How Are Banks Using LLMs: Enhancing Fraud Detection, Risk Assessment, and Credit Evaluation

Banks are using large language models (LLMs) to change how they operate. They are leveraging LLMs for comprehensive risk assessments, including evaluating creditworthiness through unconventional data sources and simulating various economic scenarios. From boosting customer service to detecting fraud, LLMs are making banking smarter and safer. This article looks at how banks are using LLMs to help improve efficiency and security, and what this means for customers.

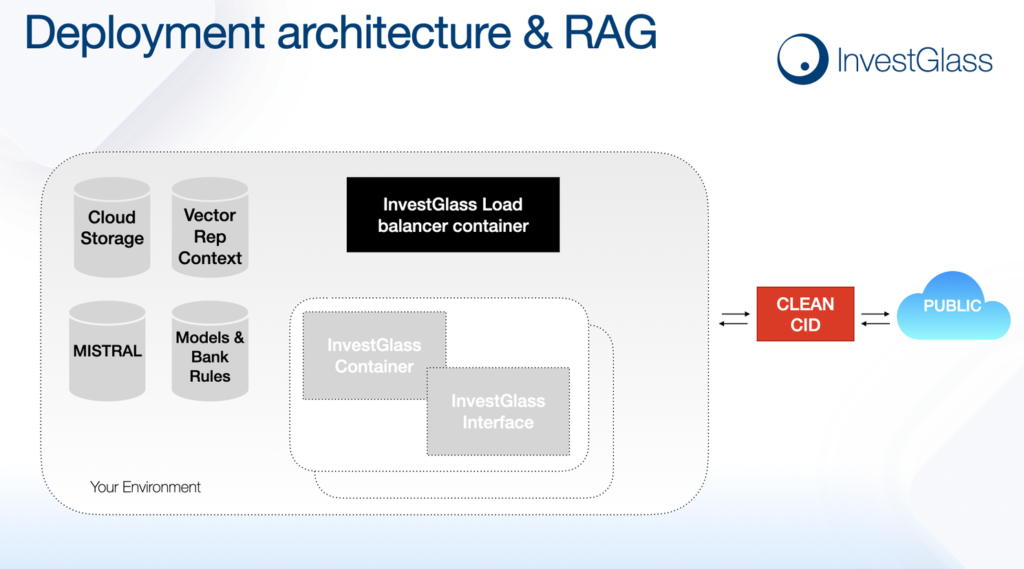

InvestGlass is the only Swiss Sovereign Solution – using Swiss CRM and Swiss AI with your preferred model. The model can be hosted in your premise or on our public cloud in Geneva Canton.

Introduction to LLMs in Banking

The banking sector is undergoing a significant transformation with the integration of Large Language Models (LLMs) in various operations. LLMs are a type of artificial intelligence (AI) designed to process and generate human-like language, enabling banks to enhance customer experience, improve operational efficiency, and reduce risks. Financial institutions are leveraging LLMs to analyze vast amounts of financial data, detect fraudulent activities, and provide personalized services to customers. By enabling banks to process and interpret complex datasets, LLMs are revolutionizing traditional banking processes and paving the way for more efficient and secure operations. In this section, we will explore the basics of LLMs and their applications in the banking sector.

Key Takeaways

- Banks are leveraging large language models (LLMs) to enhance customer service through 24/7 support, personalized services, and efficient query handling, leading to improved customer satisfaction.

- LLMs play a crucial role in automating banking operations, streamlining processes like customer onboarding and compliance, while also significantly reducing human errors and operational costs.

- In risk assessment, fraud detection, and credit evaluation, LLMs optimize decision-making by analyzing vast datasets, predicting trends, and generating personalized financial solutions, enhancing security and customer trust.

Leveraging Large Language Models for Customer Service

In the contemporary era of digitization, customer service has become an essential aspect of engagement and large language models (LLMs) are at the forefront in revolutionizing this sector. Banks are tapping into LLMs to deliver constant support via chatbots and virtual assistants, ensuring that communication is smooth and interactions mimic those with humans. Thanks to natural language processing (NLP), these AI-powered mechanisms can process customer inquiries with high efficiency, substantially improving the overall experience for customers.

