – previously the most reluctant to move is running to catch up.

2 – Nurture all customer segments we mean ALL

Over the past years, the role of wealth managers, as well as their client targeting, has changed. From a pure wealth focus, wealth managers are now considering other customer segments. Pricing structures of wealth managers are shifting to include lower balance prospects. Indeed, in order to succeed and be able to provide their service to all market segments by reducing costs or improving efficiency, wealth managers need to partner with Artificial Intelligence advisory providers or similar fintech solutions and SAAS solutions.

Correspondingly, these previously underserved markets are surging as key interests for the future. Women’s and mass-affluents’ presence in the financial markets is getting important and the trend can be assumed to grow. The increasing interest in underserved markets enhances the wealth managers’ need to reformulate their pricing strategies to convince these customer segments and partner with InvestGlass. We provide an all-in-one CRM as the cheapest solution on the market and enable offering your service to other segments.

3 – Trust me I am your banker!

Studying the client’s expectations and behaviour, only 27% of Swiss individuals have worked with a financial advisor and over 50% manage their finances internally. This trend of behaviour is a worrying aspect for wealth managers with the rise of new, more efficient, advisors such as Artificial Intelligence and Fin-tech companies.

The Swiss financial environment clearly showcases a duality: most use a bank but choose other means to manage their wealth. This opens a large array of opportunities to convince sceptics, yet, it also conveys long-term risks.

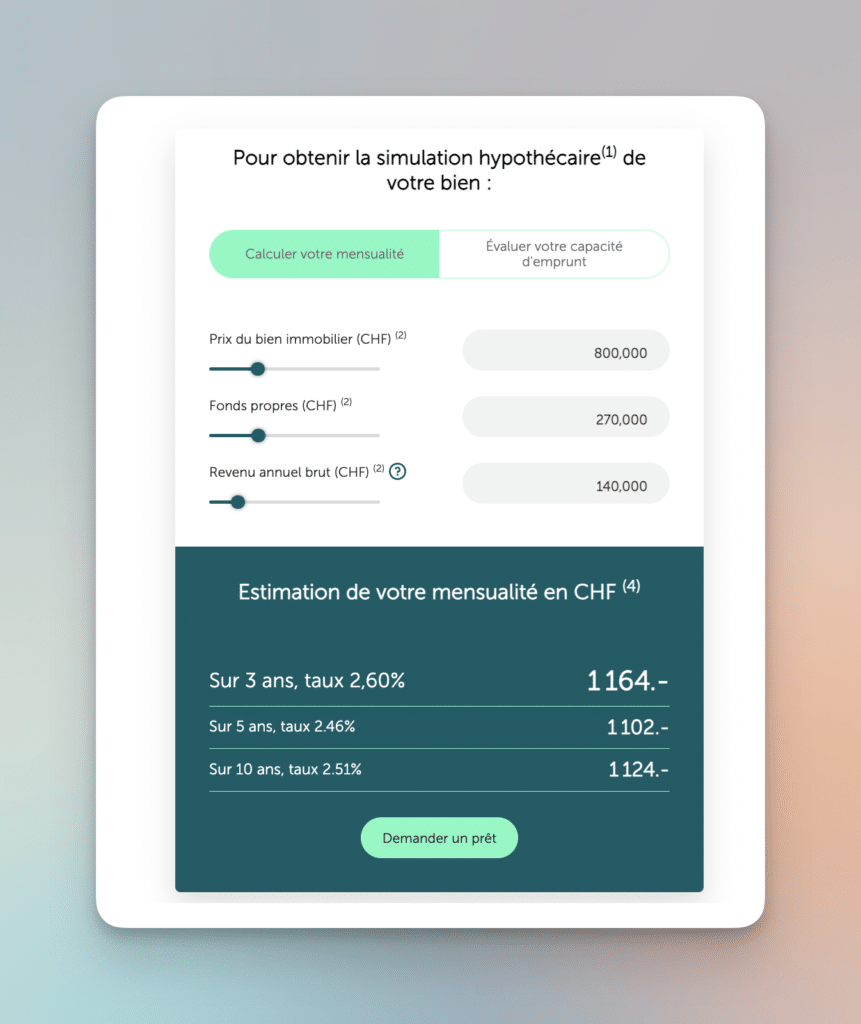

The challenge for wealth managers is that every decision of any individual is now demanding some kind of advice, ranging from buying a house to which insurance a client is selecting. This is where wealth managers need to evolve in the future, in order to gain market shares and fulfil clients’ expectations more thoroughly.

