What is KYC for cryptocurrencies?

In order to understand why KYC matters for crypto, it’s important to first understand what KYC is. KYC is short for “know your customer,” and it refers to the process of verifying the identity of a person or company who wants to do business with another party. This process usually involves collecting and verifying personal information like name, address, date of birth, ID cards and social security number.

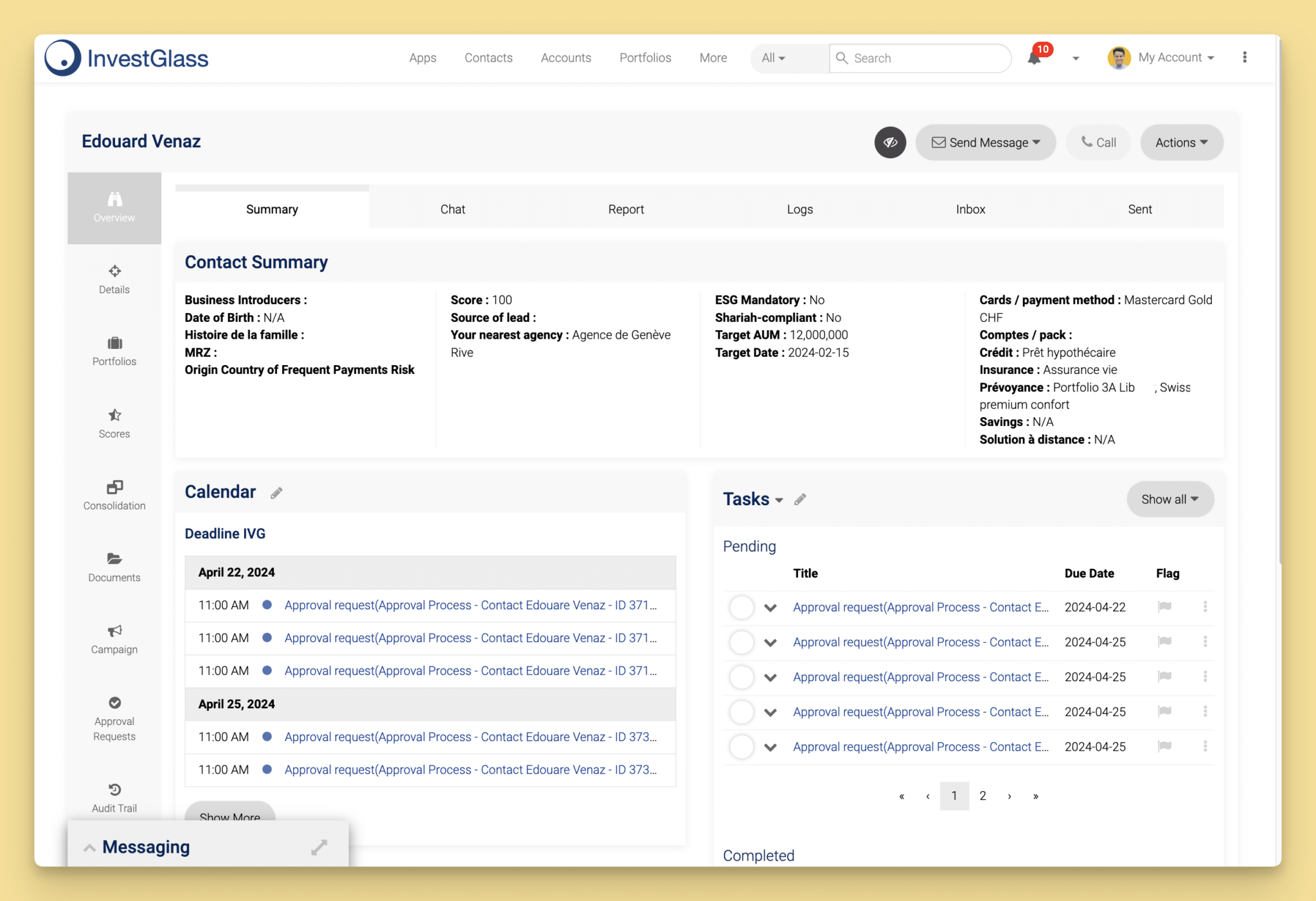

We present here the basics of where you should start, what is the situation for Switzerland, and how we suggest you start leveraging InvestGlass KYC tools. We orchestrate your fintech solution and connect with the best Anti-Money Laundering solutions.

The basics of KYC compliance for crypto?

1. Collect identifying information about the person or company you want to do business with. This information should include name, address, date of birth, utility bills, and financial experience – risk tolerance. KYC requirements will change from one country to another.

2. Verify that the information you collected is accurate and valid. You can do this by checking for inconsistencies or errors, and by contacting the person or company to confirm the information. The verification process can be automated with a rule-based engine. InvestGlass provides automation rules to remain compliant even when your number of users expands quickly.

3. Perform additional checks to make sure the person or company is who they say they are. This might include running a background check or verifying their identity through an online service. We can be in the decentralized exchanges and anonymous transactions business yet, the same rules will apply to your advisory and brokerage business as most other regulated businesses.

