The Swiss CRM

built for Private Equity

Powering Precision in Private Equity with a Swiss Neutral CRM

Simplify Your Workflow

From Start to End

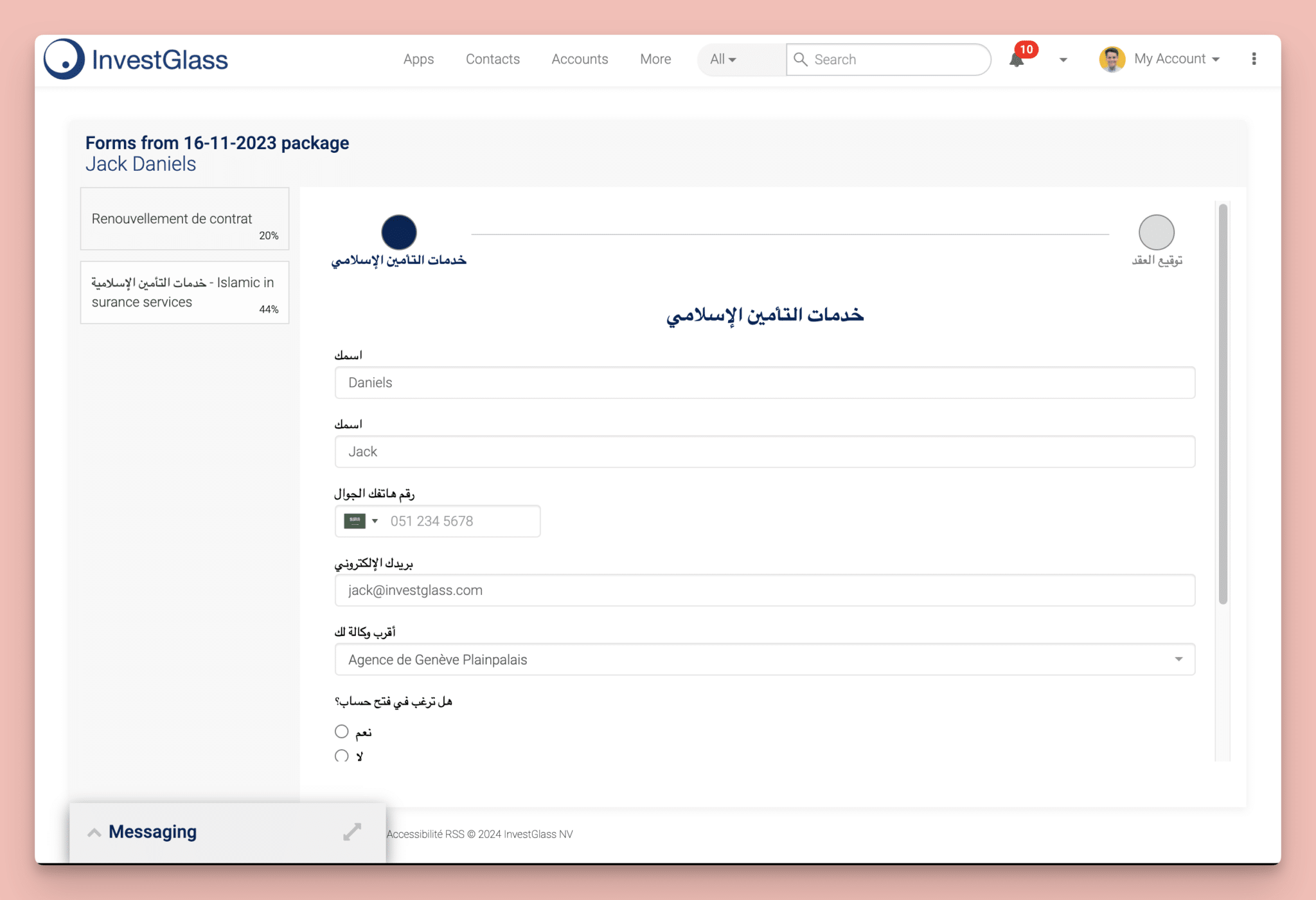

Digital Onboarding and Signature

InvestGlass revolutionizes private equity and venture capital operations with its digital onboarding and signature feature. Simplify investor onboarding with electronic document handling and secure e-signatures, reducing administrative tasks and accelerating capital commitments. This streamlined process enhances investor experience and operational efficiency, crucial for fast-paced deal environments.