InvestGlass’s platform enables compliance with the need of the market by providing the means to make fast and efficient investment decisions. Satisfy your clients’ expectations starting today!

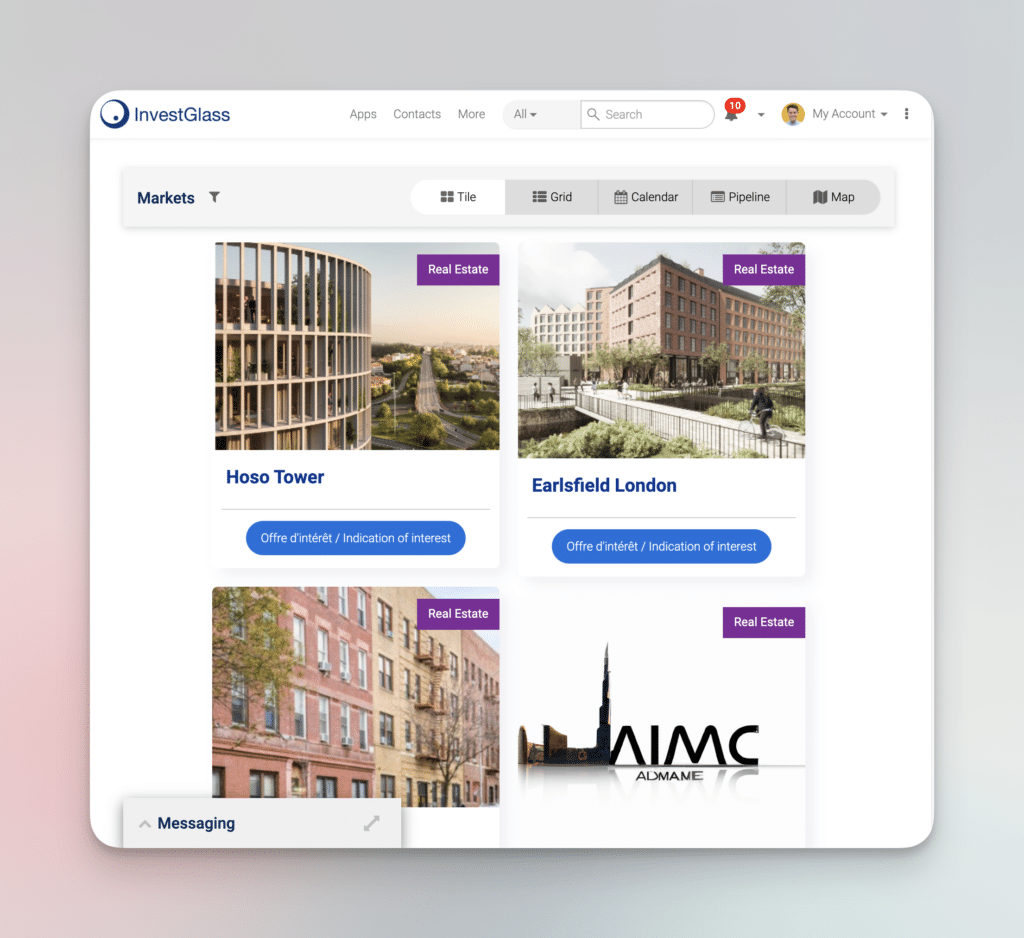

4 – Marketing hyper-personalization and All-in-one solution

Our customer-focused society has long supported mass customization. This trend is slowly but surely impacting financial services and wealth managers and has been exacerbated by the pandemic as the health crisis creates and enhances a plurality of needs within customer segments. Wealth managers are thus expected to connect with Artificial Intelligence and digital advisory fintech to tailor their offering to each customer. The two main focuses are going to be risk-assessing firms, whose technology can interpret a client’s risk profile, and predictive analytics firms, which are expected to have extreme growth potential within the wealth management industry. Use InvestGlass CRM and tailor your offering to each customer with our customizable client portal.

