How to implement FINSA?

THIS IS NOT A LEGAL ADVICE – PLEASE CONSULT YOUR OWN LEGAL ADVISOR.

As of January 1, 2018, the Financial Services Act (FinSA) came into effect in Switzerland (Federal Council shall regulate new details). The new act replaces the old Banking Act and regulates all financial services providers in Switzerland.

The main purpose of the FinSA is to protect consumers by ensuring that only qualified and reputable providers offer financial services in Switzerland. In order to operate as a financial service provider in Switzerland, you must now obtain a license from FINMA, the Swiss financial regulator.

ccording to FINMA, approximately 2,000 – 2,500 financial companies in Switzerland have been impacted by FinSA regulations since its enforcement in 2020. As of 2022, over 1,500 financial advisors have registered with the Financial Advisor Register (Beraterregister) to comply with the new requirements. Financial service providers managing assets exceeding CHF 10 million (around 11.2 million USD) must obtain a license from FINMA. Non-compliance with FinSA can result in penalties of up to CHF 500,000 (approximately 560,000 USD). Moreover, the regulation enhances investor protection for over 4.5 million retail investors in Switzerland by ensuring greater transparency in financial products and services.

Only providers who meet rigorous qualifications and comply with strict rules and regulations will be granted a license by FINMA. So what does this mean for clients and how InvestGlass automate this bank process?

First FINSA is built to improve trust… Clients can be assured that only licensed providers are authorized to offer financial services in Switzerland. All providers who have obtained a license from FINMA are subject to regular inspections to ensure compliance with FinSA regulations. Clients can feel confident that they are dealing with a reputable provider when they transact business with a licensed provider.

The Financial Services Act (FinSA) applies to all financial service providers in Switzerland. This includes banks, insurance companies, asset managers, and any other company that provides financial services to consumers.

On its FinSA website, banks provide information on the latest requirements arising from the Swiss Federal Act on Financial Services (FinSA) and the measures taken by banks to put them into practice from 1 January 2022.

In this article, we will present key aspects of FinSa and how InvestGlass CRM and PMS are solving those challenges.

Financial sercices act FinSa – Definitions

Under the Financial Services Act, financial services mean the:

- acquisition or disposal of financial instruments;

- receipt and transmission of orders for financial instruments;

- administration of financial instruments and discretionary portfolio management also called centralized management;

- issuing of personal recommendations on financial instrument transactions that we call investment advice;

- granting of loans to finance financial instrument transactions or Lombard loans.

A financial instrument is a security or other contractual right or obligation that gives the holder a financial interest in one or more underlying assets.

A transmission of trading orders is when you buy or sell a security on behalf of another person. This includes placing an order with a financial institution to buy or sell a security on behalf of another person.

A personal financial recommendation is investment advice that is given to an individual investor. It is important to remember that personal financial recommendations should only be given by qualified and registered investment advisors. unlicensed providers are not allowed to provide personal financial recommendations.

Lombard loans are loans that are granted to finance financial instrument transactions. These loans are typically granted to individuals or businesses with a good credit history. Lombard loans are a type of short-term loan, and the interest rate is usually higher than for other types of loans.

And financial instruments, financial services are regulated with FinSA :

- equity securities (shares, securities equivalent to shares such as participation certificates entitling the holder to dividend rights and/or voting rights, or securities convertible into equity securities);

- debt instruments: securities not classified as equity securities;

- units in collective investment schemes;

- structured products;

- derivatives;

- private investment structures;

- deposits whose redemption value or interest rate is risk or price dependent, excluding those with an interest rate linked to an interest rate index;

- bonds: units in an overall loan subject to uniform conditions.

How the financial service provider will inform their customers?

Most of the obligations laid down in the Swiss Federal Act on Financial Services are not applicable to the institutional client segment. Professional experience and regulated business under a registration body is protecting the bank.