4. Keep detailed records of all the information you collect and all the steps you take to verify someone’s identity. (Utility bill, crypto wallet number, sometimes driver’s license or ID card)… The information you provide is then stored in InvestGlass CRM based in Switzerland.

The KYC measures will depend on the crypto exchange you are using and the local regulator’s minimum requirements.

What are KYC clashes with crypto exchanges?

In order to prevent money laundering, crypto exchanges have started to use AML/KYC data insights. AML (anti-money laundering) refers to the set of laws and regulations that aim to prevent the illegal activity of money laundering. By using AML/KYC data insights, crypto exchanges are able to identify suspicious activity and prevent money laundering. This is a significant development, as it will help to make cryptocurrencies more trustworthy and increase adoption. You will find here some key players you should know about :

– Binance, one of the world’s largest cryptocurrency exchanges, recently stopped allowing new users to register for its platform due to increasing KYC demands from regulators.

– Bitfinex, another major exchange, has also been impacted by KYC issues. In 2017, the exchange was forced to halt withdrawals after one of its banking partners demanded that it provide more information about its customers.

– Bitstamp, another large exchange, has also had to deal with KYC issues in the past. In 2016, the exchange suspended withdrawals for several weeks after its banks demanded more information about its customers.

– Kraken, well known for being one of the most compliant exchanges, had to stop service to Japan in order to meet KYC/AML regulations.

– Poloniex is one of the oldest exchanges still in operation and it too has had to make changes to its platform to comply with KYC/AML regulations.

How crypto brokers and traditional financial institutions are working together?

Most banks are regulated by stringent bank secrecy acts. They are not allowed to release client information to 3rd parties. However, there are special circumstances where they are forced to do so such as with subpoenas or court orders. In these cases, the customer would be notified that their information was being shared.

As a broker or intermediary, you have to make sure that your process is solid and that customer’s identity is well shared with the financial institutions you are working with.

How to keep track of illegal activities?

InvestGlass is a portfolio management software that can help you keep track of illegal activities. The software gives you the ability to monitor your portfolios in real-time, and it also allows you to set up alerts for specific keywords. This means that you can be notified immediately if there is any mention of illegal activities in your portfolios. InvestGlass can also help you track down the source of the activity so that you can take action to stop it. In addition, InvestGlass provides a wide range of features that can help you manage your portfolios more effectively. These include a risk management tool, a performance tracking system, and a number of other features. With InvestGlass, you can be sure that your portfolios are safe from illegal activity.

How Compliance with the Travel Rule Benefits VASPs and Financial Institutions

Complying with the Travel Rule offers substantial advantages for Virtual Asset Service Providers (VASPs) and financial institutions. Here’s how:

- Access to Traditional Banking Systems

- Compliance paves the way for smoother interactions with traditional banks. By adhering to the Travel Rule, VASPs demonstrate a commitment to regulatory standards, which helps build trust with financial institutions. This can simplify the process of establishing banking relationships, making fiat-crypto gateways more accessible.

- Compliance paves the way for smoother interactions with traditional banks. By adhering to the Travel Rule, VASPs demonstrate a commitment to regulatory standards, which helps build trust with financial institutions. This can simplify the process of establishing banking relationships, making fiat-crypto gateways more accessible.

- Attracting Institutional Investors

- Institutional investors often seek assurance that their investments are secure and follow regulatory guidelines. VASPs that comply with the Travel Rule are better positioned to attract such investors, securing new funding sources and enhancing growth potential. This compliance represents an added layer of credibility that reassures investors about the integrity of transactions.

- Institutional investors often seek assurance that their investments are secure and follow regulatory guidelines. VASPs that comply with the Travel Rule are better positioned to attract such investors, securing new funding sources and enhancing growth potential. This compliance represents an added layer of credibility that reassures investors about the integrity of transactions.

- Increased Transaction Transparency and Security

- Implementing the Travel Rule increases the transparency of transactions, ensuring that parties involved in transactions are clearly identified. This transparency builds trust among customers, as it mitigates risks associated with fraud and money laundering. With enhanced security measures, VASPs can offer their clients a safer trading environment.

- Implementing the Travel Rule increases the transparency of transactions, ensuring that parties involved in transactions are clearly identified. This transparency builds trust among customers, as it mitigates risks associated with fraud and money laundering. With enhanced security measures, VASPs can offer their clients a safer trading environment.

- Wider Market Adoption of Virtual Assets

- Compliance supports the broader acceptance of virtual assets in daily life. By aligning with global financial regulations, VASPs can facilitate the integration of cryptocurrencies into regular economic activities. This broadens their customer base and fosters more everyday use cases for virtual currencies.

- Compliance supports the broader acceptance of virtual assets in daily life. By aligning with global financial regulations, VASPs can facilitate the integration of cryptocurrencies into regular economic activities. This broadens their customer base and fosters more everyday use cases for virtual currencies.

- Regulatory Approval and Industry Standing

- Aligning with international regulations like the Travel Rule improves a company’s standing within the financial industry. It indicates a proactive approach to compliance, potentially easing regulatory approvals for new products and services. This can give VASPs and financial institutions a competitive edge in the rapidly evolving cryptocurrency market.