Additionally, customers’ expectations have been changing and shifting towards all-in-one solutions. Indeed, clients and prospects aim for the most inclusive offer on the market. Therefore, wealth managers and financial companies, in general, need to include supplementary services or products in order to compete against inclusive competitors. Wealth managers, who can recognize this trend and act on it, will experience higher client satisfaction and retention. InvestGlass’s all-in-one solution, fin-tech ecosystem and open API embrace the trend.

5 – Get out with trendy thematics – even if you don’t share them. It’s the client first!

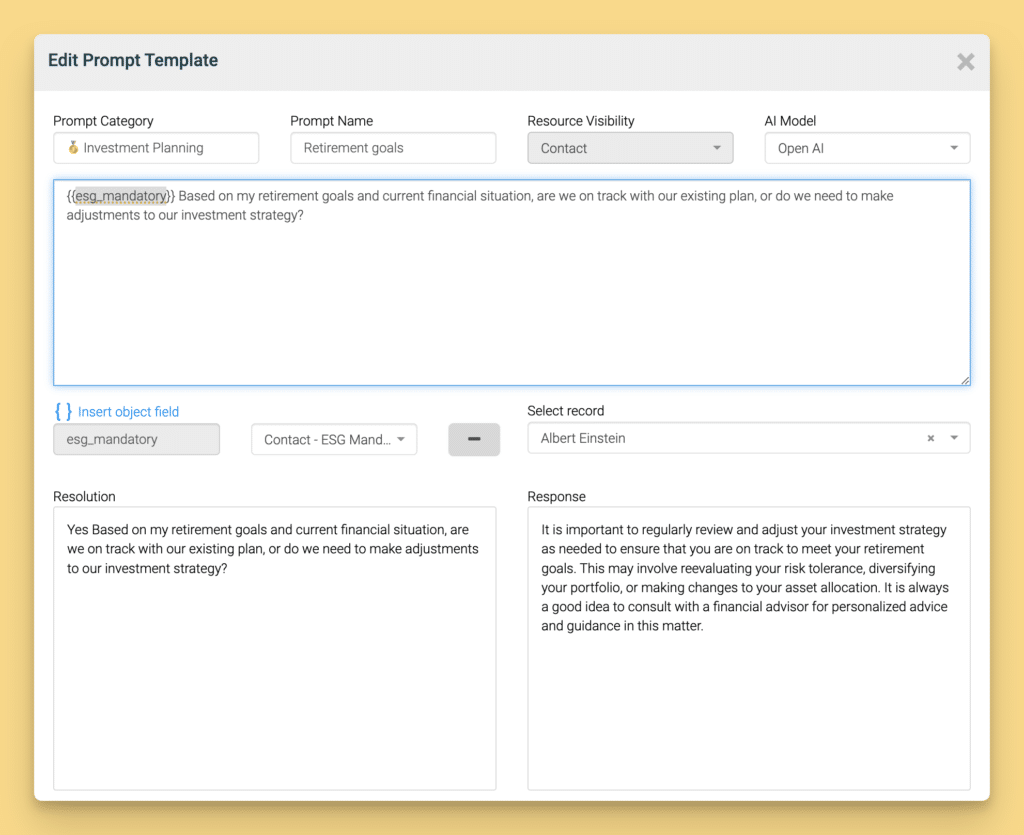

Over the last decades, before the pandemic became the main topic of discussion, sustainability and sustainable investment trend were gaining ground. Global warming, child labour, and, more generally, ethical and environmental issues were increasingly important for investors. The pandemic accelerated the trend and wealth managers’ clients consider ESG (environmental, social, and corporate governance) criteria more closely than in the past. The focus is thus to understand clearly the values and needs of your clients.

