What does HNWIS mean?

What does HNWIS mean?

High Net Worth Individual (HNWI) is a designation used by the financial services industry to refer to individuals with high incomes and/or significant assets. HNWIs typically have investable assets of $1 million or more, and may also have annual incomes in excess of $250,000. In some cases, an individual with fewer assets may still be considered an HNWI if their annual income is significantly higher than average.

The term HNWI’s typically used by banks, investment managers, and other financial services providers to identify potential clients who may be able to benefit from their products and services. While there is no strict definition of what constitutes a HNWI, the designation is generally reserved for individuals who have a significant amount of disposable income and/or investable assets.

HNWIs are an important target market for the financial services industry, as they typically have a high level of disposable income and are more likely to invest their money than individuals with lower incomes.

According to the World Wealth Report 2022, released by Capgemini, there are approximately 18.6 million HNWIs globally, with a combined wealth of US$64.9 trillion. This represents an increase of 2.4 million HNWIs and US$5.6 trillion in wealth since 2020. North America is home to the largest number of HNWIs (6.7 million), followed by Europe (5.3 million) and Asia-Pacific (4.5 million) (World Wealth Report).

How do wealth managers preserve the fortune of the high net worth individuals?

Private wealth managers typically work with HNWIs to help them preserve and grow their wealth. This can involve a variety of activities, such as investing their money in assets that will appreciate over time, helping them to manage their taxes effectively, and providing financial planning advice.

Many HNWIs have complex financial situations, so it is important for them to work with wealth management companies that are able to provide tailored advice and solutions. Wealth management firms typically have a deep understanding of the financial markets and are well-positioned in liquid assets to help HNWIs grow their wealth over the long term.

Wealth managers are more and more challenged by the exclusive services provided by other financial professionals like private banking. Private banking has a more global approach on how to manage hnwis’ wealth: investment strategies, tax advice, pre-IPO (initial public offering) placements, value investment in several countries and even the organization of special events are some services of private banking.

What typical investable assets do a high-net-worth individual invest in?

HNWIs typically invest in a variety of assets, including stocks, bonds, real estate, and private equity. They may also invest in more speculative assets, such as hedge funds and venture capital. They invest in liquid assets as well as in illiquid assets. They usually hold a minimum of 30 000$ in investable assets. HNWIare often seen as accredited investors and banks will offer more sophisticated investment vehicle. Most financial advisors will offer product specialists to calibrate their offer to this investor segment.

What are the benefits of being a high-net-worth individual?

There are several benefits that come with having the HNWI status. Firstly, high net worth individuals typically have a higher level of disposable income than other individuals, which means they have easy access to investments, and they can take more risks. Secondly, HNWIs are usually able to access a wider range of investment opportunities than other investors, as they often have the capital to invest in more speculative assets. Finally, HNWIs typically have access to a higher level of financial advice and support than other investors, as they can afford to pay for the services of private wealth managers.

What are the challenges of being a high-net-worth individual?

There are also a number of challenges that come with being a HNWI. High net worth individuals often have complex financial situations, which can make it difficult to find the right wealth management company to work with. Finally, high net worth individuals may also be subject to public scrutiny and media attention, which can be intrusive and stressful.

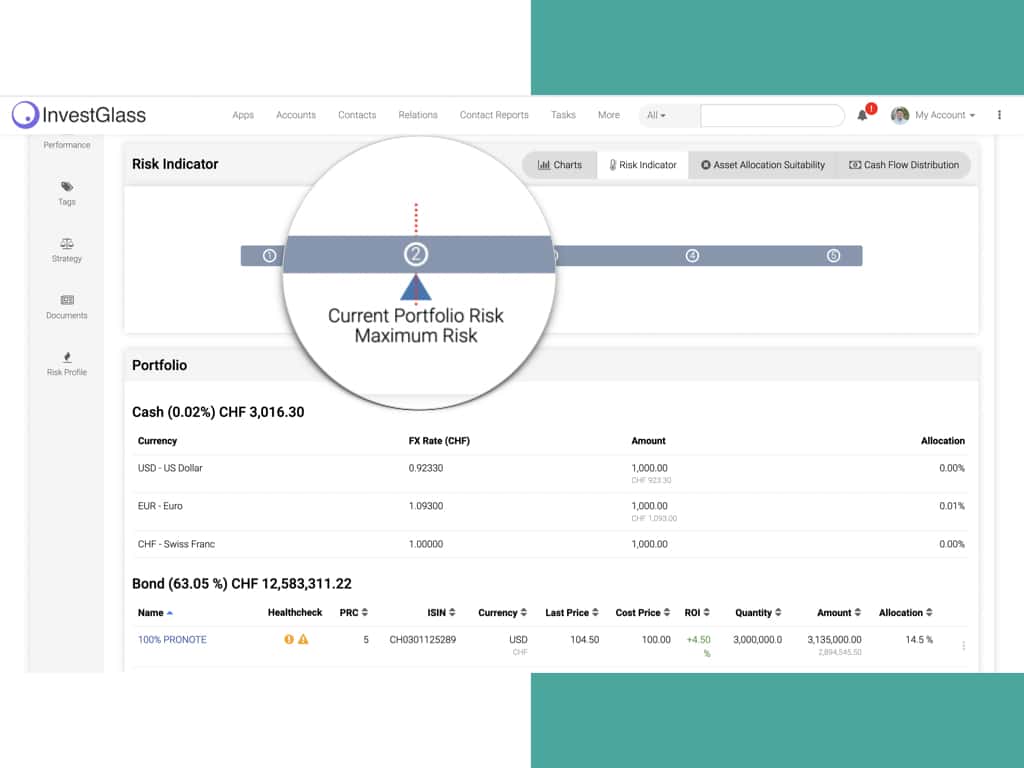

Investment management companies and other financial institutions can help HNWIs to manage their personal assets and help them to reduce their unlimited spending. An investment adviser has to stay well-organized and to do a HNWI classification on order to correctly manage HNWI wealth. In that case, using a CRM can be very useful. InvestGlass is a Swiss-based CRM and PMS, fully flexible and customisable. Global banks and other financial institutions are using InvestGlass to develop their business and to be more reactive with their clients. A lot of investment management companies are using this Swiss Cloud to manage the ultra-high net worth of their clients.

Key takeaways

The high-net-worth individual is a segment of the top 1% of the world’s population and hold more than $1 million in investable assets. They are in high demand by private wealth managers as they have a certain amount of cash and so they can access a large panel of investments. InvestGlass provides the necessary CRM and PMS tools for wealth managers to take care of the ultra HWNI. The PMS, portfolio management system will highlight how portfolios are charged.

The platform is built with tools for any type of asset such as private equity, and private debt. The solution is hosted on Swiss servers which is another guarantee that customers’ names will not be recorded on American servers. The solution is built for banks and multi-family officers. InvestGlass digital forms will be a fantastic way to simulate a retirement plan showing how cash can be protected for future investments. With the digital portal, HNWIs will enjoy privileges like reduced fees, access to special events, special rates, a luxury hotel upgrades program, and many discounts.

InvestGlass PMS can be connected to bank or brokerage accounts and its tools will facilitate new solicitations, with respect to MIFID and LSFIN FIDLEG.