The advantages of employing LLMs go beyond simple communication capabilities. By analyzing extensive quantities of consumer data, these advanced models have the capacity to anticipate behaviors, needs, and preferences—equipping banks with the necessary insights for tailoring highly individualized services and recommendations. HDFC. Bank stands as a testament to such benefits. It has experienced a surge in customer satisfaction following faster service delivery made possible by leveraging LLMs. These systems also proficiently assist users through intricate processes like setting up accounts by providing timely information.

Enhancing operational efficiency Includes managing client exchanges across varied platforms while meeting expectations for omnipresent channel services since they continuously learn from interaction patterns over time—an evolution that sharpens decision-making acumen while diminishing error rates within institutions by efficiently condensing bulky documents among other complex duties.

By 2024 projections point toward banking bots attaining an accuracy rate close to 85%, which speaks volumes about their growing efficacy in fundamentally transforming how financial institutions address client servicing matters.

Automating Banking Operations with LLMs

Financial institutions within the banking sector are embracing a digital overhaul, with Large Language Models (LLMs) at the forefront of this evolution. The adoption of LLMs is instrumental in automating various processes, leading to an increase in operational efficiency and better allocation of resources. These sophisticated models offer considerable support to back-office personnel by swiftly processing critical documents such as loan applications and Know Your Customer (KYC) forms, minimizing human errors and expediting routine operations.

Equipped with the ability to sift through unstructured data from multiple sources, these models deliver insights that might elude conventional systems. By incorporating LLMs into their existing frameworks, banks can significantly improve operational efficiency without needing to completely revamp their infrastructure. This fusion enables financial entities to refine their workflows efficiently, thereby diminishing costs and curtailing mistakes, which contributes positively not only towards streamlining staff workload but also elevates the overall customer experience within the banking ecosystem.

Streamlining Customer Onboarding

The initiation of a customer’s engagement with a bank is greatly influenced by the onboarding process. Large Language Models (LLMs) facilitate this stage, assisting customers in setting up their accounts, responding to inquiries they may have and showcasing new offerings. By automating certain tasks and creating standardized templates for financial documents, LLMs help expedite traditionally lengthy procedures while reducing the possibility of human error—resulting in an improved experience for customers.

These models exhibit proficiency in deciphering vital details from complex paperwork by transforming unstructured data into an organized format suitable for Examination. This function not only accelerates the customer integration procedure, but also ensures adherence to Know Your Customer (KYC) regulations—a crucial factor in mitigating risk and securing trust within the organization.

Incorporation of LLMs into banking processes without any friction underscores a considerable leap towards achieving digital transformation goals within the industry.

Enhancing Compliance and Regulatory Adherence

Adhering to regulatory mandates is a critical issue for financial institutions. By leveraging LLMs, these organizations can automate the scrutiny and disclosure of financial information to remain in compliance. The acceleration and precision provided by automating data gathering not only speeds up decision-making, but also boosts the effectiveness with which compliance operations are performed.

LLMs are essential in creating regulatory documentation while guaranteeing conformity with standards such as IFRS, CCPA, and GDPR. They aid in condensing intricate details and streamlining access to data, significantly minimizing mistakes in meeting compliance obligations and bolstering the quality of financial reporting.

The use of automation through LLMs transcends current compliances. It prepares banks to adeptly navigate upcoming regulations, ensuring that they consistently satisfy mandated requirements while improving their readiness for prospective regulatory changes.

Enhancing Fraud Detection and Prevention

In the banking sector, safeguarding operations from fraudulent activities is paramount. Generative AI stands at the forefront in this regard by scrutinizing extensive financial data and transaction history to pinpoint irregular patterns and detect potential fraud. With their ability to assimilate new information constantly, these models progressively refine their proficiency in thwarting contemporary scam techniques, surpassing conventional approaches.

Generative AI offers a considerable edge for fraud mitigation through its adeptness at recognizing anomalous transactional behaviors and dynamically refining detection protocols. This perpetual adaptation facilitates banks in combatting fraud with greater efficiency and effectiveness while bolstering overall security measures. By harnessing advanced analytics, LLMs provide powerful tools that are instrumental in identifying and obstructing fraudulent actions.