Consequently, wealth managers are expected to strengthen their sustainability offerings and showcase priority in sustainable compliant products. InvestGlass provides the means and ends to integrate ESG criteria in your offering as well as an AI rebalancing advisor to match your investment strategy.

6 – Next-Gen Reporting when less is more – or maybe not

For any business, the tech age our society is in has redefined competition. Firms, companies, stores, and individuals are fighting for awareness and attention. In order to foster engagement and attention from clients, processes have to be easy to use, interactive, and customer friendly. Therefore, technologies and innovations try to enhance clients’ attention by providing visualizable data, graphs, and images to engage and interact with them. Similar account aggregation makes a more friendly and comprehensive view of the client’s assets.

Consequently, wealth managers can, via the InvestGlass module, deal with clients’ expectations to implement wealth tech which encompasses gamification in forecasting strategies and interaction in client wealth reporting.

7 – Instant Data is not flying cars

Data is the most important source of information for any sales manager. For wealth managers, it is imperative to know your customer and, thus, to base your advice and product propositions on data. The more data is gathered, the better tailored your service or product will be to the client and the higher will be his/her satisfaction. As the way to gather such data is limited, advisors and wealth managers are now aiming for an alternative source of information such as behavioural data or localization data. Additionally, machine learning is an important asset when pursuing predictive analytics and alternative data collection. E.g., Artificial Intelligence can scan the web and extract complex data on sentiments and social network critical trends.

Hence, it is clear that wealth managers will have to develop competencies and capabilities to deal with alternative data and to support machine learning processes, capabilities inherent to the InvestGlass solution.

What is digital banking and how does it work?

Understanding Digital Banking and Its Functionality

Digital banking represents a modern approach to financial management, allowing users to perform banking tasks through online platforms, rather than visiting traditional brick-and-mortar branches. It’s accessible via websites and mobile applications, providing unparalleled convenience to customers who wish to manage their finances seamlessly.

The Mechanics of Digital Banking

Digital banking enables users to:

- Access Accounts Anytime, Anywhere: Log in to view account balances, monitor transactions, and receive notifications around the clock, whether at home or on the go.

- Conduct Financial Transactions: Effortlessly transfer funds between accounts, make payments, and set up automatic bill pays.

- Apply for Financial Products: Quickly apply for personal loans, credit cards, or even mortgages, streamlining what used to be paper-intensive processes.

- Enhanced Security Features: Benefit from cutting-edge security measures like biometric authentication and encrypted transactions to protect personal information.

Why Digital Banking is Thriving

The rise of digital banking can be attributed to its unmatched convenience, allowing individuals to bypass long queues and restrictive branch hours. It caters to a tech-savvy audience that values efficiency and real-time access to their financial portfolio. By adopting digital channels, banks can also reduce operational costs and offer innovative services tailored to the needs of the modern consumer.

In essence, as more people rely on their devices for day-to-day tasks, digital banking solidifies itself as a vital component of contemporary financial management.

What Features Can Be Found in Mobile and Online Banking Apps?

Mobile and online banking apps have evolved to offer a wide array of features, sometimes surpassing the functionalities available in traditional bank branches. Here’s a closer look at what you can expect:

- Comprehensive Financial Tools: These apps often come equipped with personalized financial advice, savings calculators, and even big-purchase planning tools—providing more than just basic banking functions.

- Seamless Everyday Transactions: From checking account balances and viewing statements to transferring funds and paying bills, these apps simplify daily banking tasks.

- Mobile Check Deposit: A convenient feature that enables customers to deposit checks using their smartphone’s camera, eliminating the need for a trip to the bank.

- Peer-to-Peer Payments: Many apps allow you to transfer money to friends and family instantly, often with just a few taps.