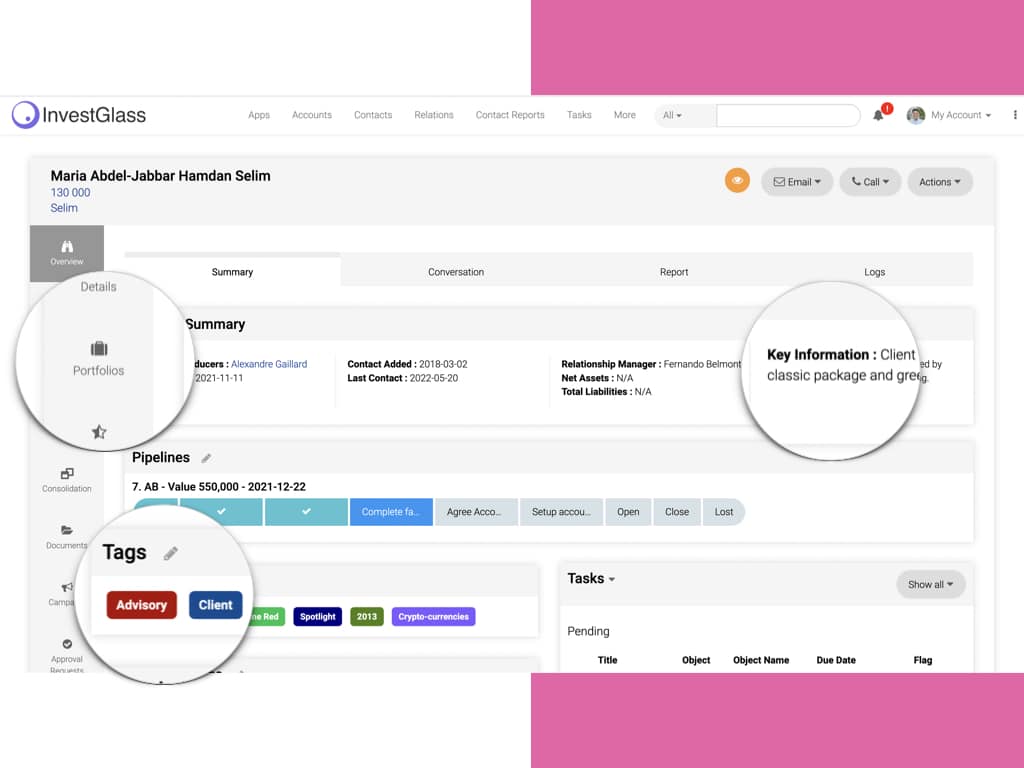

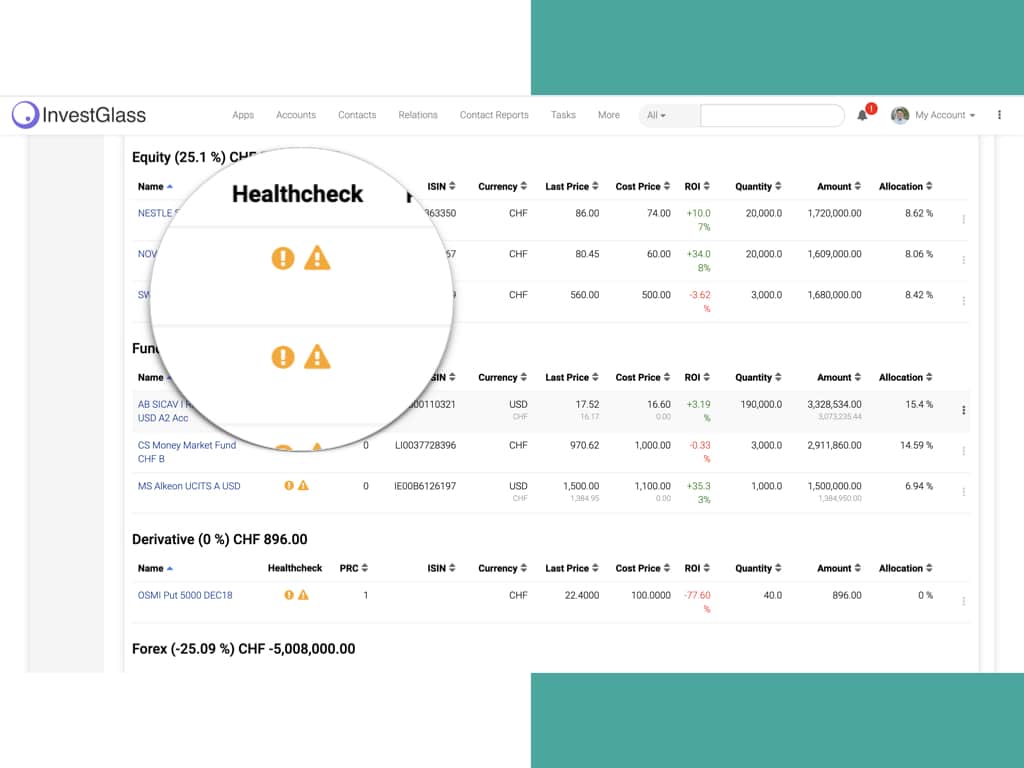

For the retail client, client protection is more important. Prudential supervision is organised into the documents published by the bank and sent to retail clients. Advisory, bankers, and compliance officers will also enjoy dashboards with all relevant information to review portfolios that are not in line with the client protection threshold. InvestGlass produces those documents and automated warnings.

General information and financial institutions’ acts should be disclosed

Banks and brokers have to record and show what is their supervision by the Swiss Financial Market Supervisory Authority “FINMA. More information can at be found Laupenstrasse 27, CH-3003 Berne, Switzerland or on their website www.finma.ch.

Financial services under the Swiss Financial Services Act (FinSA)

The financial institutions should then present the services offered to retail clients, private clients, institutional clients, professional clients, and foreign clients subject. For example :

- Discretionary management mandate – the assets of clients will be managed with a model portfolio tool. The program of investment and rebalancing are standardised.