Embedding LLMs within anti-fraud mechanisms not only fortifies security, but also reinforces customer confidence by providing assurance about the protection of their financial data. As these technologies advance, they will advance. They will increasingly become crucial assets for banks pursuing secure operations free from threats of data breaches.

Improving Credit Risk Assessment

Assessing credit risk is a critical element in the banking sector that significantly influences lending activities. By harnessing LLMs, banks can scrutinize various data sources and employ sophisticated algorithms to refine their decision-making process. These models adeptly sift through historical information and discern market trends to pinpoint potential red flags, facilitating thorough risk evaluations.

The integration of generative AI into this realm propels the ability to conduct real-time assessments and craft detailed scenario analyses, which bolsters informed choices regarding loans as well as predictions about market movements. Such technology not only elevates the effectiveness of managing risks, but also quickens and enhances the precision within loan sanction procedures. Using synthetic data minimizes the partiality inherent in credit scoring mechanisms, thus guaranteeing equitable and trustworthy results.

Real-Time Credit Scoring

Banks must make expedient lending decisions that align with prevailing financial trends, and real-time credit scoring is pivotal in this process. Leveraging LLMs, banks can scrutinize immense volumes of both historical and recent financial data, which facilitates swift action to mitigate imminent threats. Real-time alerts generated by these models for atypical transaction patterns markedly elevate the precision and efficiency of risk assessments within the banking sector.

The proficiency to conduct credit scoring in real time equips banks with agility to adapt to fluctuating market scenarios, preserving their competitive edge while ensuring informed decision-making during loan approvals. Such a capability is indispensable for sustaining an adaptable credit risk assessment system attuned to the ever-evolving economic landscape.

Personalized Loan Offers

The banking industry’s competitive environment is placing a higher value on customized loan proposals. Banks can utilize LLMs to design loan products specifically suited to the unique profiles and conduct of their customers by interpreting customer data, which reveals critical insights that help in shaping loans according to particular preferences and financial conditions.

Not only does this tailored methodology improve client satisfaction, but it also broadens reach for financial services firms. Financial institutions are able to pinpoint underserved segments through these personalized strategies and offer tailor-made loan options that address the distinctive requirements of their clientele, thus building fidelity and confidence.