- Location and Access Services: Easily locate ATMs nearby and enjoy features like cardless ATM withdrawals, providing both convenience and security.

- Budgeting and Tracking Tools: Keep track of your spending and savings with integrated budgeting tools designed to help users manage their finances effortlessly.

- Virtual Assistance: Some apps include AI-driven virtual assistants to help answer questions and complete tasks, making navigation intuitive.

- Live Customer Support: Bridging the gap between digital and personal banking, certain apps offer the ability to chat with a live representative, ensuring that human support is available whenever needed.

When choosing a banking app, consider how these features align with your needs and prioritize those offering a balance of automated efficiency and human interaction.

How Do Digital Banks Generate Revenue?

Digital banks, much like their traditional counterparts, have several avenues for generating income. Here’s a closer look at their primary revenue streams:

- Interest on Loans: Digital banks utilize customer deposits to issue various loan products. By lending this money, they charge interest, which becomes a significant source of their earnings.

- Fees for Bank Services: These banks also impose fees for numerous services. This includes charges for wire transfers, account management, and overdraft protection, among others.

- Credit Products: Beyond simple loans, digital banking platforms often offer credit cards and other credit facilities. The interest accrued from these products contributes to their revenue.

While the methods bear resemblance to traditional banking models, digital banks often leverage technology to streamline operations, potentially reducing costs and attracting tech-savvy customers.

How is Security Ensured in Digital Banking?

Digital banking has revolutionized how we manage our finances, but it’s crucial to understand how safety is maintained in this virtual space. Banks deploy a variety of technological defenses to safeguard their customers’ data and prevent unauthorized access.

Key Security Measures

- Advanced Encryption:

- Financial institutions use state-of-the-art encryption to encode sensitive data, ensuring that even if information is intercepted, it remains unintelligible to potential cybercriminals.

- Firewalls:

- Firewalls act as a barrier between the bank’s internal networks and potential threats from the internet, filtering out malicious traffic and preventing unauthorized access.

- Multifactor Authentication (MFA):

- MFA adds an extra layer of security by requiring users to verify their identity through multiple methods, such as a password and a one-time code sent to their phone.

- Artificial intellogence on premise

- Use InvestGlass on your own server or on Swiss private clouds

Potential Risks

Despite these robust security measures, online banking isn’t entirely risk-free. Users can inadvertently expose themselves to threats, especially when:

- Connecting through public Wi-Fi, which is often insecure.

- Using devices that haven’t been updated with the latest security features.

Safety Tips for Users

To further enhance your digital banking security:

- Create Strong Passwords: Use a mix of letters, numbers, and symbols.

- Keep Software Updated: Regularly update your devices with the latest security patches.

- Avoid Sharing Sensitive Information: Never share passwords or PINs, even with friends or family.

By combining bank-level security measures with individual vigilance, you can protect your financial information and enjoy the convenience of online banking with confidence.

Is Online Banking Safe and What Precautions Should Be Taken?

Online banking offers unparalleled convenience, allowing users to manage their finances from virtually anywhere. Financial institutions go to great lengths to ensure secure transactions, employing cutting-edge technologies such as:

- Encryption: This technology scrambles data, making it unreadable to unauthorized parties.

- Firewalls: Acting as barriers, firewalls prevent unauthorized access to banking systems.

- Multifactor Authentication (MFA): By requiring multiple forms of verification, MFA adds an extra layer of security.

While banks have robust protection measures in place, the safety of online banking also depends on user behavior. Here are essential precautions you should consider:

Tips for Safeguarding Your Online Banking

- Avoid Public Wi-Fi: Accessing your bank account over public Wi-Fi networks can expose you to potential threats. Stick to secure, private networks whenever possible.

- Secure Your Devices: Regularly update your computer and mobile devices with the latest security patches and antivirus software to fend off vulnerabilities.

- Create Strong Passwords: Utilize a combination of letters, numbers, and symbols. Consider using password managers to store and generate strong passwords.

