How to Implement FINMA new Behavioural Duties?

22 May, 2024

In the ever-evolving wealth management industry, regulatory changes play an important role in shaping practices and standards. Recently, the Swiss Financial Market Supervisory Authority (FINMA) announced significant updates regarding behavioral duties applicable to investment advisory and portfolio management services. These changes underscore FINMA’s commitment to enhancing investor protection and promoting integrity within the financial sector. As wealth management professionals, it’s crucial to understand the implications of these new directives and adapt accordingly.

Let’s Look at the Key Updates from FINMA

On May 15, 2024, FINMA unveiled amendments to the Financial Services Act (FinSA) and the Financial Institutions Act (FinIA), focusing on behavioral duties for financial service providers. The key points relevant for wealth managers are:

Enhanced Information Duty

Providers, including wealth managers, must provide accurate, comprehensive information to clients, ensure the suitability of recommendations, and disclose potential risks. This includes:

a) Clarifying the Level of Advice: When establishing the mandate agreement, clearly specify whether the advice is transactional or portfolio-based.

b) Providing Information About Complex Leveraged Products: Offer detailed explanations about products like CFDs and other highly leveraged instruments.

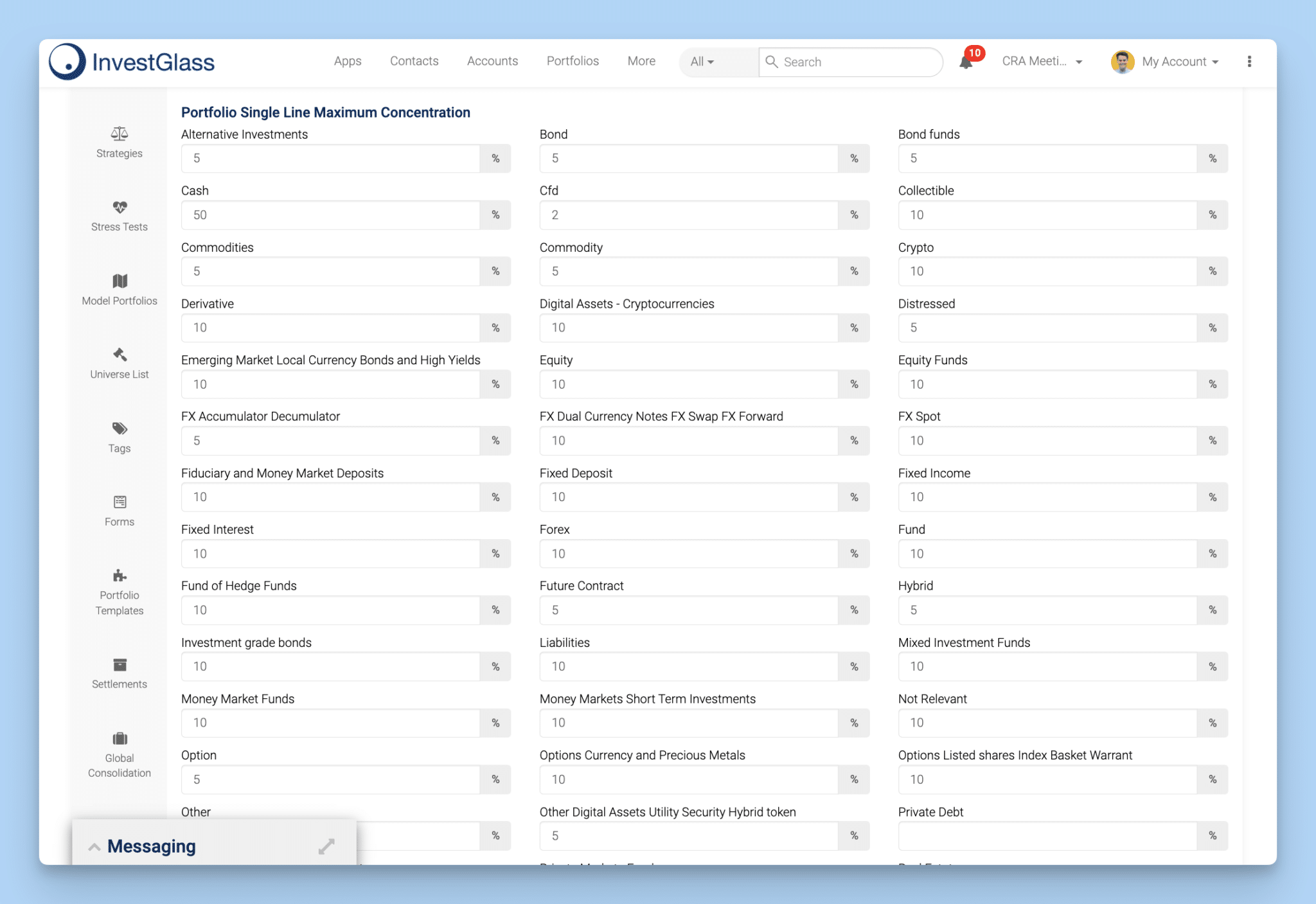

c) Disclosing Concentration Risks: Inform clients if a portfolio exceeds 10% in an instrument (excluding diversified funds) or 20% in an issuer.

Client-Centric Approach

Prioritizing clients’ best interests is paramount. Wealth managers must tailor services to each client’s individual needs, preferences, and risk tolerance. This involves:

a) Assessing Clients’ Knowledge and Experience: Evaluate clients’ familiarity and experience with relevant asset classes.