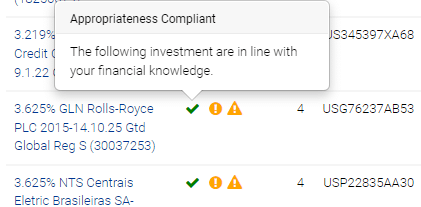

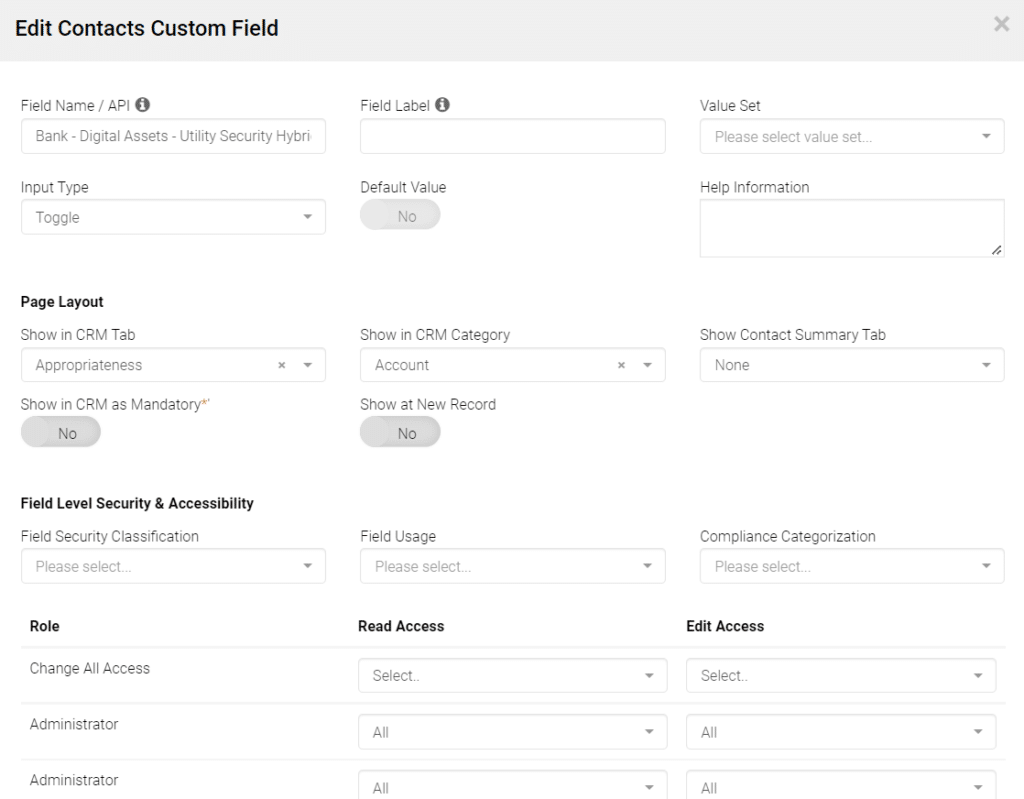

- Advisory investment mandates for entire portfolios are when a financial institution agrees to make all the investment decisions for a customer. This includes deciding which securities to buy or sell, and when to make these decisions. Advisory transaction mandates are when a financial institution agrees to make recommendations on specific financial instrument transactions for a customer. Here the advisory department can collect information coming directly from the CRM fields with a FINSA classification to detect suitability and appropriate incompatibilities. If it is accepted by the client, the advisor can apply some exception that we call Override. Those overrides are collected and recorded in Contact Report.

- Financial institutions that provide services other than personal financial recommendations, such as the receipt and transmission of orders for securities, are required to disclose this information to their customers. This brochure provides an overview of the Financial Services Act (FinSA) and how the bank will be complying with the new regulations.

- A Lombard loan is a type of short-term loan, and the interest rate is usually higher than for other types of loans.

Who is the Mediation body of the financial services act?

Investors are free to contact the Swiss Banking Ombudsman. The mediation body to which banks are affiliated and located Bahnhofplatz 9, P.O. Box, CH-8021 Zurich, the ombudsman’s office. The mediation procedure, as well as all the appropriate information, can be found on the following website www.bankingombudsman.ch. They are in charge of the mediation proceedings.

Which Client segmentation is defined?

Under the Swiss Federal Act on Financial Services, banks and brokers as financial services providers are required to assign each of their clients to one of the following three segments:

- private commonly called retail customers,

- professional clients or institutional investors

This classification is done on the basis of the following principles:

- Private clients are clients who are neither professional nor institutional investors;

- Professional clients are clients such as companies with professional treasury operations, occupational pension institutions and public law bodies, with a high level of knowledge and experience in financial fields;

- Institutional clients are clients such as banks, collective investment schemes, insurance companies and other financial intermediaries subject to prudential supervision in Switzerland or abroad, which, due to their status, structure and financial resources, are deemed to have a high level of sophistication in financial fields.

This definition can be slightly different from one bank to another bank. Professional clients are regarded as sophisticated investors with a lower level of investor protection than Retail clients, as a result of their level of knowledge and experience and their ability to bear financial losses.

Private clients have the highest level of protection under the Financial Services Act (FinSA). They are defined as clients who are neither professional nor institutional investors.

The reduction in the level of protection and change of classification to the professional client or institutional client is changing the client protection.

If clients classified as private or professional wish to be classified in a segment offering a lower level of protection and they satisfy the conditions laid down in this regard, they should inform their banker or sales. He will provide them with an opting-out form for classification. This will impact the suitability and appropriateness test from the portfolio management tool and CRM interaction will be different too.

