AI in Customer Service: Revolutionising Customer Interactions

Artificial intelligence (AI) is rapidly transforming various sectors, and one of the most impacted areas is customer service. This transformation is not just a trend; it’s a revolution that fundamentally changes how businesses interact with their customers and provide customer support. In the banking and finance industry, AI integration is enhancing customer experience and boosting agent efficiency. InvestGlass, a company at the forefront of this transformation, provides an all-in-one solution leveraging AI technology to revolutionize customer service.

Enhancing Customer Service with AI

Customer service refers to the support provided to customers before, during, and after purchasing a product or service. With AI integration, businesses can leverage customer service automation to handle routine tasks, provide instant responses to service inquiries, and significantly improve customer service. AI systems can analyze customer conversations, identify patterns, and deliver relevant information to meet customer needs effectively.

Automating Routine Tasks

Routine tasks in customer service, such as answering frequently asked questions, processing simple transactions, or providing basic information, can be efficiently handled by AI. Virtual customer assistants can efficiently manage these routine tasks, ensuring that customers receive timely and accurate information. By automating these tasks, businesses can free up human agents to focus on more complex and value-added interactions. This automation not only increases efficiency but also reduces the likelihood of human error.

Providing Instant Responses

One of the significant advantages of AI in customer service is the ability to provide instant responses through AI-driven chatbots and virtual assistants. AI-powered chatbots and virtual assistants can handle multiple customer inquiries simultaneously, ensuring that customers do not have to wait for assistance. These AI tools utilize natural language processing (NLP) to understand and respond to customer queries accurately, enhancing the overall customer experience. Additionally, AI can enhance the interaction during customer calls, ensuring that support agents have all necessary customer information to efficiently handle inquiries and resolve issues.

Offering Self-Service Options

AI enables businesses to offer robust self-service options. Self-service portals powered by AI enable customers to find solutions independently, enhancing their overall experience. Customers can access information and resolve issues independently through AI-powered interfaces. This self-service capability empowers customers, providing them with the convenience of solving problems on their terms and reducing the load on customer service teams.

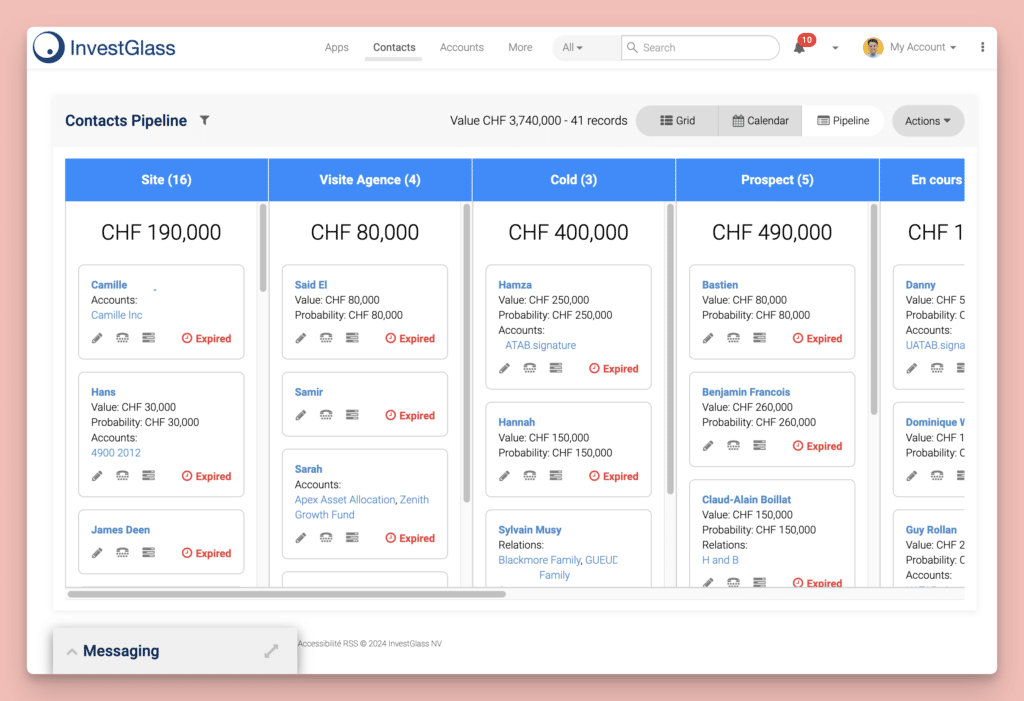

Case Study: InvestGlass

InvestGlass, with its AI-powered customer service software platform, helps financial institutions manage customer interactions efficiently. By implementing AI, banks and financial institutions can handle complex customer queries, reduce human error, and improve overall service delivery. This not only boosts agent productivity but also enhances customer satisfaction.

Key Benefits of AI in Customer Service

Instant Responses and Intelligent Routing

AI in customer service allows for instant responses to customer queries through automated customer service chatbots and virtual assistants. InvestGlass utilizes NLP to understand customer questions and provide accurate answers. Intelligent routing ensures that more complex customer queries are directed to the appropriate support agents. This streamlined process ensures that customers receive timely and accurate assistance.

Customer Data Analysis

AI can analyze vast amounts of customer data, including purchase history and service interactions, to offer personalized solutions and valuable customer insights. In the banking sector, understanding customer behavior and needs can lead to better customer retention. InvestGlass excels in providing financial institutions with tools to analyze customer conversations and identify market trends, allowing for more personalized and effective customer engagement.