b) Obtaining Detailed Financial Information: Gather comprehensive data about clients’ overall financial situations (e.g., entire “balance sheet,” not just net values) for accurate risk profiling.

Conflict of Interest Disclosure

Transparency remains central. Providers must disclose all relevant information, including potential conflicts of interest arising from in-house or external financial products.

Inducement Disclosure

To mitigate conflicts of interest and preserve independence, providers must clearly disclose inducements (commissions, rebates, or incentives) that could impair their duty to act in clients’ best interests.

How InvestGlass Helps: A Step-by-Step Guide

Our InvestGlass portfolio management tool is designed to help wealth managers seamlessly comply with FINMA’s new behavioral duties. Here’s how you can utilize InvestGlass to stay compliant and enhance your client services.

Step 1: Setting Up Client Profiles

- Log in to InvestGlass: Access your dashboard and navigate to the ‘Client Management’ section.

- Create a New Client Profile: Enter all relevant details including personal information, financial background, and investment goals.

- Assess Knowledge and Experience: Use the integrated questionnaires to evaluate clients’ familiarity with different asset classes.

Step 2: Clarifying the Level of Advice

- Establish the Mandate Agreement: Clearly specify in the client profile whether the advice is transactional or portfolio-based.

- Document the Agreement: Use the document management feature to store signed agreements securely.

Step 3: Providing Detailed Product Information

- Complex Product Disclosures: For products like CFDs, use the product description templates to provide detailed explanations.

- Risk Disclosure: Ensure clients are aware of the potential risks by attaching comprehensive risk disclosure documents to their profiles.