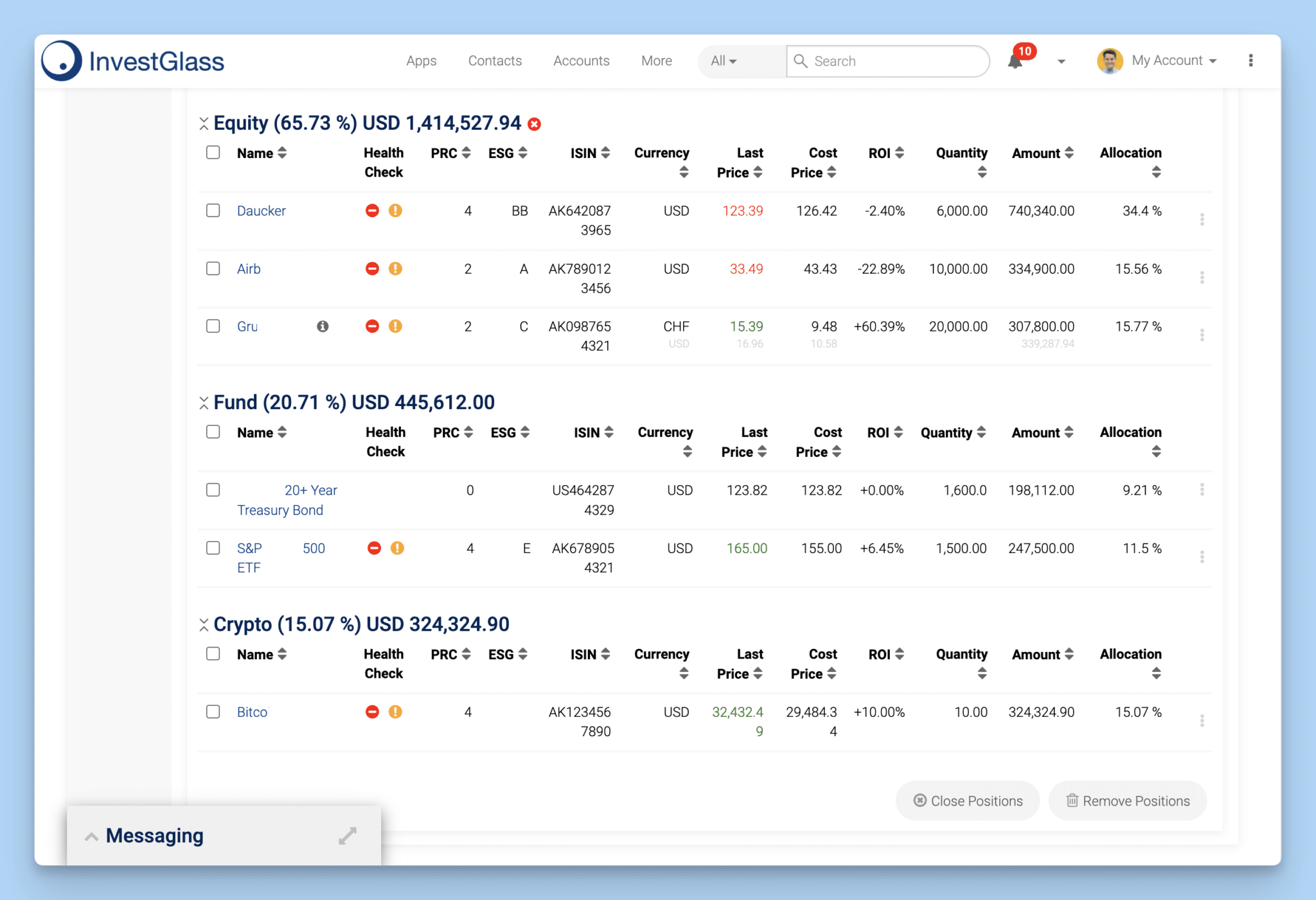

Portfolio Management System

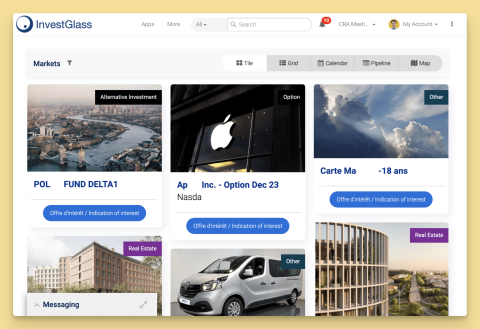

Our Portfolio Management System is tailored for private equity and venture capital workflows, offering tools to manage complex investment structures and track performance across multiple funds. With real-time insights, detailed analytics, and comprehensive reporting, InvestGlass empowers fund managers to optimize strategies, monitor portfolio companies, and maximize returns.

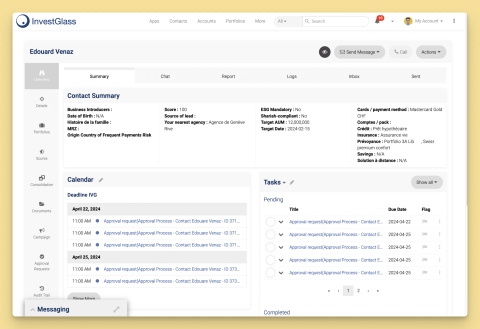

The Swiss CRM

InvestGlass’s Swiss Neutral CRM ensures the highest levels of privacy and data security, essential for sensitive deal information. Hosted in Switzerland, it complies with stringent Swiss data protection laws, guaranteeing data sovereignty. This builds trust with investors and portfolio companies, ensuring that all sensitive information is securely managed.

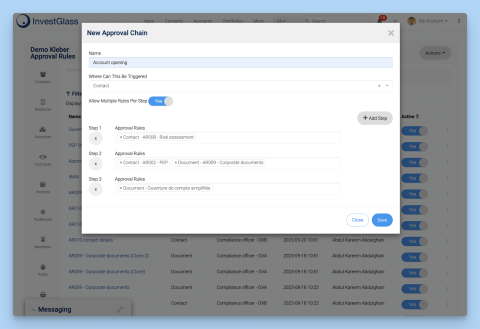

Automation Process and GPT

Leverage automation and GPT to streamline private equity and venture capital workflows with InvestGlass. Automate due diligence processes, generate personalized investment reports, and enhance data analysis using advanced AI. This reduces manual labor, minimizes errors, and provides deep insights, enabling your team to focus on deal origination and value creation.

Investor & Employee Portal

InvestGlass offers a comprehensive portal designed for private equity and venture capital firms, enhancing transparency and communication. Investors can access fund performance, track their capital commitments, and communicate securely with fund managers. Employees benefit from a centralized platform to manage deal flow, collaborate on investment opportunities, and access critical tools, ensuring an efficient and cohesive work environment.