By embracing the Travel Rule, VASPs and financial institutions not only meet legal requirements but also unlock numerous avenues for growth and collaboration.

What about KYC and Compliance in Switzerland?

Switzerland is one of the most popular countries for cryptocurrency and blockchain companies. The country has a very favorable regulatory environment, and it is also home to a number of major exchanges. However, Switzerland is also subject to KYC and AML regulations. This means that companies operating in the country must take steps to ensure that they are compliant with these KYC rules : of the Financial Institutions Act (FinIA) and the Financial Services Act (FinSA).

In order to comply with these regulations, companies must take steps to collect and verify the identity of their customers – Anti-Money Laundering Act (AMLA) This process is known as “know your customer” (KYC). KYC involves collecting information about a customer’s identity, such as their name, address, date of birth, and contact information. The company must then verify this and compliance functions can be managed in-house or outsourced to specialists. Currently, Swiss law allows the outsourcing of compliance functions but for IT it is preferable to be onshore.

Other useful documents for doing crypto business in Switzerland:

1. 2016/07 FINMA Circular “Video and online identification” (03.03.2016)

2. SBA guidelines on opening corporate accounts for blockchain companies

3. FINMA Guidance 02/2019 Payments on the blockchain

5. Guidelines for the recognition of self-regulation in asset management as a minimum standard

6. CO Guidelines for inquiries regarding the regulatory framework for initial coin offerings (ICOs)

8. Guidelines for FinTech license

9. Guidelines on licensing as a DLT trading facility according to Art. 73a ff. FinMIA

10. External asset managers respectively investment managers and trustees are supervised by Supervisory Organisations, such as AOOS (www.aoos.ch)

11. FINcontrol Suisse AG (www.fincontrol.ch), OSIF (www.osif.ch), SO-FIT (www.so-fit.ch) or OSFIN (www.osfin.ch). SRO VQF (https://www.vqf.ch/en/sro), SRO PolyReg (www.polyreg.ch) or SRO ARIF (www.arif.ch), Ombudsman Office ( https://www.efd.admin.ch/efd/en/home/the-fdf/ombudsman-finsa.html).

12. Prospectuses for offering securities in the public need to be approved by prospectus offices, like BX Swiss AG (www.regservices.ch) or SIX Exchange Regulation AG (www.ser-ag.com)

Advantages of Compliance with FinCEN and FATF Travel Rules for Cryptocurrency and Virtual Assets

Complying with the FinCEN and FATF Travel Rules offers substantial benefits for cryptocurrency and virtual asset companies:

- Increased Market Opportunities

Adhering to these regulations can open doors to new business ventures. By aligning with global standards, businesses enhance their appeal and become attractive prospects in a rapidly evolving financial landscape. - Enhanced Mainstream Adoption

Compliance paves the way for cryptocurrencies to be integrated into everyday financial transactions. This regulatory alignment fosters confidence in virtual currencies, making them more accessible and usable by the general public. - Improved Banking Relationships

Cryptocurrency firms that meet these compliance requirements gain better access to traditional banking services. This connection to conventional financial institutions facilitates smoother transactions and collaborations with institutional investors. - Increased Transparency and Trust

By adhering to these rules, companies can offer heightened transparency in their operations. This transparency builds trust with consumers, as each transaction is conducted with greater visibility and accountability.

In essence, compliance with the FinCEN and FATF Travel Rules can significantly boost the credibility and operational capabilities of cryptocurrency companies, enabling them to thrive in both the digital and traditional financial markets.

Why start your cryptocurrency business with InvestGlass?

InvestGlass is a Swiss CRM software that enables you to manage your portfolios, clients, and transactions with ease. The software is available in both English and French, and it integrates with a number of exchanges, allowing you to keep track of all your portfolio activity in one place. In addition, InvestGlass data is stored safely and securely in Switzerland. Customer data stays in Switzerland. Account verification can however use third-party providers whose access is made with servers in Germany or Ireland. InvestGlass team will help you with the selection of third-party vendors. Our financial intermediaries clients are often using approval process chain in serie, and parallel to structure their KYC remediation and controls.

The tool automation is made to prevent fraud, terrorism financing, tax evasion, and fraudulent activity, it can be connected to most crypto exchanges, and you can connect to trade crypto with the dedicated order management system. The ultimate objective is to leverage InvestGlass automation solutions to control unverified users and potential criminal activity. The CRM is built for brokers and advisory mindset.

The CRM and PMS (portfolio management system) are made for mass adoption by your team. The solution is fully customizable to build a bespoke and complete KYC process. We worked with several identity verification process vendors that are connected to the CRM via our API. An API means that the solution is flexible and can be easily extended with more features as your needs evolve.

The PMS – portfolio management tool is crypto exchange friendly. You can adapt it to any kind of crypto assets which is handy for your customers reporting. Bitcoin reporting is made simple with pre-built transaction ledgers.

KYC is an important part of doing business in the crypto world, and Switzerland provides a number of resources to help businesses comply with KYC regulations. InvestGlass the Swiss CRM software will boost your growth with safety.