Step 4: Monitoring and Disclosing Concentration Risks

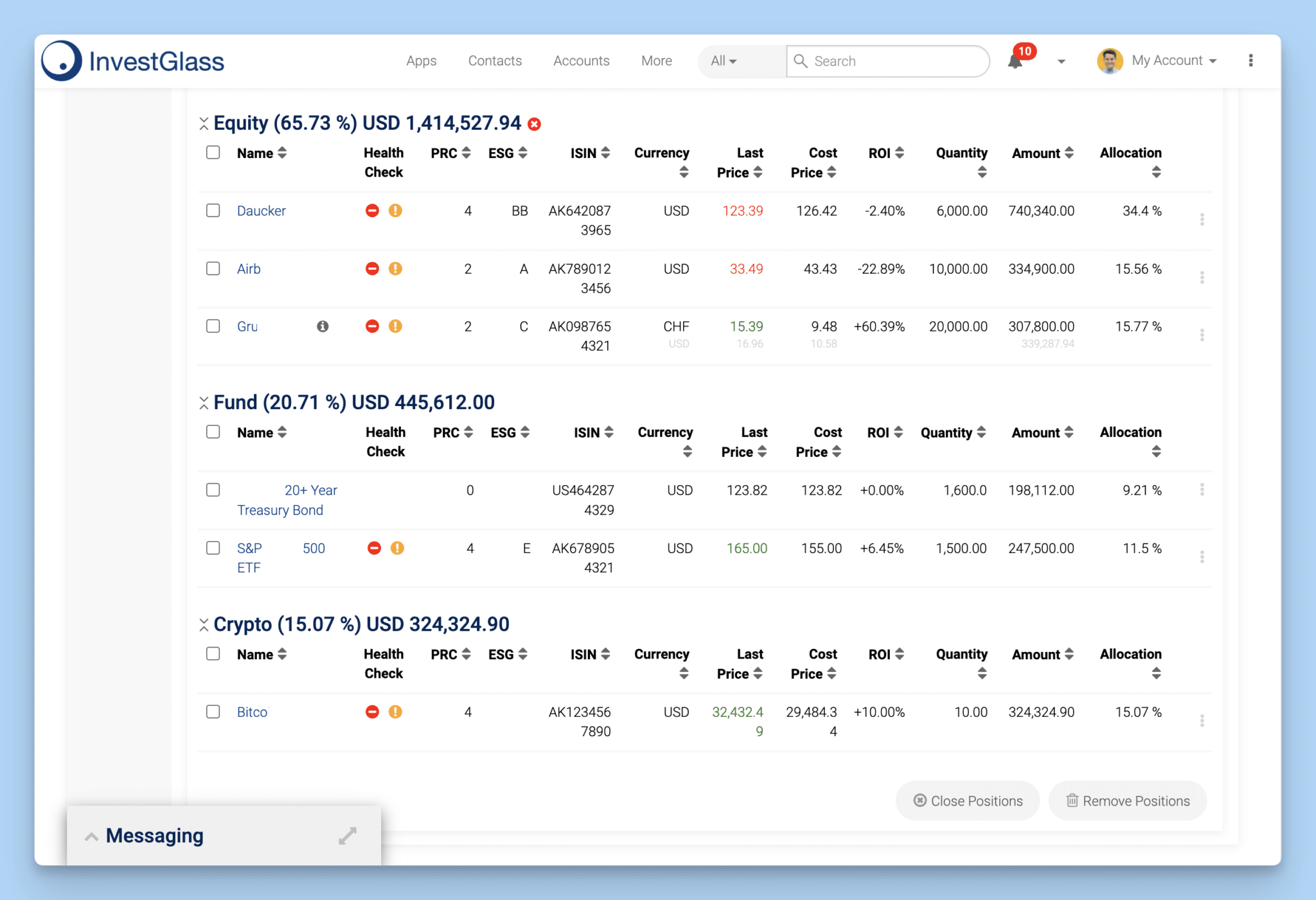

- Portfolio Analysis: The portfolio analysis tool monitors asset allocation.

- Set Threshold Alerts: Configure alerts to notify if a portfolio exceeds 10% in a single instrument or 20% in an issuer.

- Disclose Risks: Automatically generate and send client risk disclosure reports.