Enhanced Agent Efficiency and Customer Satisfaction

AI-powered tools assist support teams by handling time-consuming tasks such as categorizing customer inquiries and providing knowledge base articles. This support allows agents to focus on more critical customer service tasks. InvestGlass’s platform is designed to boost agent efficiency, ensuring that support teams can manage their workload more effectively and provide higher quality service.

Predictive Analytics and Sentiment Analysis

AI uses predictive customer service analytics to anticipate customer needs and sentiment analysis to gauge customer satisfaction. InvestGlass leverages these technologies to help financial institutions tailor their services to improve customer loyalty and satisfaction. By predicting customer needs and understanding their sentiments, businesses can proactively address issues and enhance the customer experience.

Fraud Detection and Risk Management

AI-driven fraud detection is instrumental in identifying fraudulent activities by analyzing unstructured data and identifying unusual patterns. In the finance industry, where security is paramount, InvestGlass provides robust AI solutions for fraud detection, ensuring the safety and trust of customers. By continuously monitoring transactions and identifying suspicious activities, AI helps in mitigating risks and protecting customer assets.

Implementing AI with InvestGlass

InvestGlass is the right solution for financial institutions looking to revolutionize their customer service. Here are a few ways InvestGlass helps businesses leverage AI:

Comprehensive AI Integration

InvestGlass integrates AI seamlessly into existing systems, providing financial institutions with a robust AI integration strategy to enhance their customer service without overhauling their infrastructure. This seamless integration ensures that businesses can start benefiting from AI capabilities quickly and efficiently.

Customer Experience Optimization

By analyzing customer data and interactions, InvestGlass helps businesses improve the customer journey through targeted marketing and personalized service delivery. Understanding customer preferences and behavior allows businesses to tailor their services and communications, leading to higher customer satisfaction and loyalty.

Operational Efficiency

InvestGlass’s AI solutions reduce operational costs by automating routine tasks and improving agent assistance, leading to AI-driven efficiency and better resource management. Automating repetitive tasks allows human agents to focus on more complex issues, enhancing overall operational efficiency.

Scalable AI Solutions

InvestGlass offers scalable AI technology solutions that grow with the business, ensuring that financial institutions can continually meet their customers’ evolving needs. As customer demands and business requirements change, InvestGlass’s scalable solutions provide the flexibility needed to adapt and stay competitive.

Challenges and Considerations in AI Implementation

Data Privacy and Security

One of the primary concerns in implementing AI in customer service is data privacy and security. Financial institutions handle sensitive customer information, and ensuring data protection is crucial. AI systems must be designed with robust security measures to prevent data breaches and unauthorized access.

Integration with Existing Systems

Integrating AI with existing customer service systems can be challenging. Businesses must ensure that AI solutions are compatible with their current infrastructure and can be integrated seamlessly, ensuring system compatibility. InvestGlass addresses this challenge by providing comprehensive integration support, ensuring a smooth transition to AI-powered customer service.

Training and Adoption

For AI implementation to be successful, businesses must invest in training their staff to work with AI tools. This includes understanding how to use AI-driven insights and effectively collaborating with AI systems. InvestGlass offers AI training programs and support to help businesses and their employees adapt to new AI technologies.

Ethical Considerations

The use of AI in customer service also raises ethical considerations, and businesses must ensure that their AI systems adhere to ethical AI practices. Businesses must ensure that their AI systems are designed to treat all customers fairly and without bias. Ethical AI practices include transparent algorithms, accountability, and the ability to explain AI decisions to customers. InvestGlass is committed to ethical AI practices, ensuring that their solutions are fair, transparent, and accountable.

Future Trends in AI for Customer Service

Advanced Personalization

The future of AI in customer service will see even more advanced personalized customer service, providing highly tailored experiences based on a deep understanding of individual customer preferences and behavior. This level of personalization will enhance customer loyalty and drive business growth.

Proactive Customer Service

AI will enable businesses to move from reactive to proactive support, predicting potential problems and addressing them before they impact the customer. Instead of waiting for customers to reach out with issues, AI systems will predict potential problems and address them before they impact the customer. This proactive approach will significantly improve customer satisfaction and reduce churn.

Integration with Internet of Things (IoT)

The integration of AI with IoT devices will provide new opportunities for IoT-enabled customer service. IoT devices can collect real-time data, which AI systems can analyze to provide immediate support and solutions. This integration will lead to more efficient and responsive customer service.

Human-AI Collaboration

The future will also see increased AI-human collaboration, with AI handling routine and repetitive tasks while human agents focus on complex and emotional interactions. This collaboration will result in a more efficient and effective customer service operation.

Enhanced Security Measures

As AI continues to evolve, so will the AI security solutions designed to protect customer data. AI systems will become more adept at identifying and mitigating security threats, ensuring the highest level of protection for sensitive information.

Conclusion

AI-driven customer service is transforming the way businesses interact with their customers. For financial institutions, particularly in the banking and finance industry, implementing AI can lead to significant improvements in customer satisfaction, loyalty, and operational efficiency. InvestGlass stands out as a leader in this field, offering comprehensive AI solutions that revolutionize customer service. By leveraging AI technology, businesses can enhance customer interactions, boost agent productivity, and drive business growth.

InvestGlass’s AI-powered platform provides financial institutions with the tools needed to automate routine tasks, analyze customer data, predict customer needs, and detect fraudulent activities. With a focus on seamless integration, scalability, and ethical AI practices, InvestGlass ensures that businesses can successfully implement AI and reap its benefits.

As AI technology continues to advance, the future of customer service looks promising. Businesses that embrace AI will be well-positioned to provide exceptional customer experiences, stay competitive, and achieve long-term success. To explore how InvestGlass can transform your customer service operations, visit InvestGlass and take the first step towards revolutionizing your customer interactions.