- Monitor Account Activity: Regularly check your bank statements and account activity for any unauthorized transactions. Report any suspicious actions to your bank immediately.

- Enable Alerts: Set up notifications for transactions and login attempts. This way, you’ll know instantly if there’s unusual activity on your account.

- Beware of Phishing Attempts: Be cautious of unsolicited emails or messages requesting sensitive information. Always verify the sender’s authenticity before responding.

By taking these precautions, you can significantly enhance the security of your online banking activities. Remember, while banks provide strong protection, the first line of defense starts with you.

When it comes to choosing the best online banks for digital banking, several key features stand out. These banks typically offer highly-rated mobile applications and user-friendly websites. Such platforms are designed with robust features to streamline your daily banking tasks, giving you greater control over your finances. Additionally, they often foster a virtual community of users with similar financial goals.

To help you navigate the digital banking landscape, here are some top contenders recognized for their outstanding online services:

- Top Mobile App Functionality: These banks provide mobile apps that are praised for their ease of use, comprehensive functionalities, and seamless navigation. You can effortlessly check your balance, transfer funds, and even deposit checks with a few taps.

- User-Centric Websites: Their websites are intuitive and packed with features that go beyond basic banking. Tools for budgeting, spending analysis, and financial goal tracking are commonly available.

- Innovative Financial Tools: Expect cutting-edge features such as integration with other financial apps, personalized financial advice, and automated savings programs that help you reach your financial objectives faster.

- Community Engagement: Some banks offer platforms for connecting with other customers, allowing for shared financial goals and experiences. This sense of community can be an invaluable resource as you manage your finances.

Seek out an online bank that prioritizes these aspects to ensure a top-notch digital banking experience.

What Fees are Associated with Online Banking?

While online banks typically boast fewer fees due to reduced operating costs, some charges may still apply. Here’s a rundown of potential fees you might encounter:

- Monthly Maintenance Fees: Some online banks impose a monthly charge to keep your account active. This fee can often be waived if you maintain a minimum balance or meet specific activity criteria.

- Overdraft Fees: If you accidentally spend more than what’s in your account, an overdraft fee may be charged.

- ATM Fees: Using ATMs outside your bank’s network can incur additional fees. It’s wise to check if your bank offers a network of free ATMs to avoid these charges.

- Wire Transfer Fees: Sending or receiving money via domestic or international wire transfers may come with a fee, which can vary based on the transaction’s complexity.

- Stop Payment Fees: If you need to halt a check or an ACH payment before it processes, your bank might charge a fee for stopping the transaction.

- Foreign Transaction Fees: Making purchases in currencies other than your own can result in a conversion fee. This is common when traveling or shopping with international merchants.

Understanding these fees can help you manage your finances more effectively and potentially avoid unnecessary charges. Always review the fee schedule of the online bank you plan to use to know exactly what to expect.

Get AI first

In conclusion, the financial industry, particularly wealth management, is at a pivotal moment where embracing digital transformation and leveraging innovative tools like InvestGlass SMART AI is no longer optional—it’s essential. The acceleration of digitalization, spurred by the pandemic, demands a shift in traditional practices toward a more agile, data-driven, and customer-centric approach.

Wealth managers must expand their focus to nurture all customer segments, recognizing the growth potential in lower-balance prospects and addressing the widespread lack of trust in financial advisory with transparency and tailored solutions. Hyper-personalization emerges as a critical strategy, offering mass-customized, ecosystem-integrated products that resonate with individual client needs and preferences.

Moreover, aligning with values such as ESG and sustainable investment strengthens competitive positioning and aligns with evolving client expectations. Gamified, next-generation reporting and real-time, data-informed decision-making will enhance client engagement and deliver impactful experiences.

InvestGlass SMART AI provides the intelligence and adaptability required to navigate these transformative trends. By integrating automation, analytics, and a client-first ethos, financial professionals can stay ahead of the curve, foster trust, and deliver unparalleled value in an increasingly digital and personalized financial landscape.