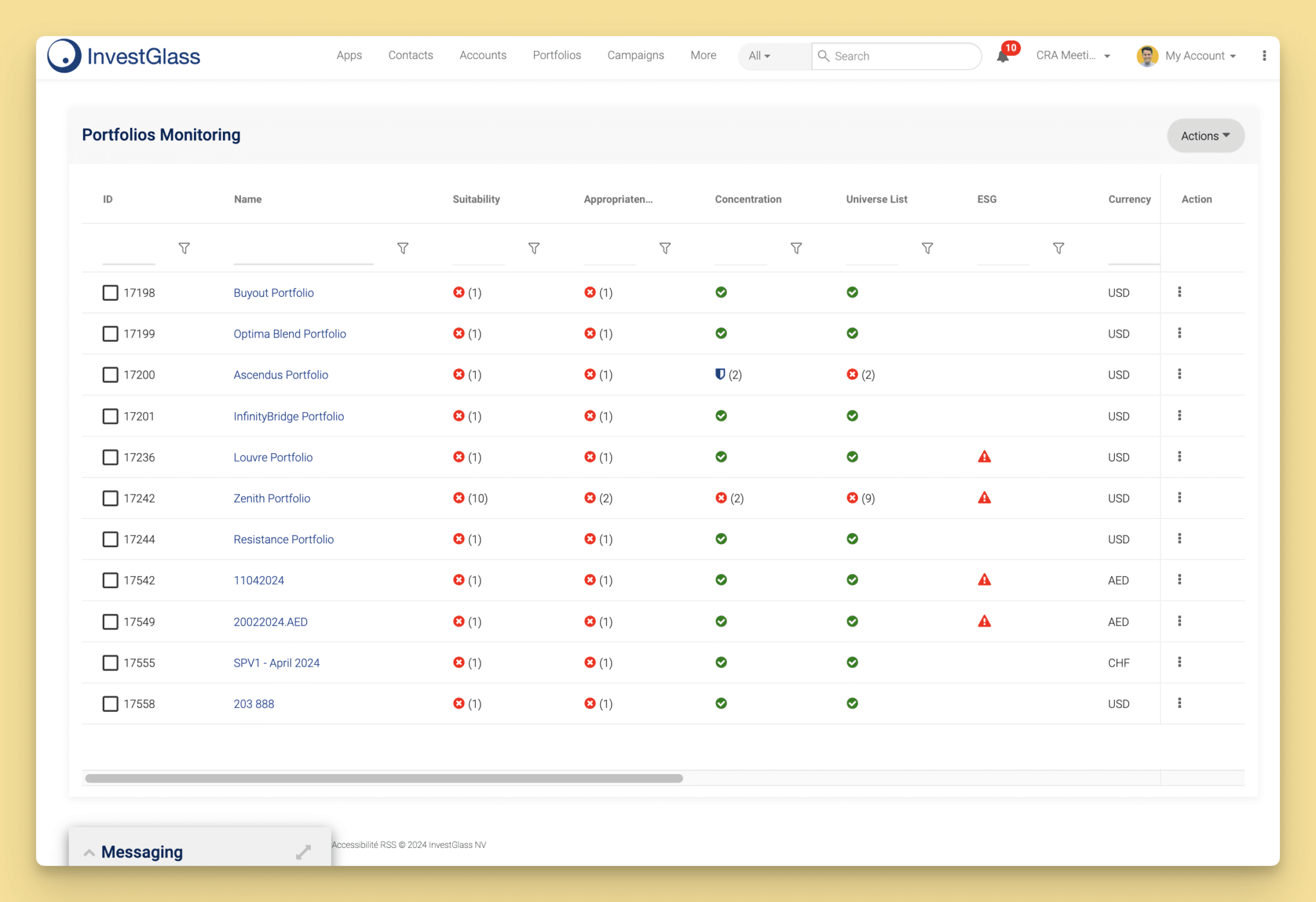

Step 5: Gathering Comprehensive Financial Information and justification of breaches

- Financial Assessment Tools: Utilize InvestGlass’s financial assessment tools to gather detailed information about clients’ financial situations.

- Portfolio Monitoring Tools: Track portfolio breaches and add justification if needed.

Step 6: Conflict of Interest and Inducement Disclosures

- Disclosure Management: Use the conflict of interest disclosure feature to document and disclose potential conflicts.

- Inducement Tracking: Use the inducement tracking module to keep track of all commissions, rebates, and incentives.

- Client Communication: Ensure transparency by sharing disclosure documents directly through the client portal.