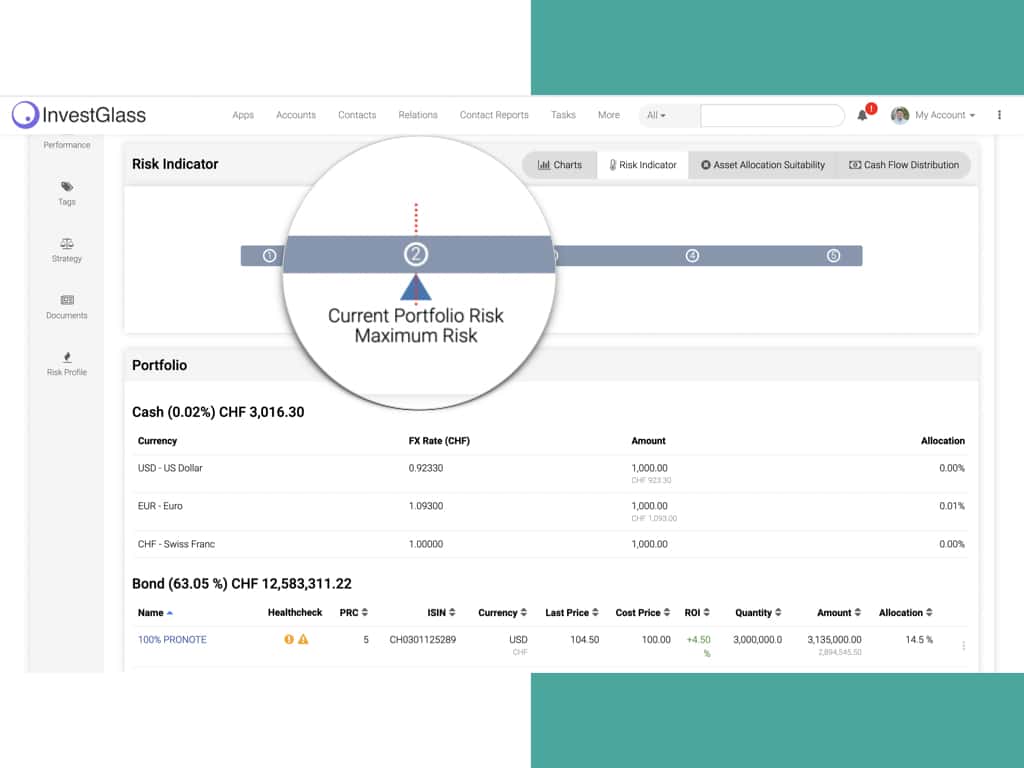

Verification of suitability and appropriateness is the core added value of the InvestGlass Swiss Cloud Solution

Discretionary asset management mandates

If a client grants a Bank a discretionary asset management mandate, the Bank ensures that the investment strategy the client has chosen is suitable, given that client’s risk profile. The risk profile is a key factor in the relationship and is based on the information communicated by the client on his or her personal circumstances, investment objectives and risk appetite. It enables the Bank to gain an understanding of the client’s needs and to recommend an investment strategy that best meets those needs. It is therefore crucial that clients communicate information that is complete and accurate. The risk profile is regularly reviewed by the Bank in conjunction with the client. Those suitability elements are recorded first from InvetGlass Digital onbaording forms which are recording all results inside the CRM.

Advisory mandates for an entire portfolio

For advisory mandates for entire portfolios, the bank ensures that the investment strategy is suitable in the same way as it does for discretionary asset management mandates.

With regard to all investment advice relating to a financial instrument offered by the Bank, the latter checks first that the financial instrument is suitable in terms of the investment strategy agreed and, second, that the client has sufficient knowledge to understand the risks linked to the instrument concerned (verification of appropriateness). If necessary, the Bank warns its client if the financial instrument is not suitable or appropriate in his or her particular case. These factors are documented by the Bank for its private clients.

Advisory transaction mandates

With regard to advice requested by a client on a transaction in a financial instrument offered by the Bank, the bank checks whether the client is able to comprehend the risks connected with that financial instrument. If necessary, the Bank warns its client if the financial instrument is not appropriate in his or her particular case.