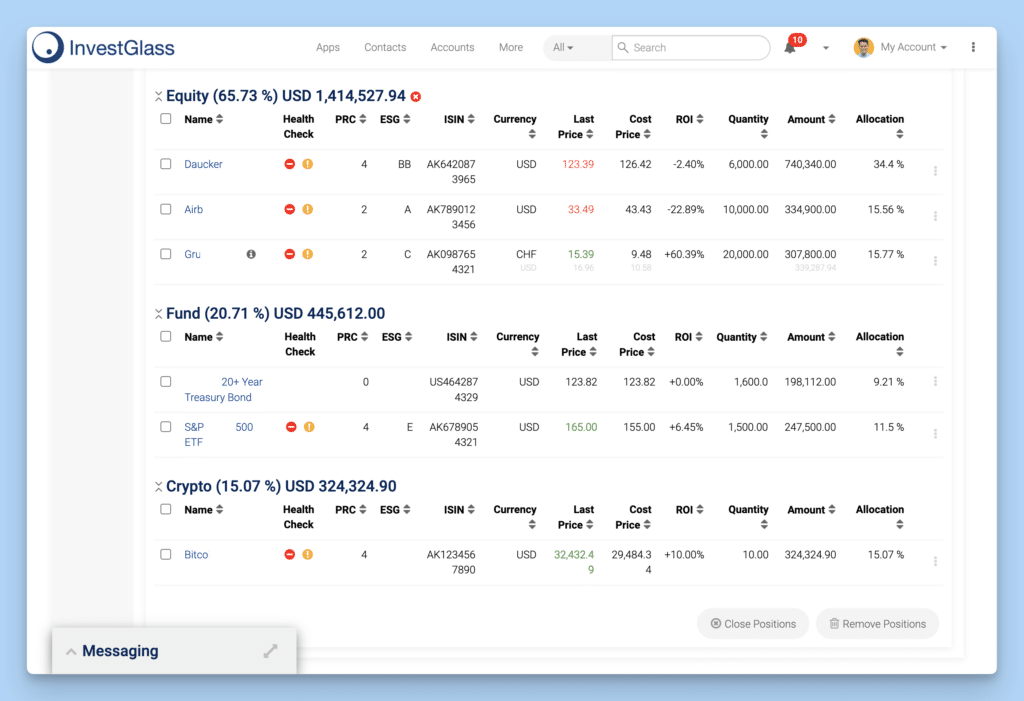

Investment and Portfolio Management

In the realm of investment and portfolio management, large language models (LLMs) are proving to be transformative. LLMs are enhancing various financial services within investment banking, such as treasury optimization and private equity strategy development. These sophisticated tools support investors and traders in anticipating market behaviors, including trends, sentiments, and instabilities, by scrutinizing an extensive spectrum of data sources such as news articles and social media postings. This breadth of analysis furnishes LLMs with the capacity to deliver insightful contributions beneficial for financial exploration and strategic decision-making processes.

By automating aspects of financial scrutiny through advanced analytics concerning both market tendencies and corporate health metrics, LLMs elevate the development process behind comprehensive research reports within the finance sector. Their aptitude for crafting forecasts while individualizing plans enhances their contribution significantly to refine risk evaluation methods alongside promoting profit-maximizable investing approaches. The added function that allows them to conduct stress tests simulating potential outcomes on portfolios amidst various fiscal conditions magnifies their applicability even further.

Generative AI revolutionizes how personalized investment strategies can be devised by aligning them precisely with each investor’s unique monetary objectives as well as tolerance levels regarding risk exposure—paving the way towards more enlightened equity selections. By doing so, it not only improves returns on investments, but also propels improvements across all aspects pertaining to effective portfolio governance.

Sentiment Analysis for Market Predictions

Analyzing the emotional tone found within news articles and social media content, sentiment analysis serves as a critical instrument in anticipating shifts in market trends. By assessing investor sentiments and subsequent decision-making impacts, LLMs enhance their predictive accuracy by recognizing key tendencies through the scrutiny of expansive datasets.

LLMs harness their NLP prowess to mine through substantial volumes of unstructured data. They can dissect historical information to detect recurring themes or patterns. This proficiency yields actionable intelligence that is highly beneficial for formulating tactical investment choices, thus unlocking valuable insights into future market activities.

Automated Trading Signals

LLMs are transforming trading tactics through the creation of automated trading signals. They deliver prompt notifications in accordance with swift alterations in financial conditions, facilitating expedited decision-making for trades. The use of NLP to analyze the sentiment within financial documents refines these market forecasts.

Traders now have the ability to rapidly adjust their approach in response to market changes, thus refining their strategies and augmenting profit margins. Incorporating LLMs into automatic trading marks a substantial advancement in utilizing AI within the realm of financial markets.

Enhancing Customer Experience with LLMs

LLMs are revolutionizing the way banks interact with their customers. By analyzing customer data and behavior, LLMs can provide personalized recommendations, offer tailored financial products, and improve customer engagement. LLM-powered chatbots and virtual assistants can handle customer inquiries, resolve issues, and provide 24/7 support. Moreover, LLMs can help banks to identify customer needs and preferences, enabling them to develop targeted marketing campaigns and improve customer retention. This personalized approach not only enhances the customer experience but also builds stronger relationships between banks and their clients. In this section, we will discuss the ways in which LLMs can enhance customer experience in banking.

Implementation and Adoption Strategies

Implementing LLMs in banking requires a strategic approach. Financial institutions need to consider various factors, such as data quality, regulatory compliance, and security, before adopting LLMs. In this section, we will discuss the key implementation and adoption strategies for LLMs in banking, including:

- Data Preparation and Integration: Ensuring that data is accurate, complete, and well-governed is crucial for the successful implementation of LLMs. Banks must focus on data quality and integration to maximize the effectiveness of LLMs.