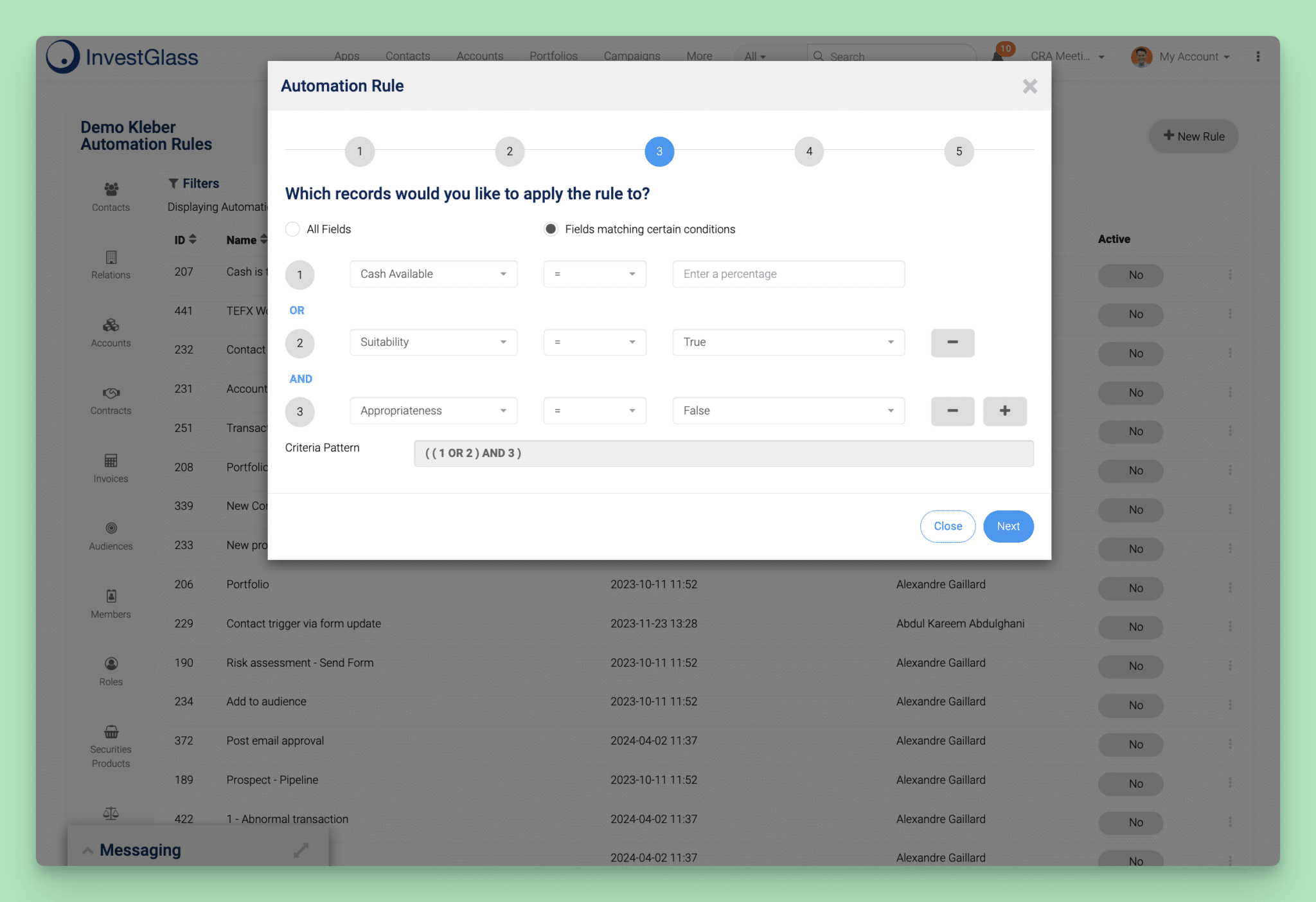

Step 7: Enhancing Client Trust with automated communication SMS and EMAIL

- Client Access to InvestGlass: Share access to the InvestGlass platform with your clients to enhance transparency.

- Push notification to Investors: InvestGlass no code – automation tool helps to push alerts to each customer individually.

Step 8: Staying Updated and Continuous Improvement

- Regular Updates: Keep your InvestGlass tool updated with the latest features and regulatory guidelines.

- Client Feedback: Collect feedback from clients to improve your services continuously.

- Training and Support: Utilize InvestGlass’s training resources and support to stay ahead of regulatory changes.

Try InvestGlass Today!

As we navigate the implications of FINMA’s new behavioural duties (planned for the beginning of 2025), InvestGlass stands out as the best solution for banks to stay compliant while providing exceptional service to clients. InvestGlass is committed to building software that supports better decision-making, ensures compliance, and enhances client satisfaction. Our comprehensive tools and features are designed to meet the stringent requirements of FINMA’s regulations, making InvestGlass the ideal choice for financial institutions seeking reliability and excellence.