However, in the case of an advisory transaction mandate, the Bank does not check whether the transaction is suitable, since it does not know the client’s risk profile or that client’s portfolio.

Transaction execution (without advice)

In the absence of a discretionary asset management mandate or advisory mandate, the Bank conducts no suitability or appropriateness checks when it executes an order for financial instruments communicated by a client, irrespective of private client or professional client classification). In the case of transaction execution without advice, the bank expressly draws its client’s attention to the fact that the Bank conducts no suitability or appropriateness checks, irrespective of whether the client is private, professional or institutional. The Bank does not reiterate this warning at any later stage in the contractual relationship.

Clients acting through an external asset manager (Gérant indépendant, IFA)

If a client appoints an external asset manager to manage assets entrusted to the bank, the Bank acts as a custodian bank and executes investment orders communicated by the client or his or her external manager, as required, based on the power of attorney granted by the client to the external manager.

Appropriateness in the event of a Lombard loan application

The Bank will provide information on the specific risks of the use of Lombard loans. If the professional clients or private client have discretionary asset management mandate or advisory mandate, the Bank will also provide with advice on whether the loan amount they are seeking is suitable. If, due to the loan amount, the risk profile no longer corresponds to that initially agreed, the Bank will inform the client and examine the situation with his client, in order to examine alternative solutions.

Financial relationships with third parties and management companies

In the case of advisory transaction mandates or transaction execution services without advice, the bank will receive payments from third-party companies relating to the acquisition of collective investment schemes. The Bank retains these amounts and informs the client of the type and amount of the remuneration it has received. Therefore a client portal is needed to facilitate the transfer of a large amount of information. InvestGlass can be used for the recording of structured products information for example.

If the client has granted a discretionary asset management mandate or advisory mandate for an entire portfolio, the bank does not receive such payments or will otherwise recredit them to the client in their entirety. The amounts recredited are shown on the annual account statement inside the portfolio management view.

The portfolio view can be customised to fit professional client or retail client needs.

Best execution of client orders

The bank has put in place all the measures necessary to obtain the best possible result in executing client orders, be this in terms of price, cost, speed, probability of execution and settlement, size, nature of the order, or any other consideration involved in the execution of order what we call execution factors. InvestGlass is connected with third-party order management system tool. These measures apply irrespective of whether an order is executed by the Bank or communicated to a third party for execution.

As a general rule, particular attention is paid to price and costs to guarantee the best possible outcome. However, for certain orders, financial instruments, markets, or market conditions, other execution factors may be equally important or take precedence over price to ensure the best possible execution.

Basic factsheet and Collective Investment Schemes Act CISA

The basic factsheet, key information document, (or its equivalent, published in accordance with European legislation and regulations) contains information on the key elements of certain financial instruments, including:

– the name of the instrument;

– the type of investment;

– the risks associated with the investment;

– how to contact the competent authority in the event of a problem.

The European KIID fund contains all the information you need to know about a financial product, including the name of the product, the type of investment, the risks associated with the investment, and how to contact the competent authority in case of a problem.

Collective Investment Schemes Act CISA are investment products that allow investors to pool their money with other investors in order to invest in a broad range of assets. These schemes can be open-ended or closed-ended.

Also, you might want to know that managers of the assets of occupational pension schemes, who were previously supervised by the Occupational Pension Supervisory Commission (OPSC), will now be subject to supervision by FINMA.