- Model Training and Validation: Training LLMs with high-quality data and validating their performance is essential to ensure accuracy and reliability. Continuous monitoring and updating of models are necessary to maintain their effectiveness.

- Regulatory Compliance and Risk Management: Adhering to regulatory requirements and managing risks associated with LLMs is critical. Banks must ensure that their LLM implementations comply with data protection laws and other relevant regulations.

- Security and Data Protection: Implementing robust security measures to protect sensitive financial information and customer data is paramount. Banks must focus on encryption, access controls, and other security protocols to safeguard data.

- Change Management and Employee Training: Preparing employees for the adoption of LLMs through comprehensive training programs is essential. Change management strategies should be in place to ensure a smooth transition and effective utilization of LLMs.

By following these strategies, financial institutions can successfully implement LLMs and unlock their full potential.

Addressing Challenges in LLM Implementation

The deployment of large language models (LLMs) within the banking sector offers considerable advantages. It is not without its difficulties. Financial institutions face a notable hurdle due to the heavy financial burdens required for maintaining and periodically updating these sophisticated models. The significant computational power necessary adds complexity to their integration in financial systems.

Handling such complex LLMs presents an array of additional challenges that must be addressed by banks and similar entities. They are tasked with overcoming obstacles relating to technical intricacies, stringent regulatory demands, protecting data privacy, as well as ethical concerns associated with AI usage. It’s critical for these institutions to ensure that key principles such as accuracy, consistency, security measures, transparency practices and equitable operations are thoroughly upheld when embracing LLM technologies into their framework.

Data Privacy and Security Concerns

When integrating large language models (LLMs) within the banking sector, the protection and security of data privacy is critical. It is imperative to implement strong encryption techniques and enforce strict access regulations to protect sensitive financial information and customer data. For LLMs to be effectively incorporated, banks must focus on complying with data protection laws while maintaining high-quality, well-governed datasets that are accurate, complete, and free from biases.

To ensure equitable results in AI-driven services, it’s necessary for banks to tackle any biases present in the training data used by generative AI systems. Respecting regulatory standards rigorously and mitigating potential risks play a vital role in upholding data privacy and security during the adoption of generative AI technologies within the banking industry.

Navigating Regulatory Compliance

Financial institutions using Large Language Models (LLMs) must prioritize regulatory compliance to conform with existing and anticipated financial regulations. Banks can achieve this through automation that aligns with the current legal framework, readying them for upcoming legislative changes. Transparency within AI-powered decision-making procedures is crucial in fostering trust and satisfying regulatory expectations, especially concerning functions such as credit evaluations and sanctioning loans.

The formulation of precise regulatory directives plays an indispensable role in the ethical deployment of LLMs within the finance sector. Adherence to guidelines like GDPR alongside other relevant financial legislations demands comprehensive security measures and strict observance of all necessary regulatory requirements. This adherence ensures AI’s prudent application throughout various banking activities.

Training and Upskilling Employees

The banking sector can significantly benefit from the adept integration of LLMs, provided that bank employees are proficiently skilled. To sustain a competitive advantage within this industry, it’s crucial for staff to undergo ongoing education and training in AI technologies. It is vital for them to have an extensive comprehension of data governance principles so they can harness the power of LLMs effectively.

By focusing on enhancing employee skills through comprehensive training programs, banks ensure their teams are equipped to exploit LLMs to their fullest extent. Such an investment not only bolsters operational efficiency but simultaneously elevates the quality of customer experience as well.

Integrating LLMs into Existing Systems

Incorporating Large Language Models (LLMs) into the established systems of banks is essential for reaping their full advantages without interrupting ongoing operations. Technologies such as Machine Learning Model Import facilitate effortless incorporation of tailor-made machine learning models with LLMs, guaranteeing a smooth and effective transition phase. Tools like Oracle EPM and OFSAA are instrumental in embedding LLMs within financial procedures, refining operational flows, and bolstering decision-making faculties.

The process of seamless integration not only boosts operational efficiency but also empowers banks to harness cutting-edge AI capabilities without necessitating sweeping changes to existing infrastructure. By embracing these strategies for integration, financial institutions can maintain a competitive edge while constantly enhancing the efficacy of their banking processes.