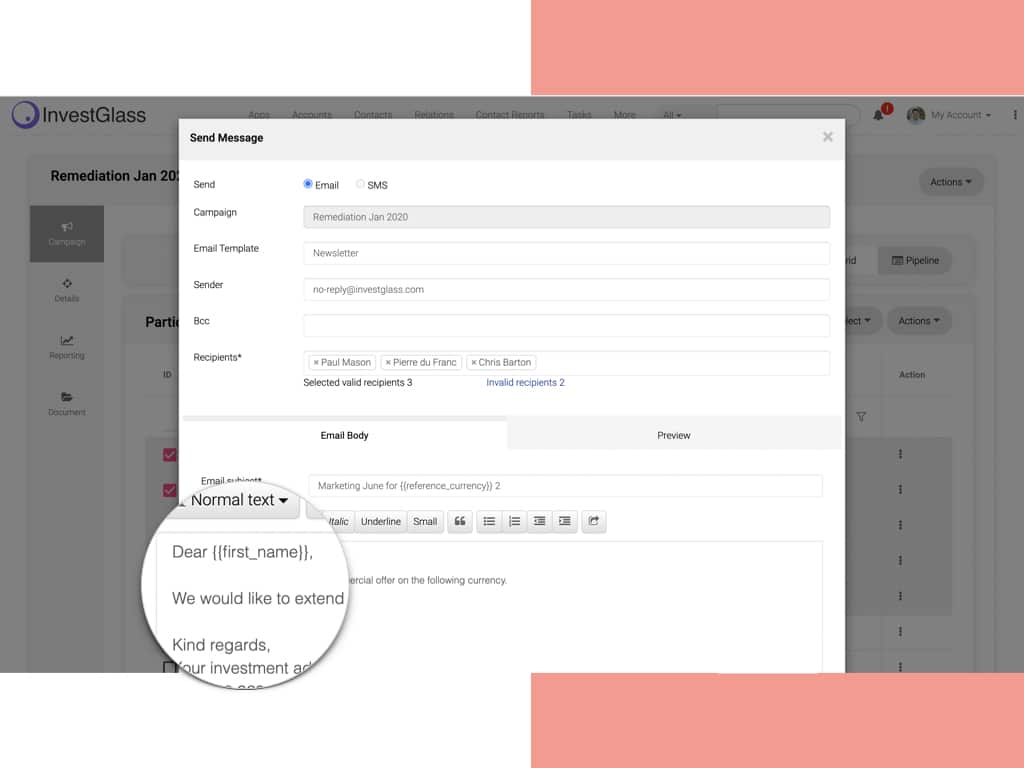

InvestGlass contact reports are built to store those KIID and basic factsheets. InvestGlass CRM – The campaign tool will send your customer an email with the PDF of the KIID and basic factsheet to be stored in the client file.

Risks associated with financial instruments and FINSA

The bank must inform all its clients of the risks linked to financial instruments. A brochure called “Risks involved in trading financial instruments” and issued by the Swiss Banking Association is provided to the retail client and professional client when their account is opened and at any time on request. This information is also available on the Swiss Banking Association’s Internet site at the following address: www.swissbanking.ch/en/downloads

In addition, the Bank also provides all its clients with its brochure called “Information on risks relating to transactions in standardized and non-standardized derivatives/structured products and investment funds with special risks”, which outlines the risks applicable to certain specific financial instruments. The bank should store also in the CRM customer personal education, professional experience, or comparable experience in the financial sector, even if most of the obligations laid down in the Swiss Federal Act on Financial Services are not applicable to this professional-client segment.

Information on costs and charges

With InvestGlass portfolio management tools, banks and brokers can communicate all costs and charges linked to the financial services it provides. The fee schedule is contained in a document provided to all new clients before the service concerned is provided. The document is available on request at any time. The communication can be shared with the private client via SMS, Email or via the InvestGlass client portal.

InvestGlass can help to automate the FINSA process by providing a CRM that includes all of the necessary information and documentation. InvestGlass’ CRM is designed to streamline the process of gathering and organizing information, and it includes a wealth of features that make it easy to manage FINSA compliance. For example, InvestGlass allows users to track interactions with clients, manage client documents, and generate reports. In addition, InvestGlass’ CRM is integrated with FINSA’s online filing system, making it easy to file compliant reports. As a result, InvestGlass can significantly simplify the process of complying with FINSA requirements.

THIS IS NOT A LEGAL ADVICE – PLEASE CONSULT YOUR OWN LEGAL ADVISOR.