Ethical Considerations and Responsible AI Use

In the process of incorporating large language models (LLMs) into their systems, banks must prioritize ethical implementation and accountable AI conduct. Crafting regulatory frameworks to guide LLM usage in financial sectors is vital for responsible application. It’s critical to establish best practices within this domain. To sustain public trust and prevent bias-fueled discrimination, banks have an obligation to guarantee that their AI platforms are executed with transparency, impartiality, and accountability.

Ensuring fair treatment of clients by AI tools without any prejudice is another key aspect of practicing ethical artificial intelligence. By adhering to principles centered on ethics within the realm of AI technologies, banks can nurture a sense of confidence and security amongst users who engage with these automated banking services—thereby improving customer experiences significantly—and securing enduring allegiance from customers over time.

Future Trends and Innovations in LLMs for Banking

Advancements in LLMs are poised to revolutionize the banking sector, with projections showing an annual expansion of 21.4% from 2023 through 2029. These developments aim to amplify productivity and efficiency within banks by simplifying operations and bolstering risk management capabilities.

Looking ahead, it’s clear that enhanced personalization via LLMs will be critical for nurturing customer fidelity. By offering experiences meticulously tailored to each user’s unique preferences and actions, banks stand a better chance at forging deeper and more enduring bonds with their clientele.

The influence of evolving LLM technologies on the banking industry is set to escalate Fostering innovation while remolding time-honored banking processes.

Summary

To summarize, the banking industry is undergoing a transformative shift through the introduction of Large Language Models (LLMs), which significantly enhance client service, streamline operational processes, bolster fraud detection mechanisms and refine credit risk evaluation. These models harness the power of natural language processing coupled with advanced analytics to deliver bespoke and streamlined solutions for customers. Integrating these LLMs into banking systems presents obstacles such as ensuring data privacy protection, safeguarding security measures, and adhering strictly to regulatory compliance standards that financial institutions must diligently address.

Moving forward, continuous progression in Large Language Models promises radical advancements within the sector by elevating efficiency levels and reinforcing both security protocols and individualized customer engagements. In order to capitalize on this innovative leap while effectively meeting future challenges head-on. Banks are compelled to evolve alongside these technologies, thus maintaining their competitive edge while satisfying customer needs in an increasingly digital landscape.

Conclusion

In conclusion, LLMs have the potential to transform the banking sector by enhancing customer experience, improving operational efficiency, and reducing risks. Financial institutions that adopt LLMs can gain a competitive advantage, improve customer satisfaction, and increase revenue. However, implementing LLMs requires careful planning, strategic thinking, and a deep understanding of the technology. By following the implementation and adoption strategies outlined in this section, banks can unlock the full potential of LLMs and stay ahead in the rapidly evolving banking industry. The future of banking lies in the effective integration of LLMs, and those who embrace this technology will be well-positioned to thrive in the financial industry.

Frequently Asked Questions

How do LLMs enhance customer service in banking?

LLMs significantly enhance customer service in banking by delivering 24/7 support through chatbots and virtual assistants, effectively managing inquiries, and personalizing services utilizing customer data.

What challenges do banks face in implementing LLMs?

Banks encounter significant challenges in implementing LLMs, including high costs, substantial computational resource needs, data privacy concerns, and navigating complex regulatory frameworks.

Addressing these issues is crucial for successful integration.

How do LLMs improve fraud detection in banking?

LLMs enhance fraud detection in banking by analyzing vast amounts of transaction data to identify suspicious patterns and adapt to emerging scam tactics through continuous learning.

This capability helps maintain robust defenses against evolving fraud schemes.

What role do LLMs play in credit risk assessment?

Advanced algorithms and the analysis of diverse data sources are leveraged by Large Language Models (LLMs) to greatly improve credit risk assessment. This enhancement facilitates more accurate decision-making and real-time credit scoring, which in turn leads to better-informed lending decisions.

What future trends can we expect from LLMs in banking?

You can expect future trends in banking LLMs to focus on enhanced productivity and efficiency, improved personalization for customer loyalty, and advancements in risk management and operational processes.

These developments will significantly transform the banking industry.